Question: The first four slides are just information to answer the yellowboxes. Please only answer the yellow boxes! I See The Light Projected Income Statement For

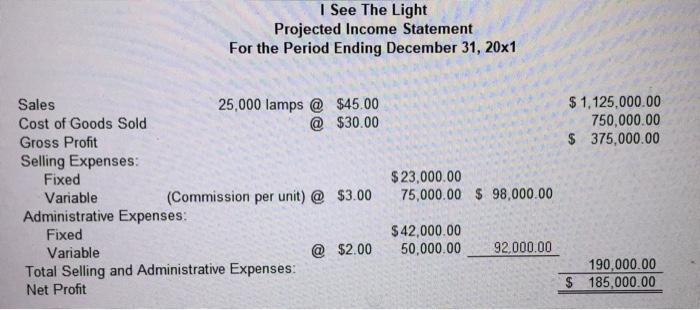

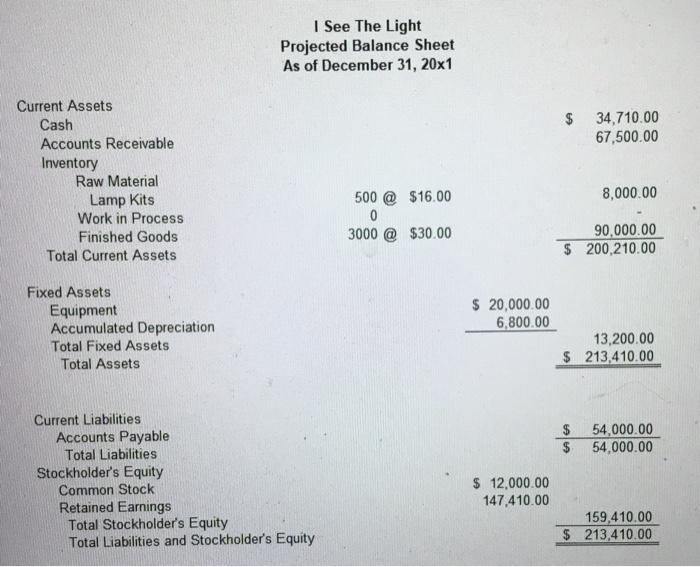

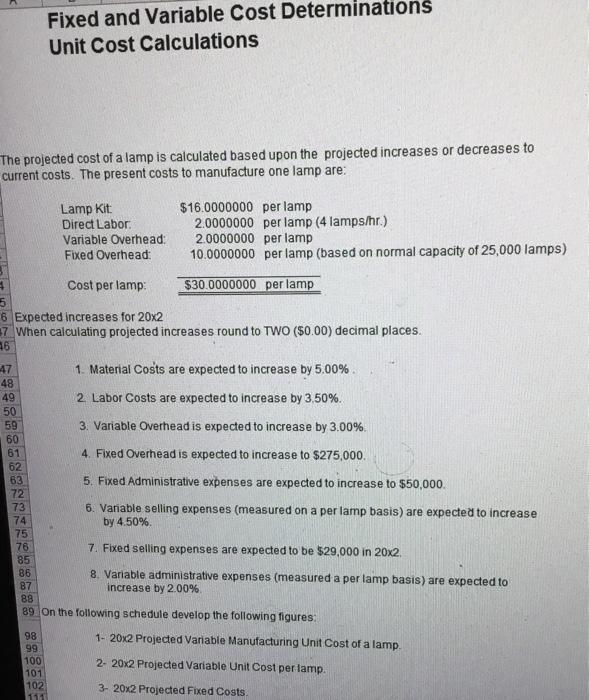

I See The Light Projected Income Statement For the Period Ending December 31, 20x1 $ 1,125,000.00 750,000.00 $ 375,000.00 Sales 25,000 lamps @ $45.00 Cost of Goods Sold @ $30.00 Gross Profit Selling Expenses: Fixed Variable (Commission per unit) @ $3.00 Administrative Expenses: Fixed Variable @ $2.00 Total Selling and Administrative Expenses: Net Profit $ 23,000.00 75,000.00 $ 98,000.00 $ 42,000.00 50,000.00 92,000.00 190,000.00 $ 185,000.00 I See The Light Projected Balance Sheet As of December 31, 20x1 $ 34,710.00 67,500.00 Current Assets Cash Accounts Receivable Inventory Raw Material Lamp Kits Work in Process Finished Goods Total Current Assets 8,000.00 500 @ $16.00 0 3000 $30.00 90,000.00 $ 200,210.00 Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets $ 20,000.00 6,800.00 13,200.00 $ 213,410.00 $ $ 54,000.00 54,000.00 Current Liabilities Accounts Payable Total Liabilities Stockholder's Equity Common Stock Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity $ 12,000.00 147,410.00 159,410.00 $ 213,410.00 Fixed and Variable Cost Determinations Unit Cost Calculations The projected cost of a lamp is calculated based upon the projected increases or decreases to current costs. The present costs to manufacture one lamp are: Lamp Kit Direct Labor Variable Overhead: Fixed Overhead: $16.0000000 per lamp 2.0000000 per lamp (4 lamps/hr.) 20000000 per lamp 10.0000000 per lamp (based on normal capacity of 25,000 lamps) Cost per lamp: $30.0000000 per lamp 5 6 Expected increases for 20x2 37 When calculating projected increases round to TWO ($0.00) decimal places. 46 47 1. Material Costs are expected to increase by 5.00% 48 49 2 Labor Costs are expected to increase by 3,50%. 50 59 3. Variable Overhead is expected to increase by 3.00% 60 61 4. Fixed Overhead is expected to increase to $275,000 62 63 5. Fixed Administrative expenses are expected to increase to $50,000 72 73 6. Variable selling expenses (measured on a per lamp basis) are expected to increase 74 by 4.50%. 75 76 7. Fixed selling expenses are expected to be $29,000 in 20x2 85 86 8. Variable administrative expenses (measured a per lamp basis) are expected to 87 increase by 2.00% 88 89. On the following schedule develop the following figures 98 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp 99 100 2- 20x2 Projected Variable Unit Cost per lamp 101 102 3- 20x2 Projected Fixed Costs 11 Job Order Costing To keep records of the actual cost of a special order job, a Job Order Cost System has been developed. Overhead is applied at the rate of 50% of the direct labor cost. 3 Job Order Costing Section 5 On January 1, 20x2. Division S began Job 2407 for the Client, THE BIG CHILDREN STORE. The 6 job called for 4,000 customized lamps. The following set of transactions occurred from 7 January 5 until the job was completed: 36 5-Jan Purchased 4,075 Lamp Kits @ $16.25 per kit. 48 9-Jan 4,150 sets of Lamp Kits were requisitioned. 49 17-Jan Payroll of 580 Direct Labor Hours @ $9.50 per hour. 50 30-Jan Payroll of 630 Direct Labor Hours @ $9.75 per hour. 59 30 Jan 3,990 lamps were completed and shipped. All materials requisitioned were 60 used or scrapped, and are a cost of normal processing. 61 62 Month End Overhead Information 63 Actual Variable Manufacturing Overhead $ 1,379.40 72 Actual Fixed Manufacturing Overhead $ 39,873.45 73 74 Round to two places, S#### Cost of Direct Material Incurred in Manufacturing Job 2407 {13.01) Cost of Direct Labor incurred in Manufacturing Job 2407 (13.02) Cost of Manufacturing Overhead Applied to Job 2407 {13.03) Cost of manufacturing one lamp {13.04

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts