Question: the first part I know is wrong, any help would be appreciated! Short Answer #2 (10 points) Placid Lake Corporation acquired 80 percent of the

the first part I know is wrong, any help would be appreciated!

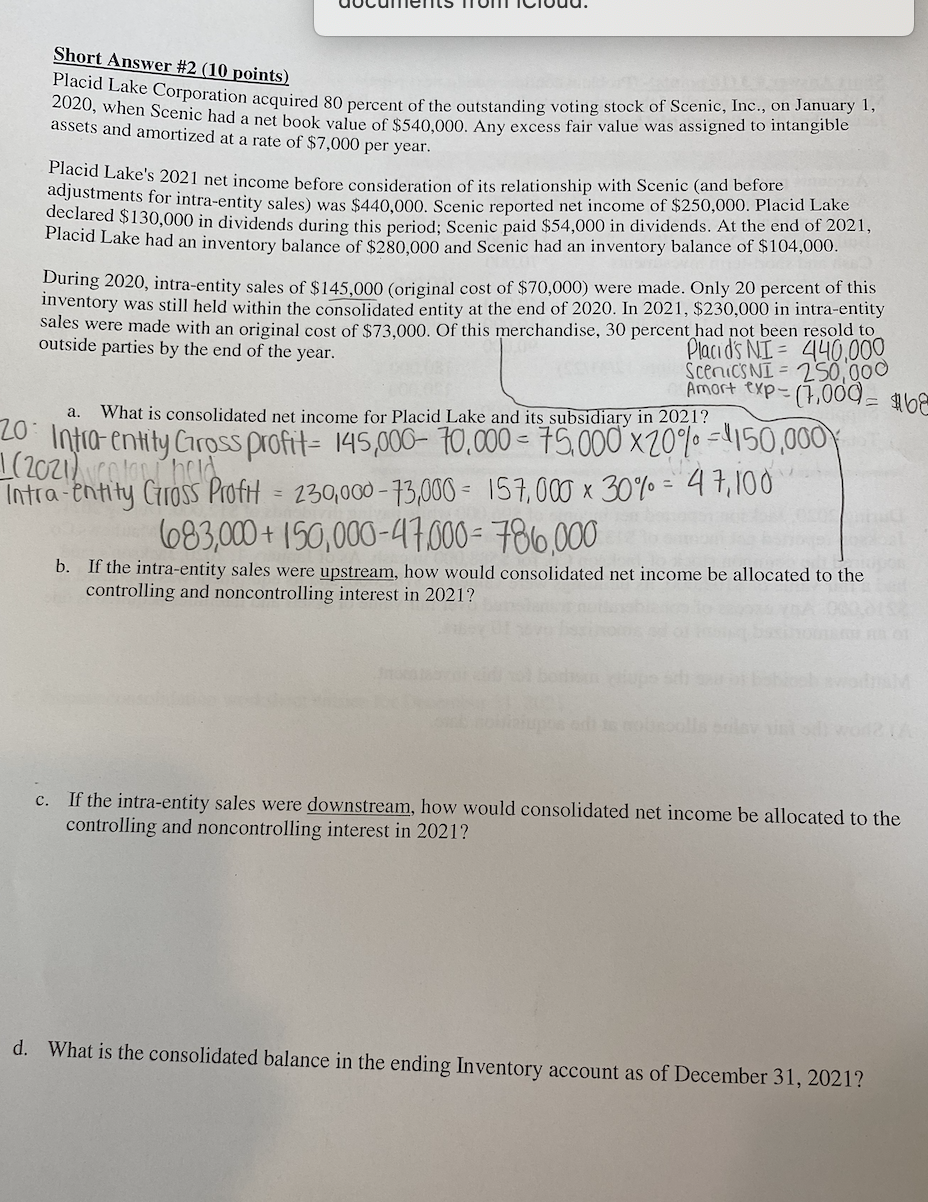

Short Answer #2 (10 points) Placid Lake Corporation acquired 80 percent of the outstanding voting stock of Scenic, Inc., on January 1, 2020, when Scenic had a net book value of $540,000. Any excess fair value was assigned to intangible assets and amortized at a rate of $7,000 per year. Placid Lake's 2021 net income before consideration of its relationship with Scenic (and before adjustments for intra-entity sales) was $440,000. Scenic reported net income of $250,000. Placid Lake declared $130,000 in dividends during this period; Scenic paid $54,000 in dividends. At the end of 2021, Placid Lake had an inventory balance of $280,000 and Scenic had an inventory balance of $104,000. During 2020, intra-entity sales of $145,000 (original cost of $70,000) were made. Only 20 percent of this inventory was still held within the consolidated entity at the end of 2020. In 2021, $230,000 in intra-entity sales were made with an original cost of $73,000. Of this merchandise, 30 percent had not been resold to outside parties by the end of the year. Placid's NI= 440,000 Scenics NI= 250,000 Amort exp-(7,000_ $be a. What is consolidated net income for Placid Lake and its subsidiary in 2021? = = 150,000 20 Intra- entity Gross profit= 145,000- 1 (2021) colon held Intra-entity Gross ProfH = 230,000-73,000= 157,000 x 30% = 47,100 X 683,000+ 150,000-47.000-786,000 b. If the intra-entity sales were upstream, how would consolidated net income be allocated to the controlling and noncontrolling interest in 2021? c. If the intra-entity sales were downstream, how would consolidated net income be allocated to the controlling and noncontrolling interest in 2021? d. What is the consolidated balance in the ending Inventory account as of December 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts