Question: The first photo is the problem, the second photo is the referenced 7.9 format example. :) Bank Reconciliation Problem The following information pertains to Hawk

The first photo is the problem, the second photo is the referenced 7.9 format example. :)

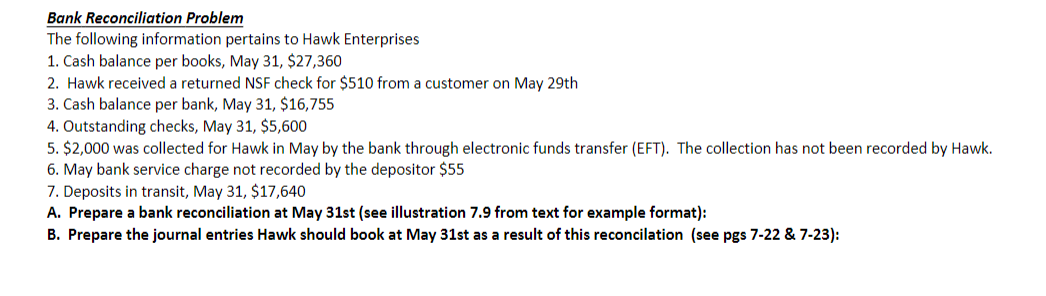

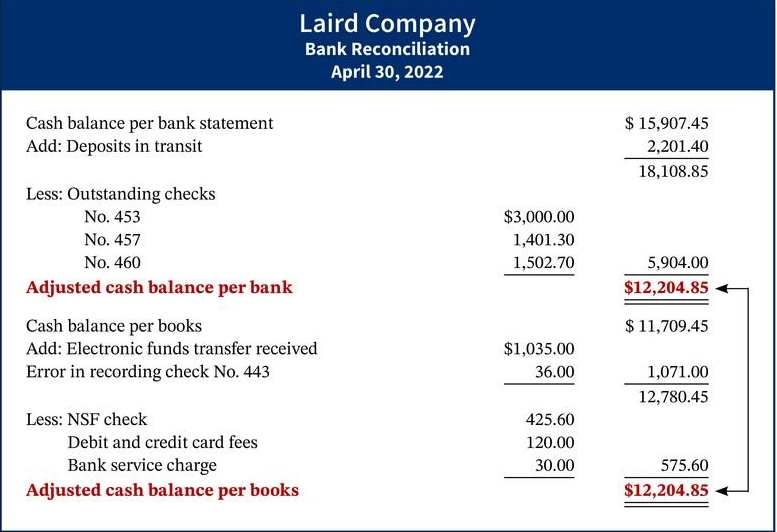

Bank Reconciliation Problem The following information pertains to Hawk Enterprises 1. Cash balance per books, May 31, $27,360 2. Hawk received a returned NSF check for $510 from a customer on May 29th 3. Cash balance per bank, May 31, $16,755 4. Outstanding checks, May 31, $5,600 5. $2,000 was collected for Hawk in May by the bank through electronic funds transfer (EFT). The collection has not been recorded by Hawk. 6. May bank service charge not recorded by the depositor $55 7. Deposits in transit, May 31, $17,640 A. Prepare a bank reconciliation at May 31st (see illustration 7.9 from text for example format): B. Prepare the journal entries Hawk should book at May 31st as a result of this reconcilation (see pgs 7-22 & 7-23): Laird Company Bank Reconciliation April 30, 2022 Cash balance per bank statement Add: Deposits in transit $ 15,907.45 2,201.40 18,108.85 $3,000.00 1,401.30 1,502.70 Less: Outstanding checks No. 453 No. 457 No. 460 Adjusted cash balance per bank Cash balance per books Add: Electronic funds transfer received Error in recording check No. 443 5,904.00 $12,204.85 $ 11,709.45 $1,035.00 36.00 1,071.00 12,780.45 Less: NSF check Debit and credit card fees Bank service charge Adjusted cash balance per books 425.60 120.00 30.00 575.60 $12,204.85

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts