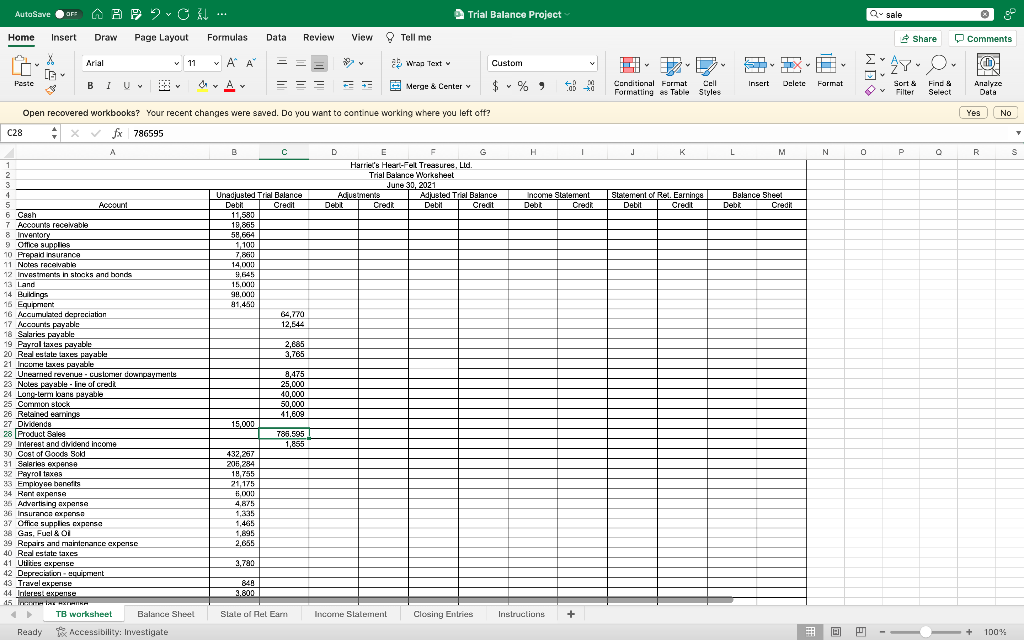

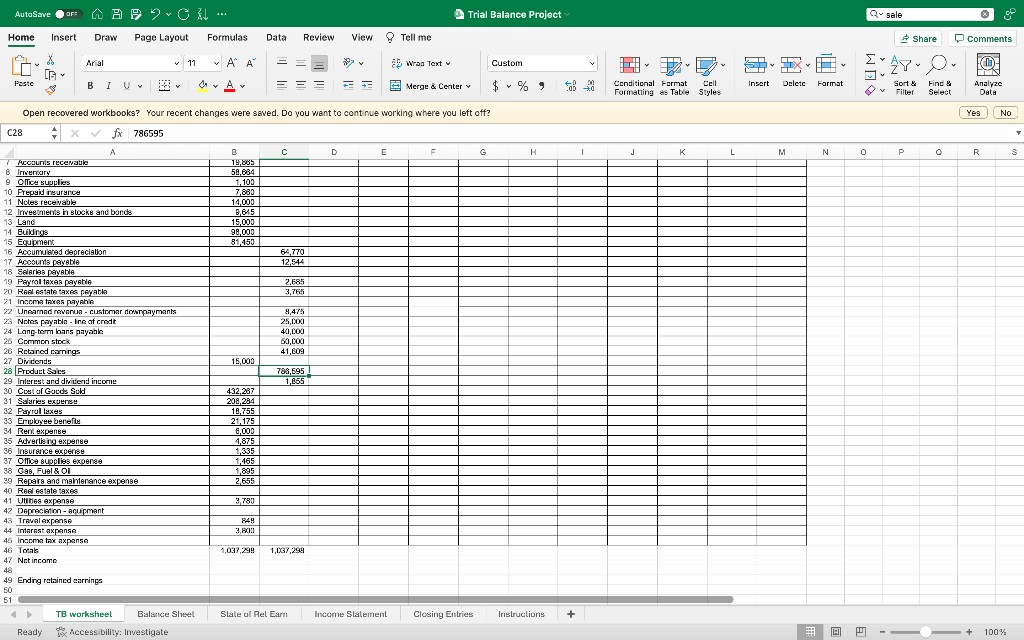

Question: The first picture is the unadjusted TB sheet. I started to make the income statement (multi-step) but I am not sure what to do. What

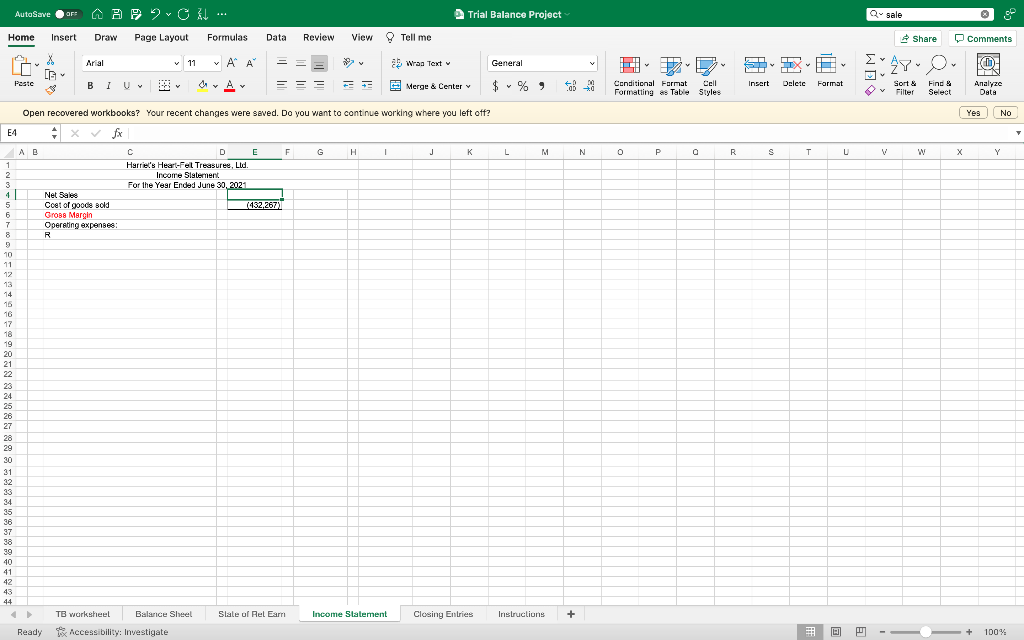

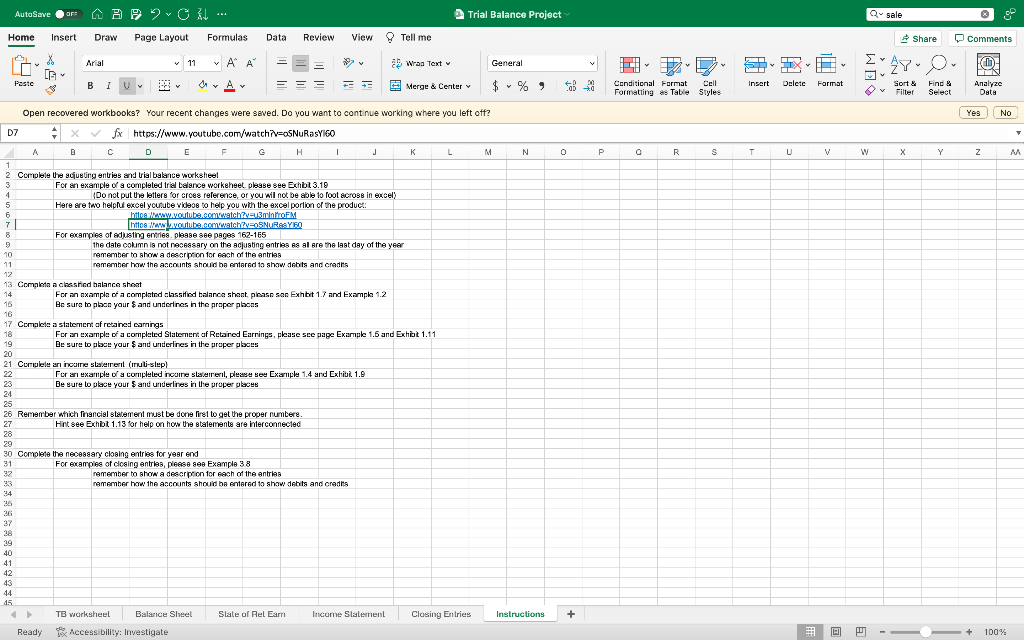

The first picture is the unadjusted TB sheet. I started to make the income statement (multi-step) but I am not sure what to do. What should the income statement and adjusted TB sheet look like? If possible, could you create a balance sheet, state of Ret Earn., closing entries, and journal entry?

| The annual premium for the insurance policy was paid on October 1, 2020 for $7,860 and posted to prepaid insurance. | |||||||

| The office supplies were counted on 6-30-21 and had a balance of $429. | |||||||

| The wages and salaries of the sales & adminstrative staff is $675 per day. | |||||||

| The payroll is a bi weekly payroll and staff work six days a week with Sundays closed. | |||||||

| The last June payroll was paid on Friday, June 25th for timecards through Saturday, June 19th | |||||||

| Depreciation for 2021 is $13,775. | |||||||

| Customers must make a downpayment for all special order items. | |||||||

| The actual customer downpayments for which items had not been sold was $4,850 at 6-30-21. | |||||||

| The physical count and pricing of the inventory at 6-30-21 is $58,158 | |||||||

| The 2020 real estate taxes are to be paid half in July and September of 2021 for the amount of $3,800 for each payment. | |||||||

| The 2021 real estate taxes will be paid in 2022. The 2021 real estate taxes are expected to be 2% more than 2020. | |||||||

| The income taxes due for the fiscal year are $ 10,875. | |||||||

| NOTE: adjusting entries do not need a date column | |||||||

| This information is not for adjusting entries - balance sheet only | |||||||

| Current portion of long-term debt | $4,500 | how much they have to pay for the coming year | |||||

| 40000 on balance sheets gets broken into current and noncurrent liabilities | |||||||

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock