Question: the first 2 images are the same! the second one is different! please answer in order and underline the answer! this is a huge part

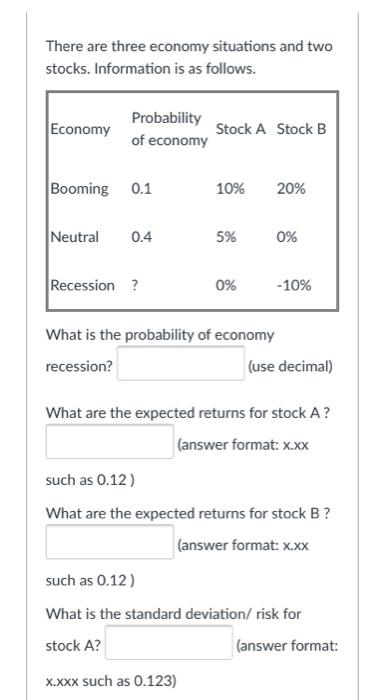

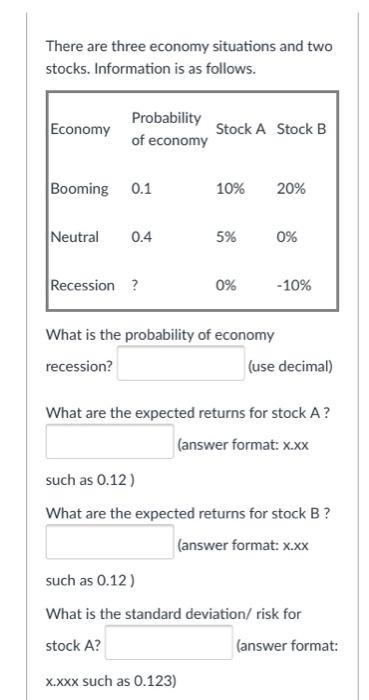

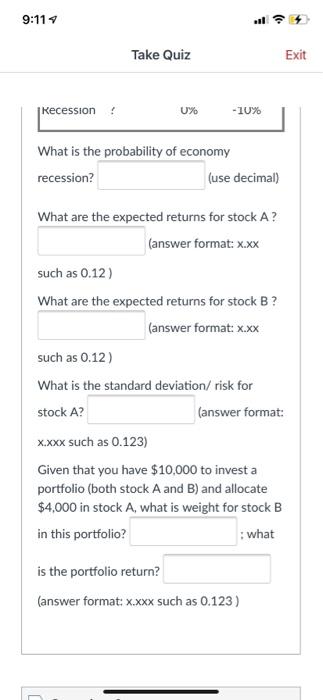

There are three economy situations and two stocks. Information is as follows. Economy Probability Stock A Stock B of economy Booming 0.1 10% 20% Neutral 0.4 5% 0% Recession? 0% -10% What is the probability of economy recession? (use decimal) What are the expected returns for stock A? (answer format: x.xx such as 0.12) What are the expected returns for stock B ? (answer format: x.xx such as 0.12) What is the standard deviation/ risk for stock A? (answer format: X.XXX such as 0.123) There are three economy situations and two stocks. Information is as follows. Economy Probability Stock A Stock B of economy Booming 0.1 10% 20% Neutral 0.4 5% 0% Recession? 0% -10% What is the probability of economy recession? (use decimal) What are the expected returns for stock A? (answer format: x.xx such as 0.12) What are the expected returns for stock B ? (answer format: x.xx such as 0.12) What is the standard deviation/ risk for stock A? (answer format: X.XXX such as 0.123) 9:114 Take Quiz Exit Recession : - 10% What is the probability of economy recession? (use decimal) What are the expected returns for stock A? (answer format: x.xx such as 0.12) What are the expected returns for stock B ? (answer format: x.xx such as 0.12) What is the standard deviation/ risk for stock A? (answer format: X.xxx such as 0.123) Given that you have $10,000 to invest a portfolio (both stock A and B) and allocate $4,000 in stock A, what is weight for stock B in this portfolio? : what is the portfolio return? (answer format x.xxx such as 0.123 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts