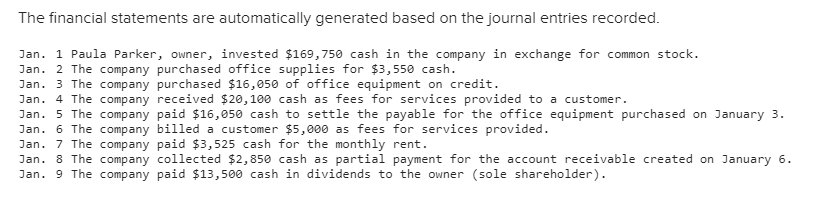

Question: The financial statements are automatically generated based on the journal entries recorded Jan. 1 Paula Parker, owner, invested $169,750 cash in the company in exchange

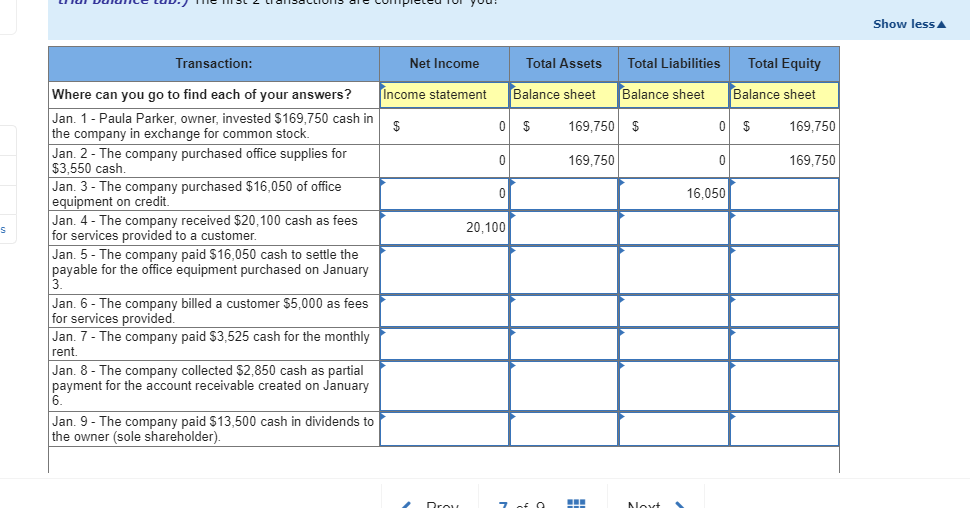

The financial statements are automatically generated based on the journal entries recorded Jan. 1 Paula Parker, owner, invested $169,750 cash in the company in exchange for common stock Jan. 2 The company purchased office supplies for $3,550 cash Jan. 3 The company purchased $16,050 of office equipment on credit Jan. 4 The company received $20,100 cash as fees for services provided to a customer Jan. 5 The company paid $16,050 cash to settle the payable for the office equipment purchased on January 3 Jan. 6 The company billed a customer $5,000 as fees for services provided Jan. 7 The company paid $3,525 cash for the monthly rent Jan. 8 The company collected $2,850 cash as partial payment for the account receivable created on January 6 Jan. 9 The company paid $13,500 cash in dividends to the owner (sole shareholder). 9 0 5 1 Show less Transaction: Net Income Total Assets Total Liabilities Total Equity Where can you go to find each of your answers? Income statement Jan. 1 - Paula Parker, owner, invested $169,750 cash in the company in exchange for common stock. Jan. 2 - The company purchased office supplies for 53,550 cash Jan. 3 - The company purchased $16,050 of office equipment on credit. Jan. 4 - The company received $20,100 cash as fees for services provided to a customer Jan. 5 - The company paid $16,050 cash to settle the payable for the office equipment purchased on January Balance sheet Balance sheet |Balance sheet 169,750$ 169,750 169,750 169,750 16,050 20,100 Jan. 6 - The company billed a customer S5,000 as fees for services provided Jan. 7 - The company paid $3,525 cash for the monthly rent Jan. 8 - The company collected $2,850 cash as partial payment for the account receivable created on January Jan. 9 - The company paid $13,500 cash in dividends to the owner (sole shareholder)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts