Question: The first issue mentioned in the case above was demonstrated in one of the Diversification (M) Group Corporation's divisions which is a profit centre based

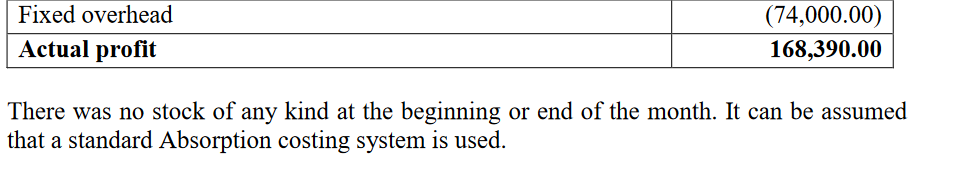

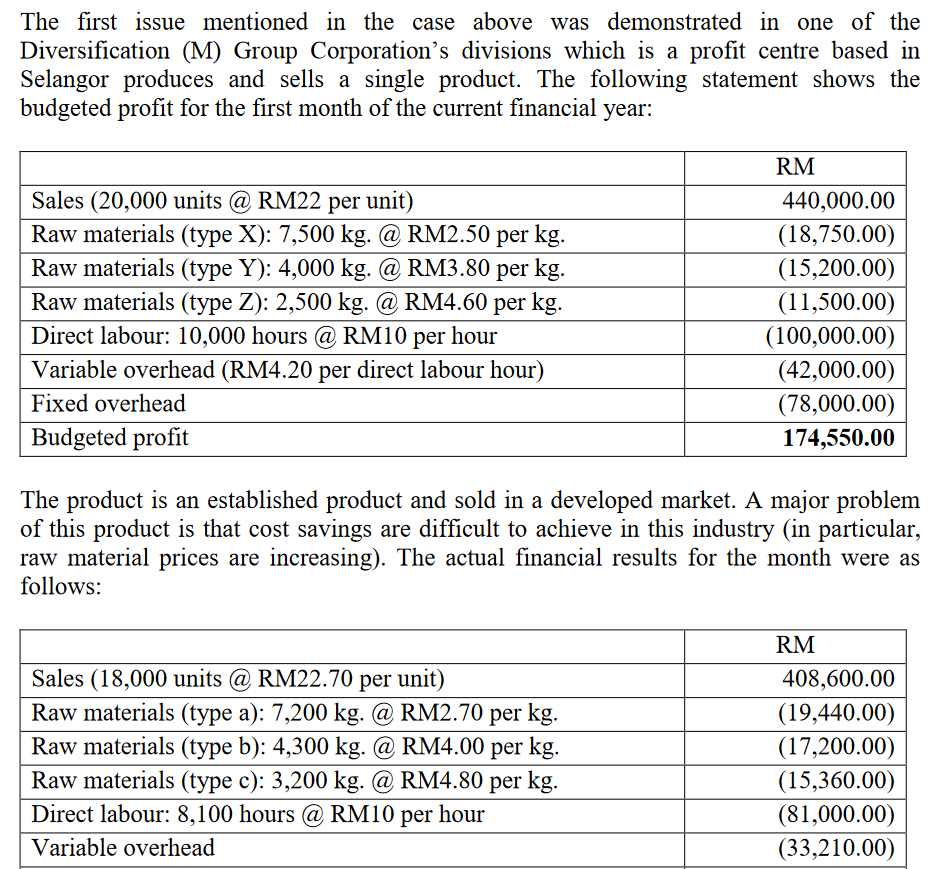

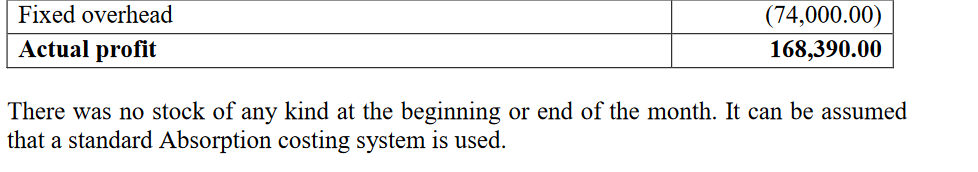

The first issue mentioned in the case above was demonstrated in one of the Diversification (M) Group Corporation's divisions which is a profit centre based in Selangor produces and sells a single product. The following statement shows the budgeted profit for the first month of the current financial year: RM Sales (20,000 units @ RM22 per unit) 440,000.00 Raw materials (type X): 7,500 kg. @ RM2.50 per kg. (18,750.00) Raw materials (type Y): 4,000 kg. @ RM3.80 per kg. (15,200.00) Raw materials (type Z): 2,500 kg. @ RM4.60 per kg. (11,500.00) Direct labour: 10,000 hours @ RM10 per hour (100,000.00) Variable overhead (RM4.20 per direct labour hour) (42,000.00) Fixed overhead (78,000.00) Budgeted profit 174,550.00 The product is an established product and sold in a developed market. A major problem of this product is that cost savings are difficult to achieve in this industry (in particular, raw material prices are increasing). The actual financial results for the month were as follows: RM Sales (18,000 units @ RM22.70 per unit) 408,600.00 Raw materials (type a): 7,200 kg. @ RM2.70 per kg. (19,440.00) Raw materials (type b): 4,300 kg. @ RM4.00 per kg. (17,200.00) Raw materials (type c): 3,200 kg. @ RM4.80 per kg. (15,360.00) Direct labour: 8,100 hours @ RM10 per hour (81,000.00) Variable overhead (33,210.00)Fixed overhead (74,000.00) Actual prot 168,390.00 There was no stock of any kind at the beginning or end of the month. It can be assumed that a standard Absorption costing system is used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts