Question: the first image is the main question and rest two images are the sub questions which I need answered Sweeten Company had no jobs in

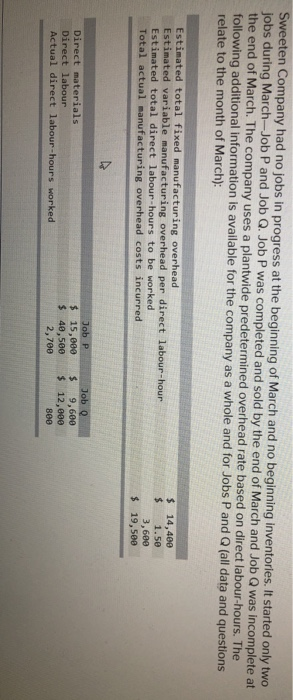

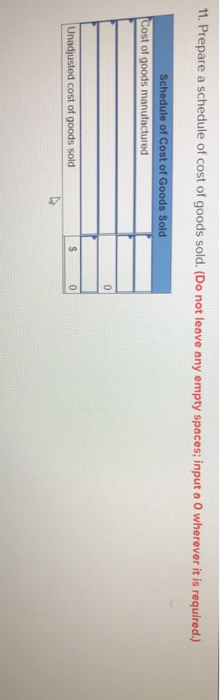

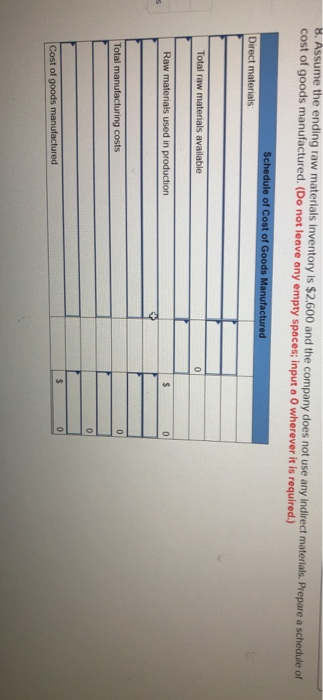

Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. It started only two jobs during March-Job P and Job Q. Job P was completed and sold by the end of March and Job Q was incomplete at the end of March. The company uses a plantwide predetermined overhead rate based on direct labour-hours. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Estimated total fixed manufacturing overhead Estimated variable manufacturing overhead per direct labour-hour Estimated total direct labour-hours to be worked Total actual manufacturing overhead costs incurred $ 14,400 $ 1.50 3,600 $ 19,500 Direct materials Direct labour Actual direct labour-hours worked Job P $ 15,000 $ 40,500 2,700 Job $ 9,600 $ 12,000 800 11. Prepare a schedule of cost of goods sold. (Do not leave any empty spaces; input a 0 wherever it is required.) Schedule of Cost of Goods Sold Cost of goods manufactured 0 Unadjusted cost of goods sold $ 0 8. Assume the ending raw materials inventory is $2,600 and the company does not use any indirect materials. Prepare a schedule of cost of goods manufactured. (Do not leave any empty spaces; input a o wherever it is required.) Schedule of Cost of Goods Manufactured Direct materials Total raw materials available 0 Raw materials used in production $ 0 Total manufacturing costs 0 0 $ 0 Cost of goods manufactured

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts