Question: The financial plan element(s) that fluctuates over time and may change based on the situation or goal is: financial capacity. time horizon. feelings of control.

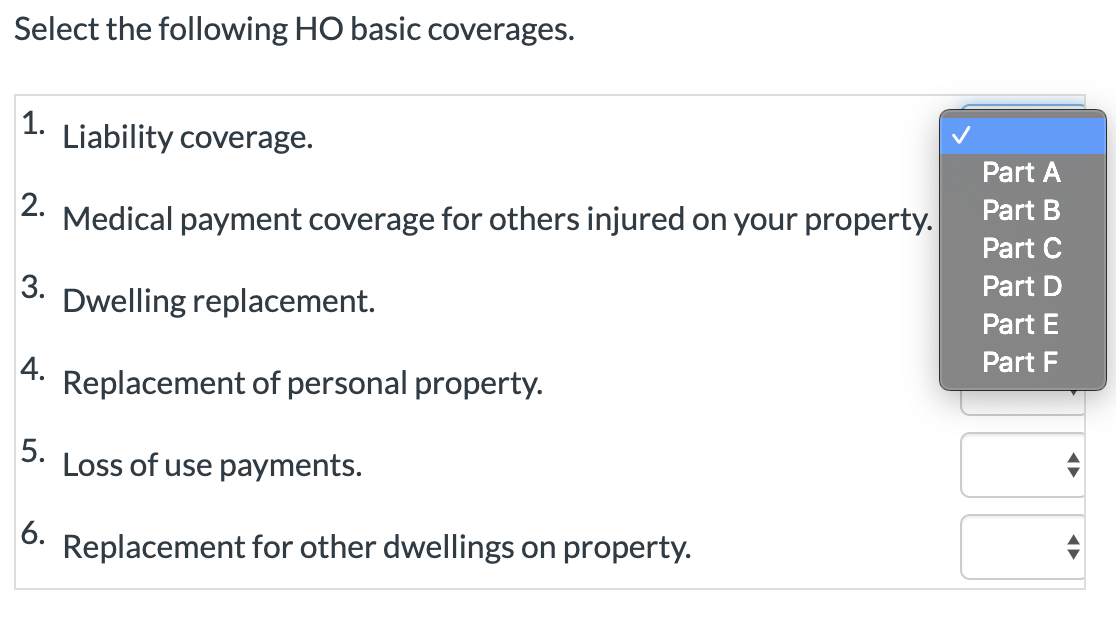

The financial plan element(s) that fluctuates over time and may change based on the situation or goal is: financial capacity. time horizon. feelings of control. feelings of control and time horizon. Select the following HO basic coverages. 1. Liability coverage. 2. Medical payment coverage for others injured on your property. Part A Part B Part C Part D Part E Part F 3. Dwelling replacement. 4. Replacement of personal property. 5. Loss of use payments. 6. Replacement for other dwellings on property. Susan was involved in an automobile accident. She was found liable for $21200 in property damages. Fortunately, she had PAP coverage with a split limit of 25/50/20, a deductible of $530, and a comprehensive deductible of $120. How much will her out-of-pocket expense be for the accident? $530. $650. $0. $120. George was in an automobile accident. According to the police report, he was responsible for causing the wreck. The accident was large enough to close down the interstate for an hour. The three people in the other car were rushed to the hospital. The costs associated with the rescue and medical care were $18,000 for each person. Based on the facts of the case, which of the following statements is true? I. George can expect his PAP premiums to increase in the future. II. George will be personally liable for any excess damages not covered by in III. George's future liability will be exempt if he can prove that he was covere land II only. I only. I and III only. III only. Raul owns real estate in two states: his personal residence in Georgia and a small condominium in a coastal town in South Carolina. After reading about probate, he has several concerns. First, he is worried that all of his personal financial information will become public if his estate goes through the probate process. Second, he is concerned that his executor will need to deal with the probate courts in both Georgia and South Carolina. He is worried that this could get expensive, in addition to being a hassle. Third, he is tired of having to worry about the many ways to title each piece of property. As a single person, Raul's home and condo are titled fee simple. Is he correct that, if he were to pass away, the property would need to go through the probate system? Yes No Later Consumers who are interested in minimizing conflicts of interest and avoid being ripped off should work with a financial advisor who: I. fully discloses any and all fees. II. fully discloses any potential conflicts of interest. III. uses mutual funds over individual stocks. I only. III only. I and II only. O I, II, and III. Mark, age 56, is a single man and died intestate. In addition to household and personal items, he had $450,000 in 401(k) retirement assets, and a named beneficiary for his 401(k) account. Who will receive the 401(k) plan? Whomever Mark noted in his will. His brothers and sisters, in equal shares, or his parents. Whomever Mark listed as the account beneficiary. Whomever the state where he died indicates through probate statute

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts