Question: The firm has two potential projects which is mutually exclusive in next year. One is the development of 30th floor of a condominium in Blue

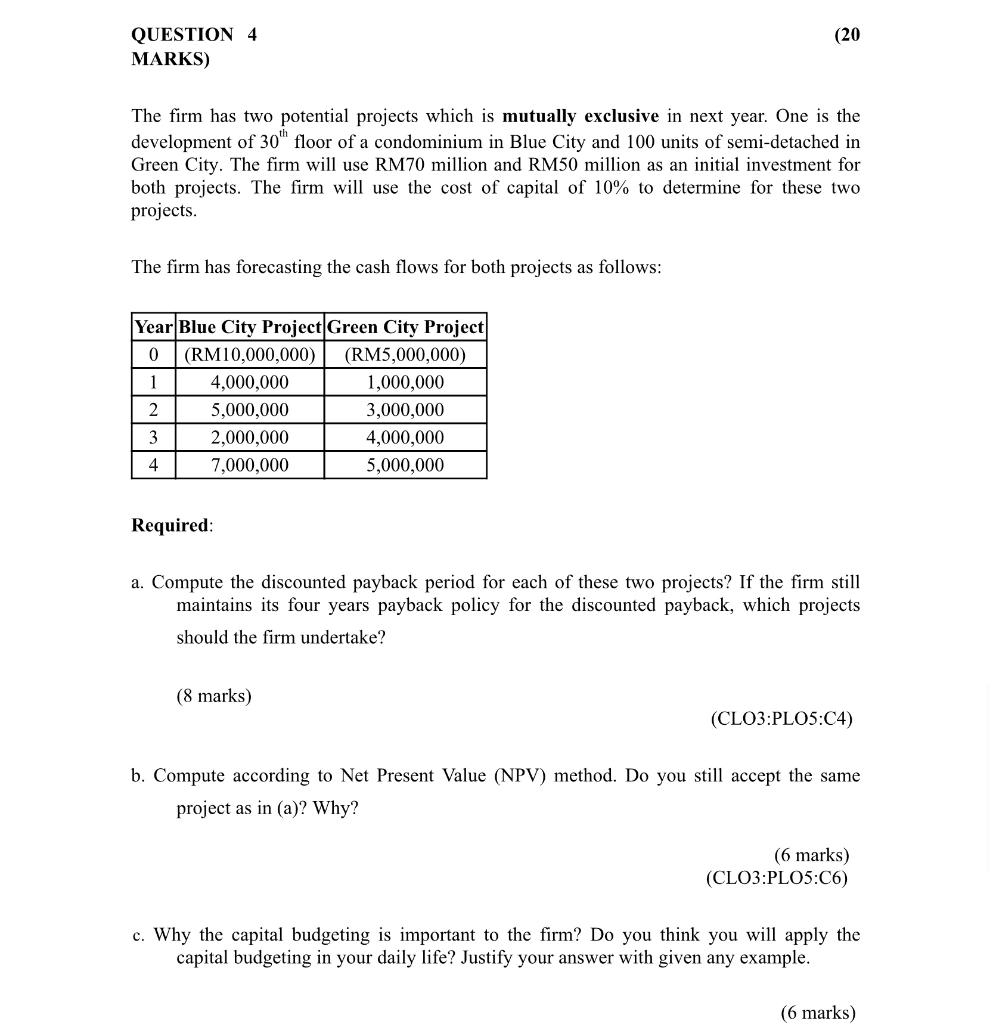

The firm has two potential projects which is mutually exclusive in next year. One is the development of 30th floor of a condominium in Blue City and 100 units of semi-detached in Green City. The firm will use RM70 million and RM50 million as an initial investment for both projects. The firm will use the cost of capital of 10% to determine for these two projects. The firm has forecasting the cash flows for both projects as follows: Required: a. Compute the discounted payback period for each of these two projects? If the firm still maintains its four years payback policy for the discounted payback, which projects should the firm undertake? (8 marks) (CLO3:PLO5:C4) b. Compute according to Net Present Value (NPV) method. Do you still accept the same project as in (a)? Why? c. Why the capital budgeting is important to the firm? Do you think you will apply the capital budgeting in your daily life? Justify your answer with given any example

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts