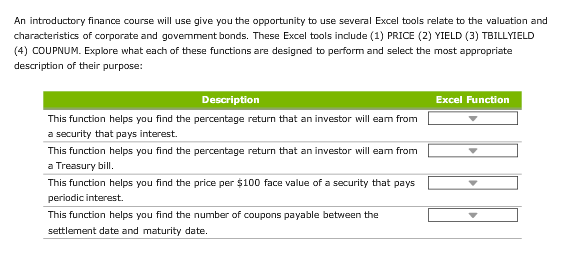

Question: The first 4 dropdown boxes each have the following answers to choose from: YIELD, PRICE, COUPNUM, and TBILLYIELD. 5th dropdown box answers: YIELD(B2, B3, B4,

The first 4 dropdown boxes each have the following answers to choose from:

YIELD, PRICE, COUPNUM, and TBILLYIELD.

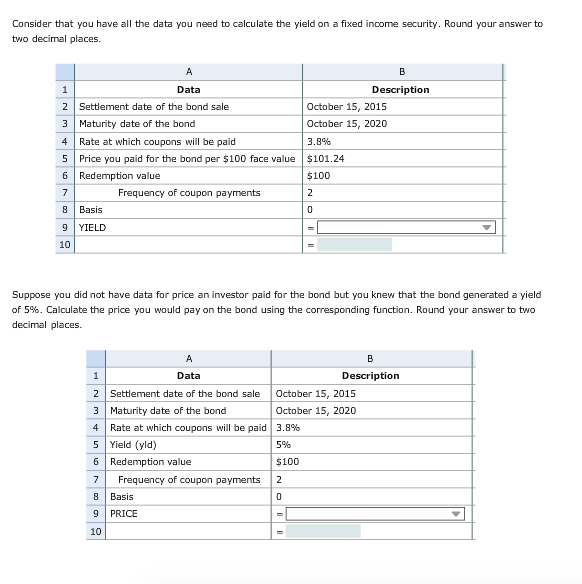

5th dropdown box answers:

YIELD(B2, B3, B4, B6, B5, B7, B8)

YIELD(B3, B4, B5, B6, B7, B8)

YIELD(B3, B2, B4, B5, B6, B7, B8)

YIELD(B2, B3, B4, B5, B6, B7, B8)

6th dropdown box answers:

PRICE(B2, B3, B4, B6, B5, B7, B8)

PRICE(B3, B4, B5, B6, B7, B8)

PRICE(B3, B2, B4, B5, B6, B7, B8)

PRICE(B2, B3, B4, B5, B6, B7, B8)

An introductory finance course will use give you the opportunity to use several Excel tools relate to the valuation and characteristics of corporate and govemment bonds. These Excel tools include (1) PRICE (2) YIELD (3) TBILLYIELD (4) COUPNUM. Explore what each of these functions are designed to perform and select the most appropriate description of their purpose: Description Excel Function This function helps you find the percentage return that an investor will eam from a security that pays interest. This function helps you find the percentage return that an investor will eam fromY a Treasury bill. This function helps you find the price per $100 face value of a security that pays periodic interest. This function helps you find the number of coupons payable between the settlement date and maturity date. Consider that you have all the data you need to calculate the yield on a fixed income security. Round your answer to two decimal places. Data Description October 15, 2015 2 Settlement date of the bond sale October 15, 2020 3 Maturity date of the bond 4 Rate at which coupons will be paid 3.8% 5 Price you paid for the bond per $100 face value $101.24 6 Redemption value $100 Frequency of coupon payments 8 Basis 9 YIELD 10 Suppose you did not have data for price an investor paid for the bond but you knew that the bond generated a yield of 5%. Calculate the price you would pay on the bond using the corresponding function. Round your answer to two decimal places. Data Description 2 Settlement date of the bond sale October 15, 2015 October 15, 2020 3 Maturity date of the bond 4 Rate at which h coupons will be paid 3.8% 5 Yield (yld) 5% 6 Redemption value $100 7 Frequency of coupon payments 2 8 Basis 9 PRICE 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts