Question: The Farm Winery case study (see HBS Coursepack) and answer the following questions with substantive answers in a cohesive essay. Review the firm's projected quarterly

The Farm Winery case study (see HBS Coursepack) and answer the following questions with substantive answers in a cohesive essay.

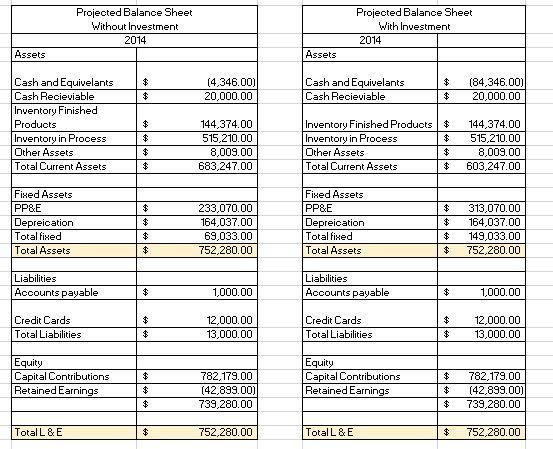

- Review the firm's projected quarterly balance sheet. Will Madsen be able to declare a dividend of $25k? If so, will the firm require additional capital contributions? If yes, how much?

- If Madsen decides not to declare any dividends in the fiscal year, will The Farm Winery require additional capital contributions by shareholders? If so, how much?

- The gross margin is projected to be positive in each quarter in 2014. This suggests that the vintage years to be sold in 2014 "pay for themselves" in the sense of revenues exceeding expenses. However, based on the cash flow projections, Madsen will not achieve his financial goal of The Farm Winery being self-sufficient in terms of capital funding in 2014 even if he decides not to provide a return to shareholders in the form of dividends. What factors should be considered if Madsen continues on his quest of being self-sufficient in the future?

Projected Balance Sheet Without Investment 2014 Assets Cash and Equivelants $ Cash Recieviable $ Inventory Finished Products $ Inventory in Process $ Other Assets $ Total Current Assets $ Fixed Assets PP&E $ Depreication $ Total fixed $ Total Assets $ Liabilities Accounts payable Credit Cards $ Total Liabilities $ Equity Capital Contributions $ Retained Earnings $ Total L & E $ (4,346.00) 20,000.00 144,374.00 515,210.00 8,009.00 683,247.00 233,070.00 164,037.00 69,033.00 752,280.00 1,000.00 12,000.00 13,000.00 782,179.00 (42,899.00) 739,280.00 752,280.00 Projected Balance Sheet With Investment 2014 Assets Cash and Equivelants Cash Recieviable Inventory Finished Products Inventory in Process Other Assets Total Current Assets Fixed Assets PP&E Depreication Total fixed Total Assets Liabilities Accounts payable Credit Cards Total Liabilities Equity Capital Contributions Retained Earnings Total L & E $ (84,346.00) $ 20,000.00 144,374.00 $ 515,210.00 $ 8,009.00 603,247.00 $ $ 313,070.00 $ 164,037.00 $ 149,033.00 $ 752,280.00 1,000.00 $ 12,000.00 $ 13,000.00 $ $ 782,179.00 (42,899.00) 739,280.00 $ 752,280.00 $ Projected Balance Sheet Without Investment 2014 Assets Cash and Equivelants $ Cash Recieviable $ Inventory Finished Products $ Inventory in Process $ Other Assets $ Total Current Assets $ Fixed Assets PP&E $ Depreication $ Total fixed $ Total Assets $ Liabilities Accounts payable Credit Cards $ Total Liabilities $ Equity Capital Contributions $ Retained Earnings $ Total L & E $ (4,346.00) 20,000.00 144,374.00 515,210.00 8,009.00 683,247.00 233,070.00 164,037.00 69,033.00 752,280.00 1,000.00 12,000.00 13,000.00 782,179.00 (42,899.00) 739,280.00 752,280.00 Projected Balance Sheet With Investment 2014 Assets Cash and Equivelants Cash Recieviable Inventory Finished Products Inventory in Process Other Assets Total Current Assets Fixed Assets PP&E Depreication Total fixed Total Assets Liabilities Accounts payable Credit Cards Total Liabilities Equity Capital Contributions Retained Earnings Total L & E $ (84,346.00) $ 20,000.00 144,374.00 $ 515,210.00 $ 8,009.00 603,247.00 $ $ 313,070.00 $ 164,037.00 $ 149,033.00 $ 752,280.00 1,000.00 $ 12,000.00 $ 13,000.00 $ $ 782,179.00 (42,899.00) 739,280.00 $ 752,280.00 $

Step by Step Solution

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Answer Explanation 1 No as there is negative retained earnings which in... View full answer

Get step-by-step solutions from verified subject matter experts