Question: the first 5 are the management contract. last two are the questions that need to be answered Article 1: Hotel Description /Contract Term This 300-room

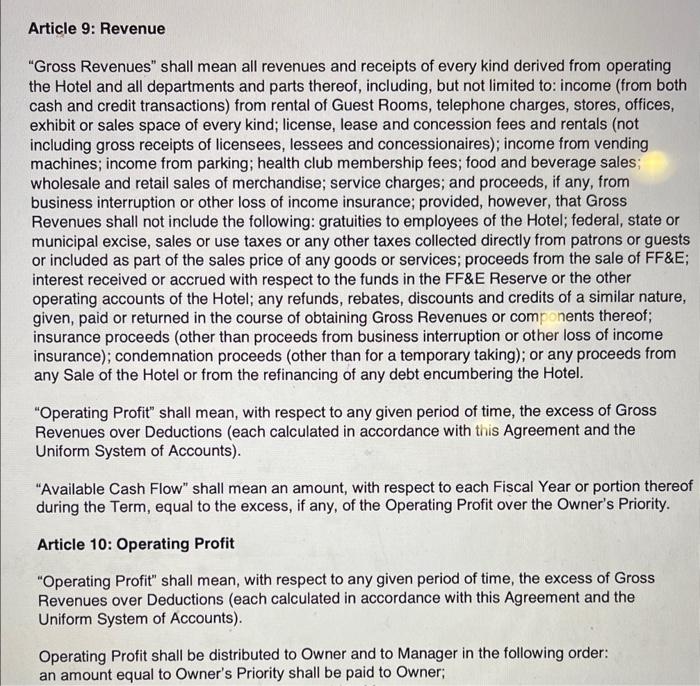

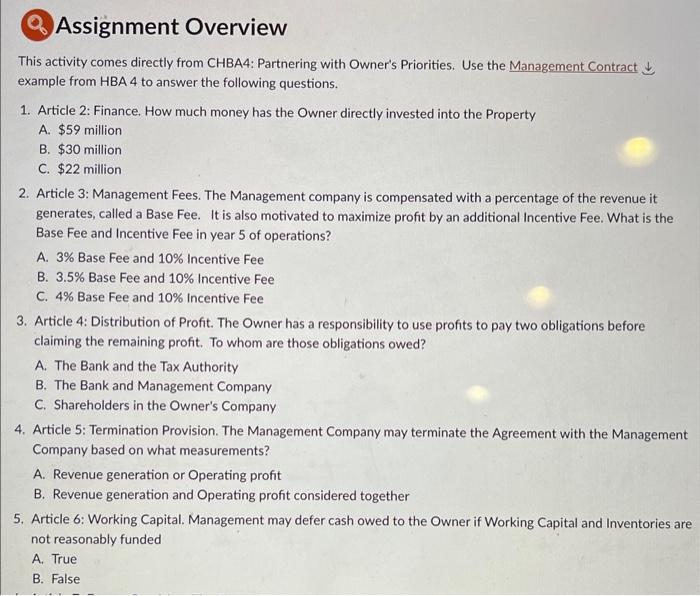

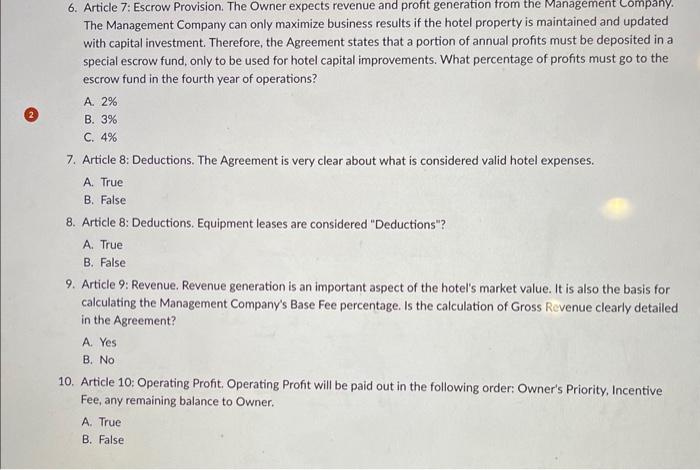

Article 1: Hotel Description /Contract Term This 300-room hotel was developed by the Owner and is currently one to one and a half years old. The term of the Management Agreement is for 30 years with two (2) 10-year renewal terms at the option of the Manager (or automatic renewal or option of the Owner, etc.). Article 2: Finance The cost of the Hotel was $59M. The approved budget for the project per the Senior Loan Agreement was $50M. The Owner will have invested $22M and financed the remainder with a $30M loan from the bank and a $5M Subordinated Loan from the Management Company. The primary loan from the Bank carries an interest rate prior to opening of LIBOR plus 2.5%. After the opening date and after the Management company debt service guarantee is in place, the interest rate is LIBOR plus 2%. After the opening date and after the Management Company's debt service guarantee expires, the interest rate varies with the level of the Debt Service Ratio from LIBOR plus 22.75%. Twenty (20) semi-annual principal payments equaling $1.5M will be made beginning 18 months after opening. The Management Company's Subordinated Loan totals $5M and includes an interest guarantee. Any amounts incurred related to the Interest Guarantee are added to the principal amount of the Subordinated Loan. The interest guarantee has a limit of $9M. Loan payments are due on December 31 , April 5, July 5 , and October 5 , beginning after the Opening Date. Interest is LIBOR plus 3%. The Management Company has guaranteed \$7M for Interest Guaranty on the Senior Debt. Any payments made to the Senior Lender pursuant to the Interest Guarantee are added to the amount of the principal of the Subordinated Loan and are subject to the same repayment schedule mentioned above. Article 3: Management Fees Base Management Fee: 3% of Hotel Sales for year 12,3.5% of Hotel Sales for year 4 , and 4% thereafter. The Base Management Fee is not subordinated to debt service. Incentive Management Fee - 10% of Operating Profit. Management Fee is listed as third priority after Interest Payments due on Senior and Subordinated Loans, and after principal payments or contributions to Accumulated Reserve Account as required in Senior Loan Agreement. The only cap on any other Management Company charge backs is a 1.5% of sales limit for International Advertising, Marketing, Promotion, and Sales Program. Article 4. Owner's Priority / Distribution of Operating Profit The first principal payment on the Senior Loan will take place 18 months from date of opening. Interest payments have been made since for 24 months on a quarterly basis. The priority of Distribution of Operating Profit is, in order: - Interest payments on Senior Loan and the Management Companies Subordinated Loan - Principal payments on senior debt and/or payments to the Accumulated Reserve Account - Management Fee and Casino Management Fee - Deferred Management or Casino Management Fees - Principal on Subordinated Loan - Deferred Principal Payments on Subordinated Loan. Article 5. Performance Termination Provision / Owner's Termination Rights Beginning four years after opening date, the Owner may terminate the agreement if (i) for two consecutive fiscal years, Rooms Department Revenue is less than 85% of Performance Standard Rooms Department Revenue, or (ii) for two consecutive Test Fiscal Years, Operating Profit for the Hotel is less than the amount of Operating Profit for the Hotel for the calendar year corresponding to such Test Fiscal Year. Management Company has the right to cure by paying to the Owner the amount necessary to reach the Minimum Performance Standards within ten (10) days of the notice date of termination. Article 6: Working Capital The Owner funded $1.15K in Working Capital. Working capital and inventories remain the property of the Owner upon termination of the contract. Owners will forward any additional funds necessary to maintain Working Capital and Inventories at levels reasonably determined by management. Manager may defer cash distributions to Owner in order to increase operating funds. Article 7: Escrow Provision / FF \&E Concerns/Physical Conditions The first-year provision is 1% (increasing to 2% in year 2,3% in year 35,4% in year 610,5% thereafter). All Routine Capital Expenditures are funded through Escrow. Major Hotel Building expenditures are Owner funded. The Owner submits an annual Capital Expenditure estimate for review. Owner may call a meeting for review of the estimate. The escrow account is pledged as collateral for the Senior Loan. Departmental expenses incurred at departments within the Hotel; administrative and general expenses; the cost of marketing incurred by the Hotel; advertising and business promotion incurred by the Hotel; heat, light, and power; computer line charges; and routine repairs, maintenance and minor alterations treated as Deductions under Section 5.01; The cost of replacing Inventories and Fixed Asset Supplies used in the operation of the Hotel; A reasonable reserve for uncollectible accounts receivable as determined by Manager; All costs and fees of independent professionals or other third parties who are retained by Manager to perform services required or permitted hereunder; All costs and fees of technical consultants, professionals and operational experts (but not including the costs of the Expert, which will be assessed in accordance with Section 11.21) who are retained or employed by Manager, a divsion of the Management Company, and their Affiliates for specialized services (including, without limitation, quality assurance inspectors, personnel providing architectural, technical or procurement services for the Hotel, tax consultants, and personnel providing legal services in connection with matters directly involving the Hotel) and the cost of attendance by employees of the Hotel at training and manpower development programs designated by Manager; The Base Management Fee; Insurance costs and expenses as provided in Article VI; Taxes, if any, payable by or assessed against Manager related to this Agreement or to Manager's operation of the Hotel (exclusive of Manager's income taxes or franchise taxes); All Impositions; The amount of any transfers into the FF\&E Reserve required, pursuant to Section 5.02; The Hotel's share of costs and expenses incurred in connection with sales, advertising, promotion and marketing programs developed for the Management Company Brand, including guest loyalty and recognition programs and the Marriott Rewards Program, where such expenses are not deducted as departmental expenses under paragraph 2 above or as Chain Services pursuant to paragraph 13 below; The Hotel's share of the charges for Chain Services; All costs and expenses of compliance by Manager with applicable Legal Requirements pertaining to the operation of the Hotel; The Hotel's pro rata share of costs and expenses (including those relating to development implementation) incurred in connection with providing services to multiple hotels and/or oth facilities in substitution for or in association with services that are or would have be performed or procured by individual hotels, which may be more effectively performed on a shared or group basis; Such other costs and expenses incurred by Manager (either at the Hotel or elsewhere) as a specifically provided for elsewhere in this Agreement or are otherwise reasonably necessan the proper and efficient operation of the Hotel. The term "Deductions" shall not include: debt service payments pursuant to any mortgage on the Hotel; payments pursuant to equipment leases or other forms of financing obtained for the FF\&E located in or connected with the Hotel, unless Manager has previously given its written conse to such equipment lease and/or financing; rental payments pursuant to any ground lease of th Site; or depreciation on the Hotel or any of its contents; All of the foregoing items listed in this paragraph shall be paid by Owner from its own funds. Article 9: Revenue "Gross Revenues" shall mean all revenues and receipts of every kind derived from operating the Hotel and all departments and parts thereof, including, but not limited to: income (from both cash and credit transactions) from rental of Guest Rooms, telephone charges, stores, offices, exhibit or sales space of every kind; license, lease and concession fees and rentals (not including gross receipts of licensees, lessees and concessionaires); income from vending machines; income from parking; health club membership fees; food and beverage sales; wholesale and retail sales of merchandise; service charges; and proceeds, if any, from business interruption or other loss of income insurance; provided, however, that Gross Revenues shall not include the following: gratuities to employees of the Hotel; federal, state or municipal excise, sales or use taxes or any other taxes collected directly from patrons or guests or included as part of the sales price of any goods or services; proceeds from the sale of FF\&E; interest received or accrued with respect to the funds in the FF\&E Reserve or the other operating accounts of the Hotel; any refunds, rebates, discounts and credits of a similar nature, given, paid or returned in the course of obtaining Gross Revenues or components thereof; insurance proceeds (other than proceeds from business interruption or other loss of income insurance); condemnation proceeds (other than for a temporary taking); or any proceeds from any Sale of the Hotel or from the refinancing of any debt encumbering the Hotel. "Operating Profit" shall mean, with respect to any given period of time, the excess of Gross Revenues over Deductions (each calculated in accordance with this Agreement and the Uniform System of Accounts). "Available Cash Flow" shall mean an amount, with respect to each Fiscal Year or portion thereof during the Term, equal to the excess, if any, of the Operating Profit over the Owner's Priority. Article 10: Operating Profit "Operating Profit" shall mean, with respect to any given period of time, the excess of Gross Revenues over Deductions (each calculated in accordance with this Agreement and the Uniform System of Accounts). Operating Profit shall be distributed to Owner and to Manager in the following order: an amount equal to Owner's Priority shall be paid to Owner; This activity comes directly from CHBA4: Partnering with Owner's Priorities. Use the Management Contract example from HBA 4 to answer the following questions. 1. Article 2: Finance. How much money has the Owner directly invested into the Property A. $59 million B. $30 million C. $22 million 2. Article 3: Management Fees. The Management company is compensated with a percentage of the revenue it generates, called a Base Fee. It is also motivated to maximize profit by an additional Incentive Fee. What is the Base Fee and Incentive Fee in year 5 of operations? A. 3% Base Fee and 10% Incentive Fee B. 3.5% Base Fee and 10% Incentive Fee C. 4% Base Fee and 10% incentive Fee 3. Article 4: Distribution of Profit. The Owner has a responsibility to use profits to pay two obligations before claiming the remaining profit. To whom are those obligations owed? A. The Bank and the Tax Authority B. The Bank and Management Company C. Shareholders in the Owner's Company 4. Article 5: Termination Provision. The Management Company may terminate the Agreement with the Management Company based on what measurements? A. Revenue generation or Operating profit B. Revenue generation and Operating profit considered together 5. Article 6: Working Capital. Management may defer cash owed to the Owner if Working Capital and Inventories are not reasonably funded A. True B. False 6. Article 7: Escrow Provision. The Owner expects revenue and profit generation from the Management Lompany. The Management Company can only maximize business results if the hotel property is maintained and updated with capital investment. Therefore, the Agreement states that a portion of annual profits must be deposited in a special escrow fund, only to be used for hotel capital improvements. What percentage of profits must go to the escrow fund in the fourth year of operations? A. 2% B. 3% C. 4% 7. Article 8: Deductions. The Agreement is very clear about what is considered valid hotel expenses. A. True B. False 8. Article 8: Deductions. Equipment leases are considered "Deductions"? A. True B. False 9. Article 9: Revenue. Revenue generation is an important aspect of the hotel's market value. It is also the basis for calculating the Management Company's Base Fee percentage. Is the calculation of Gross Revenue clearly detailed in the Agreement? A. Yes B. No 10. Article 10: Operating Profit. Operating Profit will be paid out in the following order: Owner's Priority, Incentive Fee, any remaining balance to Owner. A. True B. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts