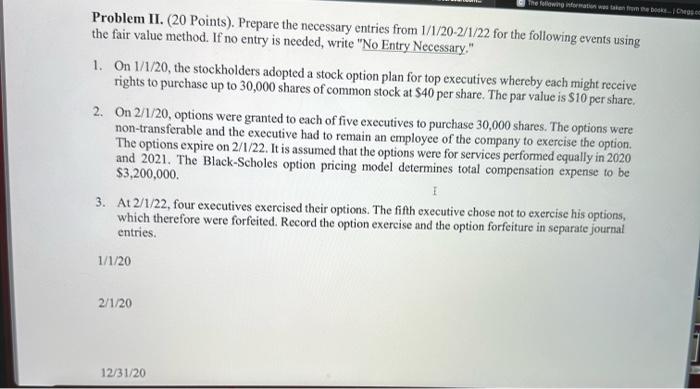

Question: the faur value method. If no entry is needed, write No Entry Necessary. 1. On 1/1/20, the stockholders adopted a stock option plan for top

the faur value method. If no entry is needed, write "No Entry Necessary." 1. On 1/1/20, the stockholders adopted a stock option plan for top executives whereby each might receive rights to purchase up to 30,000 shares of common stock at $40 per share. The par value is $10 per share. 2. On 2/1/20, options were granted to each of five executives to purchase 30,000 shares. The options were non-transferable and the executive had to remain an employee of the company to exercise the option. The options expire on 2/1/22. It is assumed that the options were for services performed equally in 2020 and 2021. The Black-Scholes option pricing model determines total compensation expense to be $3,200,000. 3. At 2/1/22, four executives exercised their options. The fifth executive chose not to exercise his options, which therefore were forfeited. Record the option exercise and the option forfeiture in separate journal entries. 1/1/20 2/1/20 12/31/20 12/31/21 2/1/22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts