Question: The FASB Codification reference is: 820-10-30-02 ACC 318 Module Four Assignment Template Complete this template by replacing the bracketed text with the relevant information. Master

The FASB Codification reference is: 820-10-30-02

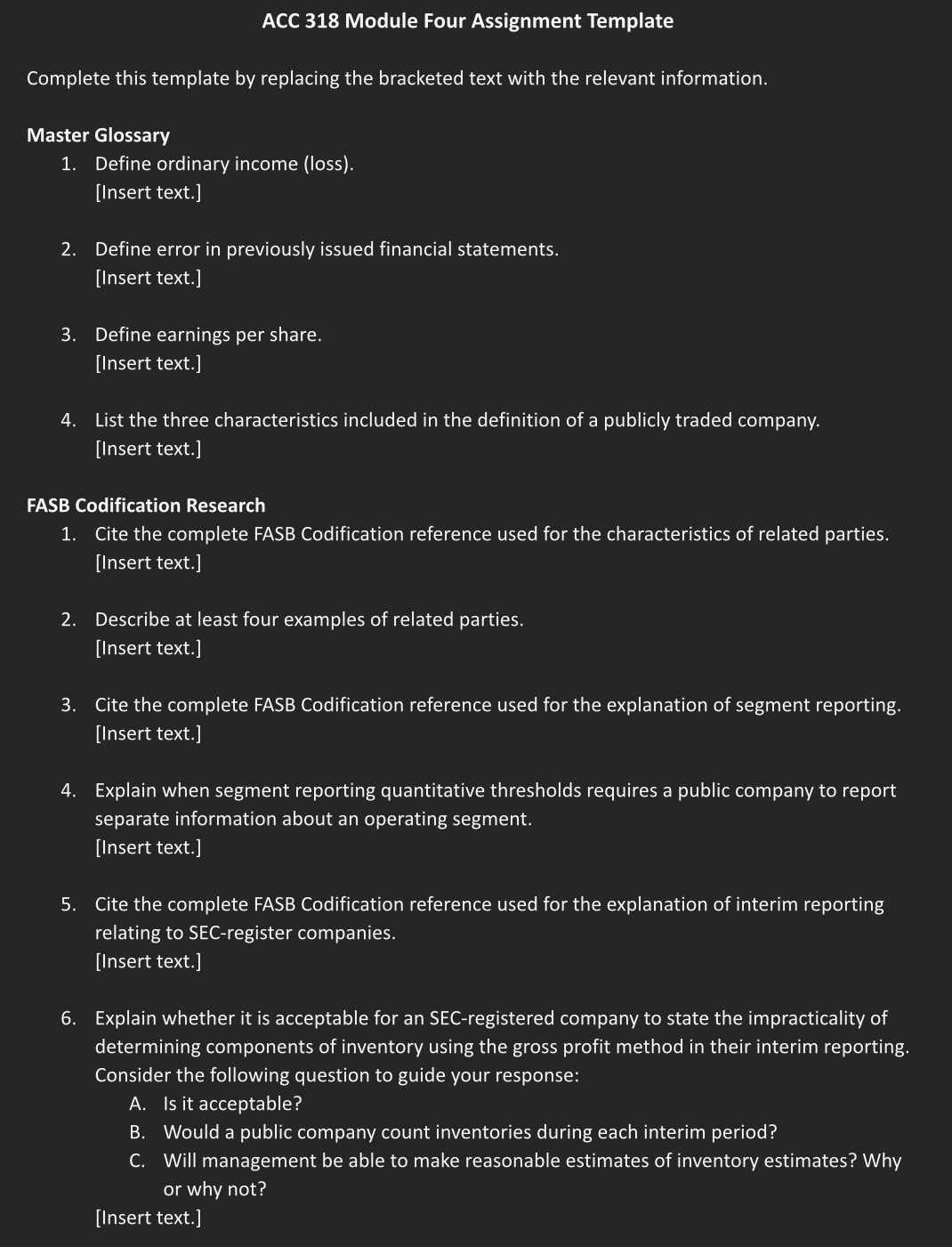

ACC 318 Module Four Assignment Template Complete this template by replacing the bracketed text with the relevant information. Master Glossary 1. Define ordinary income (loss). [Insert text.] 2. Define error in previously issued financial statements. [Insert text.] 3. Define earnings per share. [Insert text.] 4. List the three characteristics included in the definition of a publicly traded company. [Insert text.] FASB Codification Research 1. Cite the complete FASB Codification reference used for the characteristics of related parties. [Insert text.] 2. Describe at least four examples of related parties. [Insert text.] 3. Cite the complete FASB Codification reference used for the explanation of segment reporting. [Insert text.] 4. Explain when segment reporting quantitative thresholds requires a public company to report separate information about an operating segment. [Insert text.] 5. Cite the complete FASB Codification reference used for the explanation of interim reporting relating to SEC-register companies. [Insert text.] 6. Explain whether it is acceptable for an SEC-registered company to state the impracticality of determining components of inventory using the gross profit method in their interim reporting. Consider the following question to guide your response: A. Is it acceptable? B. Would a public company count inventories during each interim period? C. Will management be able to make reasonable estimates of inventory estimates? Why or why not? [Insert text.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts