Question: The financial statements reflect historical data, but managers' performance must be evaluated on the basis of values. To provide this information, financial analysts have developed

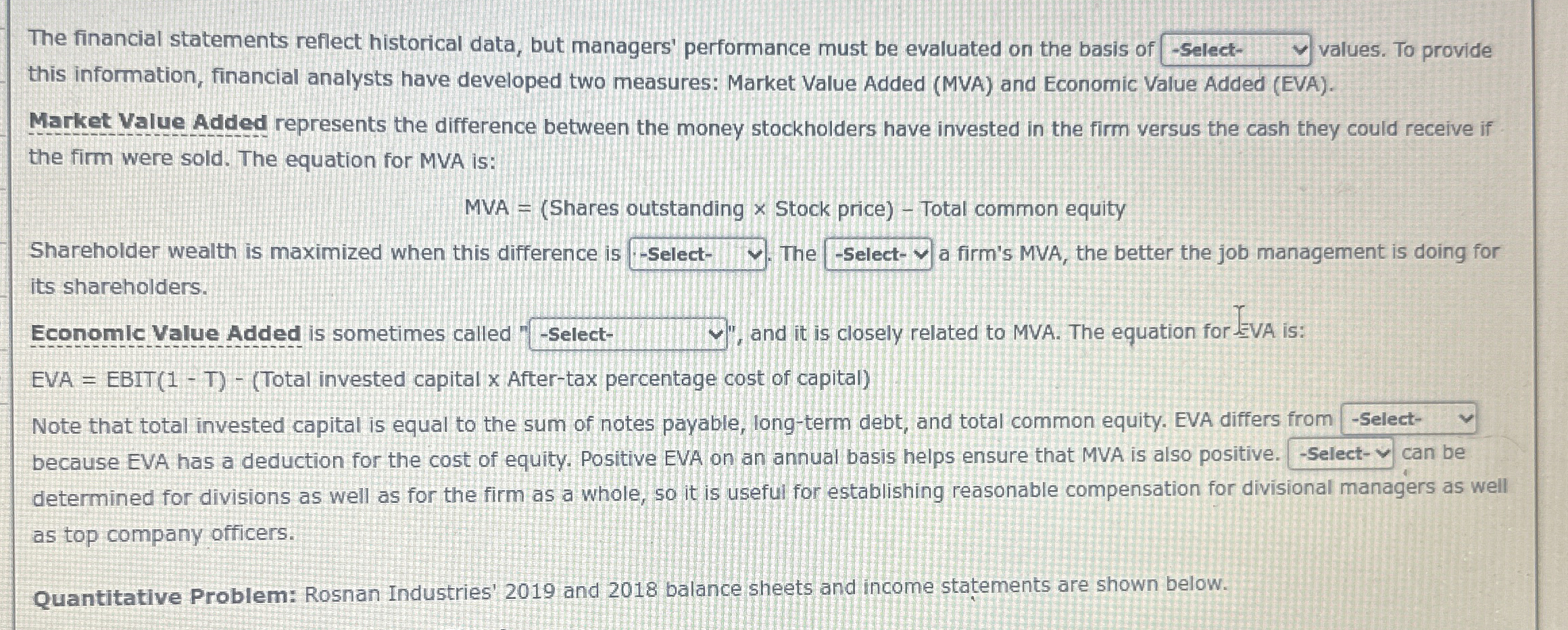

The financial statements reflect historical data, but managers' performance must be evaluated on the basis of values. To provide this information, financial analysts have developed two measures: Market Value Added MVA and Economic Value Added EVA

Market Value Added represents the difference between the money stockholders have invested in the firm versus the cash they could receive if the firm were sold. The equation for MVA is:

MVA outstanding Stock price Total common equity

Shareholder wealth is maximized when this difference is The a firm's MVA, the better the job management is doing for its shareholders.

Economlc Value Added is sometimes called and it is closely related to MVA. The equation for IEVA is:

EVA EBIT Total invested capital Aftertax percentage cost of capital

Note that total invested capital is equal to the sum of notes payable, longterm debt, and total common equity. EVA differs from because EVA has a deduction for the cost of equity. Positive EVA on an annual basis helps ensure that MVA is also positive. can be determined for divisions as well as for the firm as a whole, so it is useful for establishing reasonable compensation for divisional managers as well as top company officers.

Quantitative Problem: Rosnan Industries' and balance sheets and income statements are shown below.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock