Question: The expected return on the stock portfolio is %. (Round your response to the nearest whole number.) The expected return on the bond portfolio is

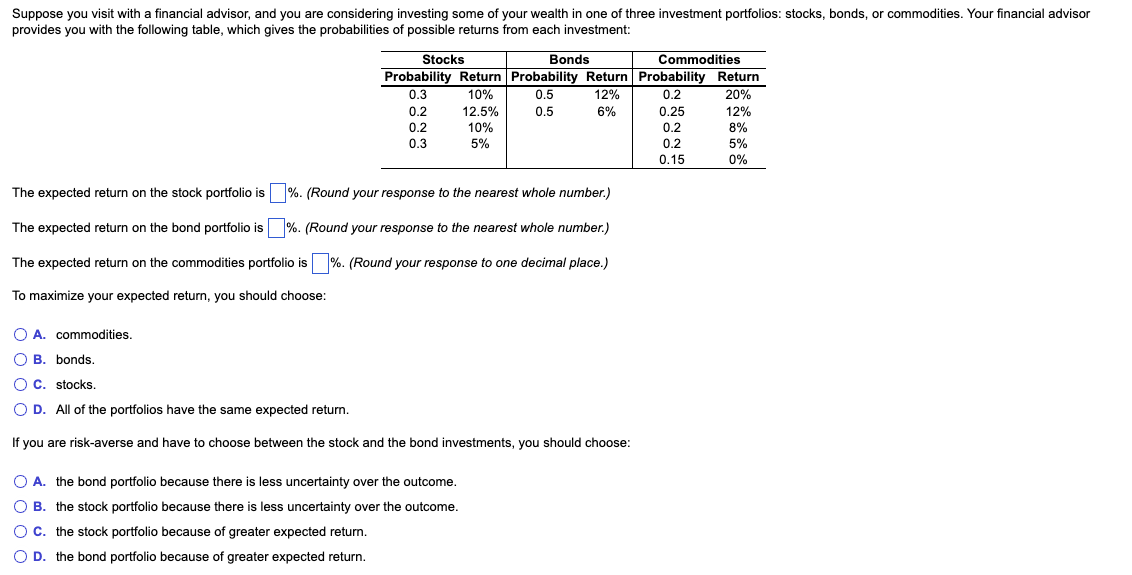

The expected return on the stock portfolio is \%. (Round your response to the nearest whole number.) The expected return on the bond portfolio is \%. (Round your response to the nearest whole number.) The expected return on the commodities portfolio is \%. (Round your response to one decimal place.) To maximize your expected return, you should choose: A. commodities. B. bonds. C. stocks. D. All of the portfolios have the same expected return. If you are risk-averse and have to choose between the stock and the bond investments, you should choose: A. the bond portfolio because there is less uncertainty over the outcome. B. the stock portfolio because there is less uncertainty over the outcome. C. the stock portfolio because of greater expected return. D. the bond portfolio because of greater expected return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts