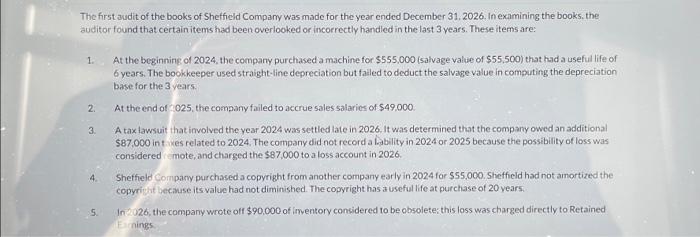

Question: The first audit of the books of Sheffield Company was made for the year ended December 31, 2026. In examining the books, the auditor found

The first audit of the books of Shefficld Company was made for the year ended December 31,2026 . In examining the books, the auditor found that certain items had been overlooked or incorrectly handled in the last 3 years. These items are: 1. At the beginning of 2024 , the company purchased a machine for $555,000 (salvage value of $55,500 ) that had a useful life of 6 years. The bookkeeper used straight-line depreciation but falled to deduct the salvage value in computing the depreciation base for the 3 years. 2. At the end of 025 , the company failed to accrue sales salaries of $49,000. 3. A tax lawsuit that involved the vear 2024 was settled late in 2026. It was determined that the company owed an additional $87,000 in t. es related to 2024, The company did not record a bability in 2024 or 2025 because the possibility of loss was considered remote, and charged the $87,000 to a loss account in 2026. 4. Sheffield Compary purchased a copyright from another company early in 2024 for $55,000. Shefficid had not amortized the copyright beciase its value had not diminished. The copyright has a useful life at purchase of 20 vears. 5. In 2026 , the company wrote off $90,000 of imentory considered to be obsoletes this loss was charged directly to Retained Escaings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts