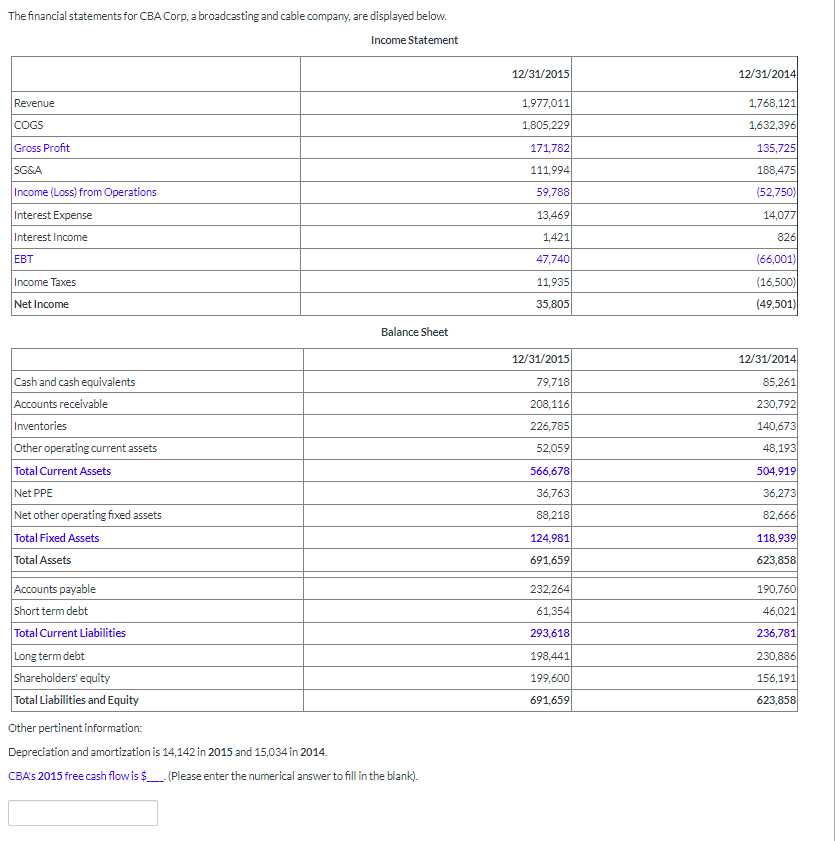

Question: The financial statements for CBA Corp, a broadcasting and cable company, are displayed below. Income Statement 12/31/2015 12/31/2014) Revenue 1,977,011 1,768,121 COGS 1,805,229 1,632,396 Gross

The financial statements for CBA Corp, a broadcasting and cable company, are displayed below. Income Statement 12/31/2015 12/31/2014) Revenue 1,977,011 1,768,121 COGS 1,805,229 1,632,396 Gross Profit 171,782 135,725 188,475 111,994 59,788 (52,750) 13,469 14,077 SGSA Income (Loss) from Operations Interest Expense Interest Income EBT Income Taxes 1,421 826 47,740 (66,001) 11,935 (16,500) (49,501) Net Income 35,805 Balance Sheet 12/31/2015 12/31/2014 79,718 85,261 208.116 230,792 226,785 140,673 52,059 48,193 504,919 566,678 36,763 36,273 88,218 82,666 Cash and cash equivalents Accounts receivable Inventories Other operating current assets Total Current Assets Net PPE Net other operating fixed assets Total Fixed Assets Total Assets Accounts payable Short term debt Total Current Liabilities Long term debt Shareholders' equity Total Liabilities and Equity 124,981 118,939 691,659 623,858 232.264 190,760 61,354 46,021 293,618 236,781 198,441 230,886 199,600 156,191 691,659 623,858 Other pertinent information: Depreciation and amortization is 14,142 in 2015 and 15,034 in 2014. CBA's 2015 free cash flow is $_. (Please enter the numerical answer to fill in the blank)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts