Question: The first picture is the problem set. The second question is the minicase that is mentioned in the problem set. Please note, that the costs

The first picture is the problem set. The second question is the minicase that is mentioned in the problem set. Please note, that the costs of goods sold in the mini-case rise each year at an inflation rate of 4%. Thank you in advance!

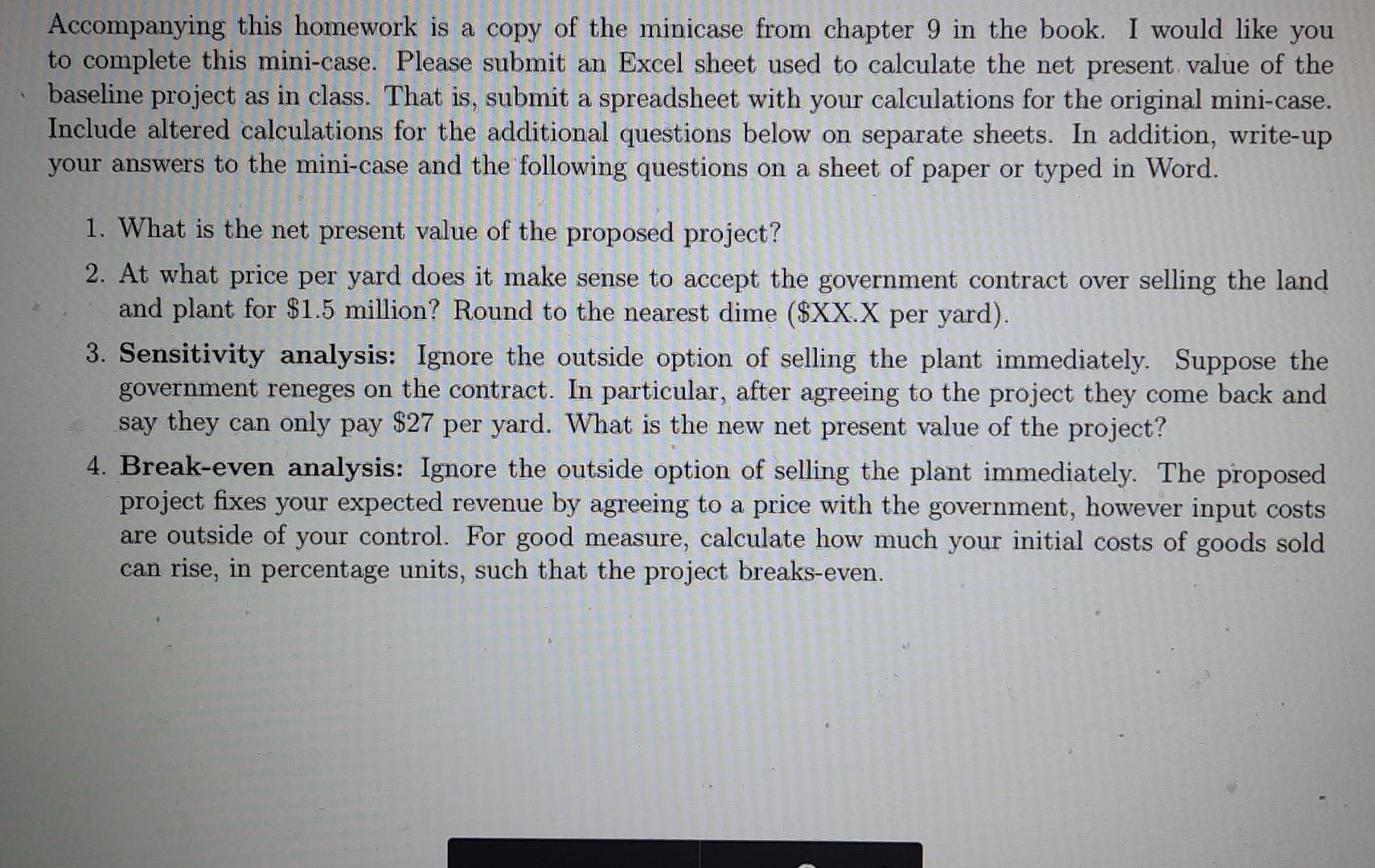

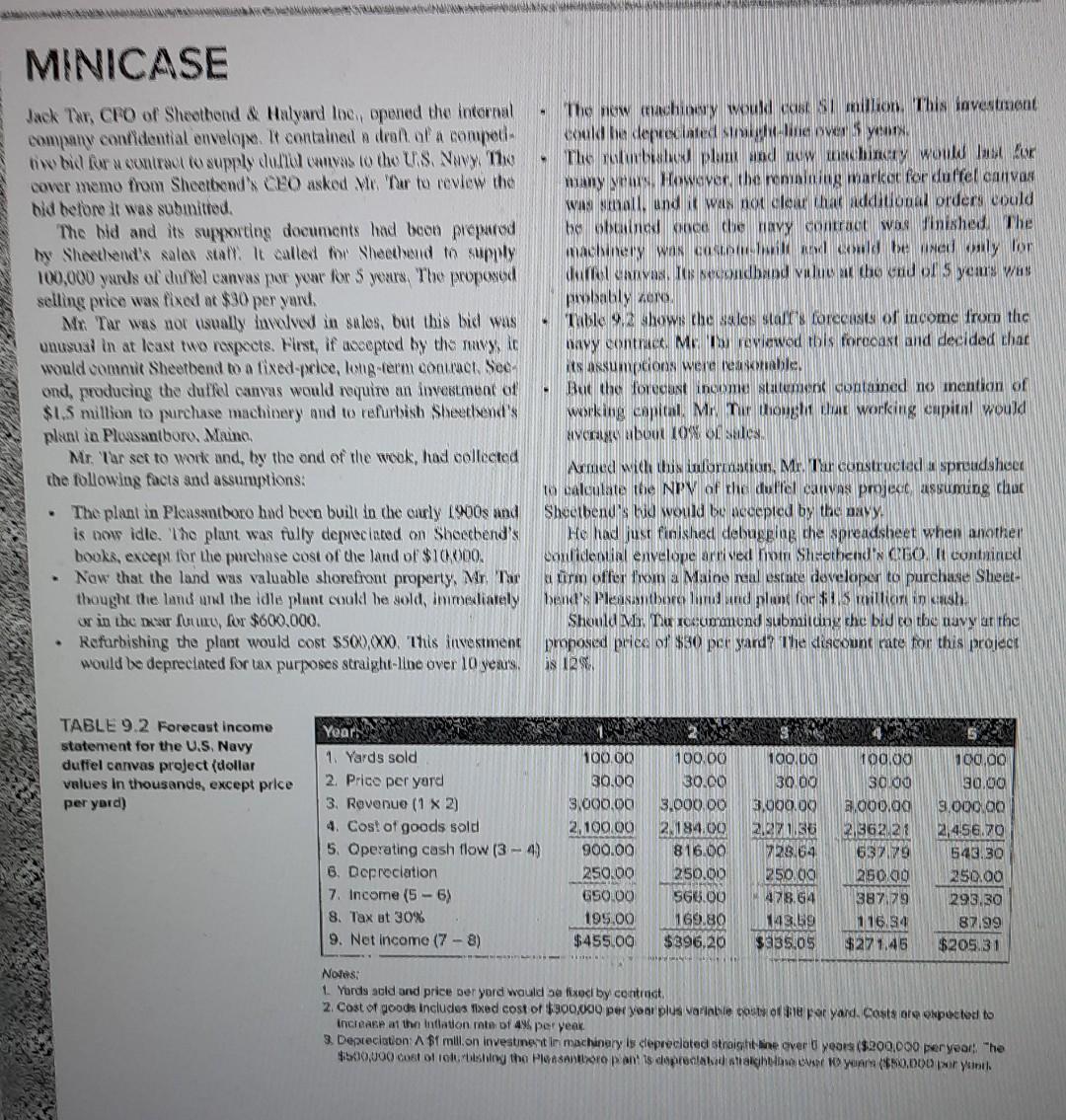

Accompanying this homework is a copy of the minicase from chapter 9 in the book. I would like you to complete this mini-case. Please submit an Excel sheet used to calculate the net present value of the baseline project as in class. That is, submit a spreadsheet with your calculations for the original mini-case. Include altered calculations for the additional questions below on separate sheets. In addition, write-up your answers to the mini-case and the following questions on a sheet of paper or typed in Word. 1. What is the net present value of the proposed project? 2. At what price per yard does it make sense to accept the government contract over selling the land and plant for $1.5 million? Round to the nearest dime ($XX.X per yard). 3. Sensitivity analysis: Ignore the outside option of selling the plant immediately. Suppose the government reneges on the contract. In particular, after agreeing to the project they come back and say they can only pay $27 per yard. What is the new net present value of the project? 4. Break-even analysis: Ignore the outside option of selling the plant immediately. The proposed project fixes your expected revenue by agreeing to a price with the government, however input costs are outside of your control. For good measure, calculate how much your initial costs of goods sold can rise, in percentage units, such that the project breaks-even. MINICASE Jack Thr, CFO of Sheathend & Halyard Ine, opened the internal company confidential envelope. It contained a draft of a competi- bid Barn contract to supply duma canvas to the US Navy. The cover memo from Sheetbend's CEO asked Me ar to review the bid hefore it was submitted, The bid and its supynating documents had been prepared by Sheetlend's sales staty. It called for Sheetsend to supply 100,000 yards of due canvas pour pour for years. The proposed selling price was fixed at $30 per part Mr Tar was not usually lavolved in sales, but this bid was unusual in at least two respects. Flest, if accepted by the music would commit Sheetbend to a fixed-pelce, long-term contract. See ond, producing the duffel canvas would require an investment of $1.5 million to purchase machinery and to refurbish Sheet hend's plant in Pleasantboro, Maino. Mr. Var set to work and, by the ond of the wook, had collected the following facts and assumptions: The plant in Pleasantboro had bece built in the curly 1900s and is now idle. The plant was fully depreciated on Shercbend's books, except for the purchase cost of the land of $10,000. Now that the land was valuable shorofiont property, Mr. The thought the land and the idle plant could be sold, immediately or in the rurfume, for $600,000. Refurbishing the plant would cost $50),XX. This investment would be depreciated for tax purposes straight-line over 10 years The new machinery would coB SI Don This Tavestment could be deprecated in your The turbule plan and now maching would be com many year However, the remaining market for duffel canvas WAS Nehalt und was not clear thac additional orders would be obtained buce che navy contract was finished The acnery was cast be wed y Tor durre anys, tos secondhand value at the end of 5 years was probably now Table 9.2 shows the sales starts forecasts of income from the navy contact Me Treviewod Ibis forecast and decided that rts assumpcions were reasonable Be the forecast income statement contained no inention of working capital, M. Tur though but working eupital would Vorgabout to o Sales Armed with this information, Me Tar constructed a sproudsheet to calculate the NPV of the culiel Canvas project assuming chur Sheeibend's bid would be necepied by the Day He had just finished debugging the spreadsheet when another confidential envelope arrived From Sheothend GO. It contained srm offer a Maine real estate developer to purchase Sheet bend's Plensantoro lord and plant for milliari in cash Should M. Tu recommend submitting the bid co the navy at the proposed price of $30 per yard? The discount rate for this project is 12 Years TABLE 9.2 Forecast income statement for the U.S. Navy duffel canvas project (dollar values in thousands, except price per yord) 1. Yards sold 2. Price per yard 3. Revenue (1 x 2) 4. Cost of goods sold 5. Operating cash flow (3-4) 6. Depreciation 7. Income (5-6) 8. Tax at 30% 9. Net Income (7-8) 100.00 30.00 3,000.00 2,100.00 900.00 250.00 G50.00 195.00 $455.00 100.00 30.00 3.000.00 2 184.00 816.00 250.00 SG6.00 169.80 $396,20 100.00 30.00 3,000.00 2,271.85 723.64 250.00 478.GA 143.69 $335.05 100.00 30.00 2.000.00 2,362 27 637179 250.00 387179 OIL 116.84 $27 1.45 100,00 30.00 9.000.00 2,456.70 548.30 250.00 295.30 87199 $205.31 Notes: 1 Yords sold and price ber yard would be fixed by contract 2. Cost of goods includes fixed cost of $900,000 per year plus Variable of peyard. Costs or onpected to Increase at the Indiation rate of 49per yeak 3. Depreciation: A $1 mill on investment in machinery is deprecated straight line over years ($200,000 per year: The $500,000 cost of how the least pan is deprecated that her oyunn (0.000 por intl. Accompanying this homework is a copy of the minicase from chapter 9 in the book. I would like you to complete this mini-case. Please submit an Excel sheet used to calculate the net present value of the baseline project as in class. That is, submit a spreadsheet with your calculations for the original mini-case. Include altered calculations for the additional questions below on separate sheets. In addition, write-up your answers to the mini-case and the following questions on a sheet of paper or typed in Word. 1. What is the net present value of the proposed project? 2. At what price per yard does it make sense to accept the government contract over selling the land and plant for $1.5 million? Round to the nearest dime ($XX.X per yard). 3. Sensitivity analysis: Ignore the outside option of selling the plant immediately. Suppose the government reneges on the contract. In particular, after agreeing to the project they come back and say they can only pay $27 per yard. What is the new net present value of the project? 4. Break-even analysis: Ignore the outside option of selling the plant immediately. The proposed project fixes your expected revenue by agreeing to a price with the government, however input costs are outside of your control. For good measure, calculate how much your initial costs of goods sold can rise, in percentage units, such that the project breaks-even. MINICASE Jack Thr, CFO of Sheathend & Halyard Ine, opened the internal company confidential envelope. It contained a draft of a competi- bid Barn contract to supply duma canvas to the US Navy. The cover memo from Sheetbend's CEO asked Me ar to review the bid hefore it was submitted, The bid and its supynating documents had been prepared by Sheetlend's sales staty. It called for Sheetsend to supply 100,000 yards of due canvas pour pour for years. The proposed selling price was fixed at $30 per part Mr Tar was not usually lavolved in sales, but this bid was unusual in at least two respects. Flest, if accepted by the music would commit Sheetbend to a fixed-pelce, long-term contract. See ond, producing the duffel canvas would require an investment of $1.5 million to purchase machinery and to refurbish Sheet hend's plant in Pleasantboro, Maino. Mr. Var set to work and, by the ond of the wook, had collected the following facts and assumptions: The plant in Pleasantboro had bece built in the curly 1900s and is now idle. The plant was fully depreciated on Shercbend's books, except for the purchase cost of the land of $10,000. Now that the land was valuable shorofiont property, Mr. The thought the land and the idle plant could be sold, immediately or in the rurfume, for $600,000. Refurbishing the plant would cost $50),XX. This investment would be depreciated for tax purposes straight-line over 10 years The new machinery would coB SI Don This Tavestment could be deprecated in your The turbule plan and now maching would be com many year However, the remaining market for duffel canvas WAS Nehalt und was not clear thac additional orders would be obtained buce che navy contract was finished The acnery was cast be wed y Tor durre anys, tos secondhand value at the end of 5 years was probably now Table 9.2 shows the sales starts forecasts of income from the navy contact Me Treviewod Ibis forecast and decided that rts assumpcions were reasonable Be the forecast income statement contained no inention of working capital, M. Tur though but working eupital would Vorgabout to o Sales Armed with this information, Me Tar constructed a sproudsheet to calculate the NPV of the culiel Canvas project assuming chur Sheeibend's bid would be necepied by the Day He had just finished debugging the spreadsheet when another confidential envelope arrived From Sheothend GO. It contained srm offer a Maine real estate developer to purchase Sheet bend's Plensantoro lord and plant for milliari in cash Should M. Tu recommend submitting the bid co the navy at the proposed price of $30 per yard? The discount rate for this project is 12 Years TABLE 9.2 Forecast income statement for the U.S. Navy duffel canvas project (dollar values in thousands, except price per yord) 1. Yards sold 2. Price per yard 3. Revenue (1 x 2) 4. Cost of goods sold 5. Operating cash flow (3-4) 6. Depreciation 7. Income (5-6) 8. Tax at 30% 9. Net Income (7-8) 100.00 30.00 3,000.00 2,100.00 900.00 250.00 G50.00 195.00 $455.00 100.00 30.00 3.000.00 2 184.00 816.00 250.00 SG6.00 169.80 $396,20 100.00 30.00 3,000.00 2,271.85 723.64 250.00 478.GA 143.69 $335.05 100.00 30.00 2.000.00 2,362 27 637179 250.00 387179 OIL 116.84 $27 1.45 100,00 30.00 9.000.00 2,456.70 548.30 250.00 295.30 87199 $205.31 Notes: 1 Yords sold and price ber yard would be fixed by contract 2. Cost of goods includes fixed cost of $900,000 per year plus Variable of peyard. Costs or onpected to Increase at the Indiation rate of 49per yeak 3. Depreciation: A $1 mill on investment in machinery is deprecated straight line over years ($200,000 per year: The $500,000 cost of how the least pan is deprecated that her oyunn (0.000 por intl

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts