Question: The first image is the same chart as in image 2 and 3, just bigger and clearer in case it is not very clear on

The first image is the same chart as in image 2 and 3, just bigger and clearer in case it is not very clear on image 2 and 3. Please be precise on the answers for each box on both questions. Thank you!

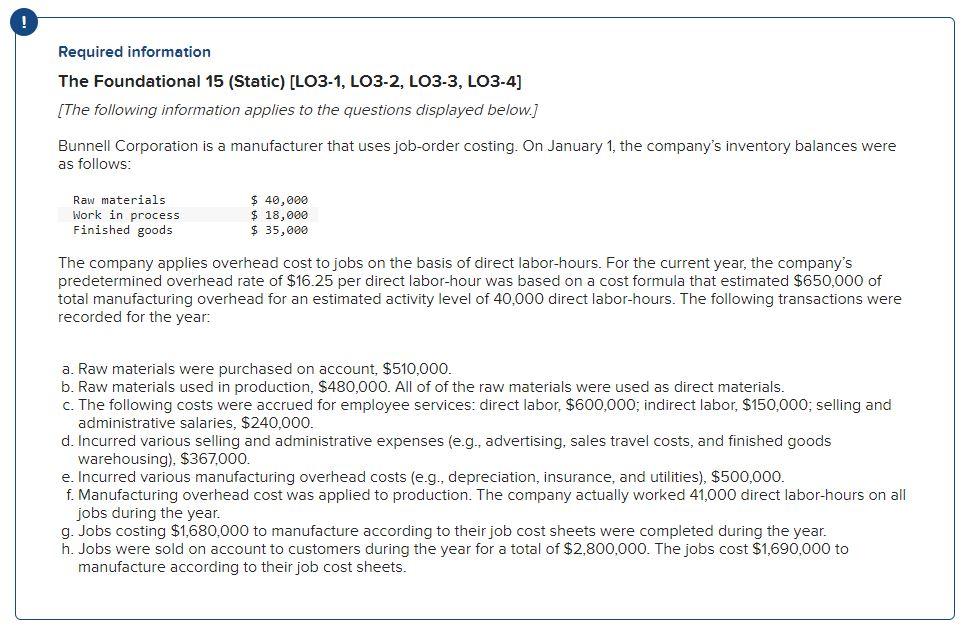

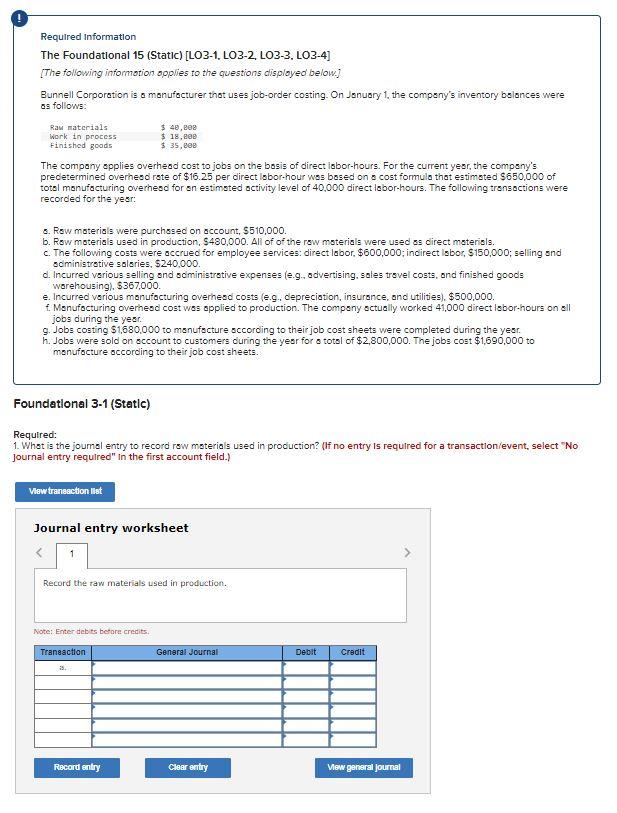

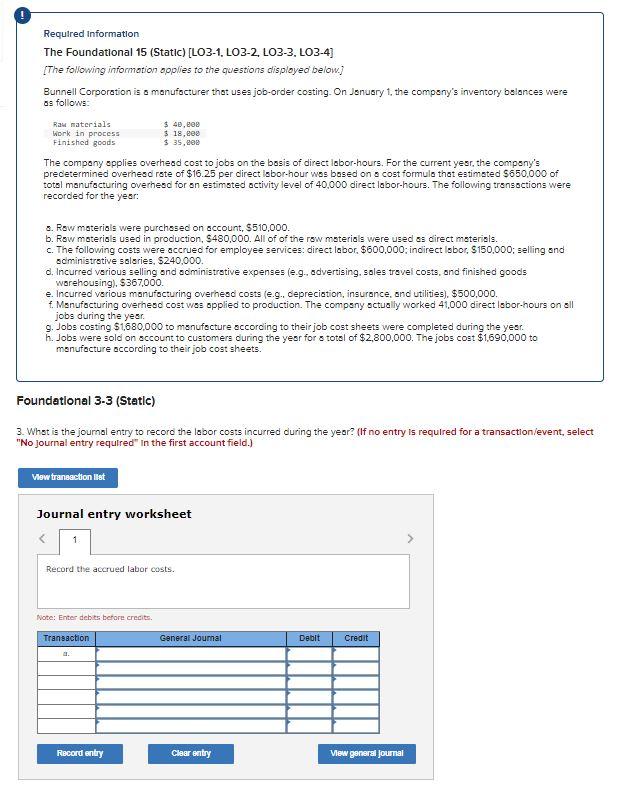

Required information The Foundational 15 (Static) [LO3-1, LO3-2, LO3-3, LO3-4] [The following information applies to the questions displayed below.] Bunnell Corporation is a manufacturer that uses job-order costing. On January 1 , the company's inventory balances were as follows: The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate of $16.25 per direct labor-hour was based on a cost formula that estimated $650,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: a. Raw materials were purchased on account, $510,000. b. Raw materials used in production, $480,000. All of of the raw materials were used as direct materials. c. The following costs were accrued for employee services: direct labor, $600,000; indirect labor, $150,000; selling and administrative salaries, $240,000. d. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods warehousing), $367,000. e. Incurred various manufacturing overhead costs (e.g., depreciation, insurance, and utilities), $500,000. f. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor-hours on all jobs during the year. g. Jobs costing $1,680,000 to manufacture according to their job cost sheets were completed during the year. h. Jobs were sold on account to customers during the year for a total of $2,800,000. The jobs cost $1,690,000 to manufacture according to their job cost sheets. Required Information The Foundational 15 (Static) [LO3-1. LO3-2, LO3-3, LO3-4] [The following informotion opplies to the questions disployed below] Bunnell Corporation is a manufacturer that uses job-order costing. On January 1 , the company's inventory belances were as folliows: The compony applies overhed cost to jobs on the bosis of direct isbor-hours. For the current year, the compsny's predetermined overhesd rete of $16.25 per direct lobor-hour was bosed on a cost formula that estimated $650,000 of total menufacturing overhesd for en estimated activity level of 40,000 direct labor-hours. The following trensoctions were recorded for the year: a. Row materials were purchased on account, $510,000. b. Row moterials used in production, $480,000. All of of the raw materials were used 8 s direct materisls. c. The following costs were accrued for employee services: direct labor, $600,000; indirect isbor, $150,000; selling snd sdministrotive soleries, $240,000. d. Incurred various selling and soministrative expenses (e.g. odvertising, soles trovel costs, ond finished goods warehousing), $367,000. e. Incurred verious manufacturing overhesd costs (e.9., depreciation, insurance, and utilities), $500,000. f. Manufacturing overhesd cost was applied to production. The compeny sctually worked 41,000 direct lebor-hours on all jobs during the year. 9. Jobs costing $1,680,000 to menufacture sccording to their job cost sheets were completed during the yesr. h. Jobs were sold on account to customers during the year for s total of $2,800,000. The jobs cost $1,690,000 to manufacture occording to their job cost sheets. Foundational 3-1 (Static) Required: 1. What is the joumal entry to record rew materials used in production? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Required informatlon The Foundational 15 (Static) [LO3-1, LO3-2, LO3-3, LO3-4] [The following informotion opplies to the questions disployeo below.] Bunnell Corporation is a manufacturer that uses job-order costing. On January t, the company's inventory balances were as follows: The compony spplies overhesd cost to jobs on the bosis of direct lobor-hours. For the current yesr, the compsny's predetermined overhesd rate of $16.25 per direct labor-hour wos bosed on a cost formula that eatimated $650,000 of total manufacturing overhesd for an estimsted activity level of 40,000 direct labor-hours. The following trensactions were recorded for the year: a. Row materials were purchssed on account, $510,000. b. Raw materials used in production, $480,000. All of of the row materials were used as direct materials. c. The following costs were accrued for employee services: direct labor, $600,000; indirect labor, $150,000; selling and sdministretive sularies, $240,000. d. Incurred various selling and soministrative expenses (e.g. advertising. sales trovel costs, and finished goods warehousing), $367,000. e. Incurred various manufocturing overhesd costs (e.g., depreciation, insurance, and utilities), $500,000. f. Manufocturing overhesd cost was opplied to procuction. The compsny sctually worked 41,000 direct labor-hours on all jobs during the yesr. 9. Jobs costing $1,680,000 to manufscture sccording to their job cost sheets were completed during the yesr. h. Jobs were sold on account to customers during the yeor for s totel of $2,800,000. The jobs cost $1,690,000 to menufocture according to their job cost sheets. Foundational 3-3 (Static) 3. Whst is the joumal entry to record the labor costs incurred during the yeor? (If no entry is required for a transactlon/event, select "No journal entry requlred" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts