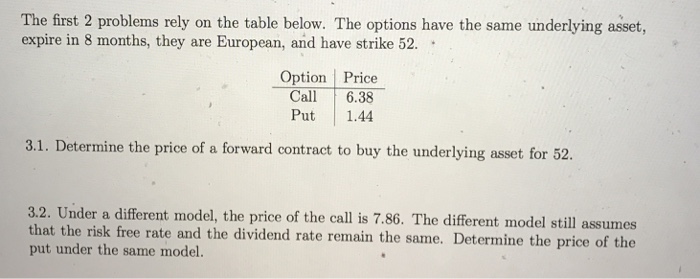

Question: The first 2 problems rely on the table below. The options have the same underlying asset, expire in 8 months, they are European, and have

The first 2 problems rely on the table below. The options have the same underlying asset, expire in 8 months, they are European, and have strike 52. Determine the price of a forward contract to buy the underlying asset for 52. Under a different model, the price of the call is 7.86. The different model still assumes that the risk free rate and the dividend rate remain the same. Determine the price of the put under the same model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts