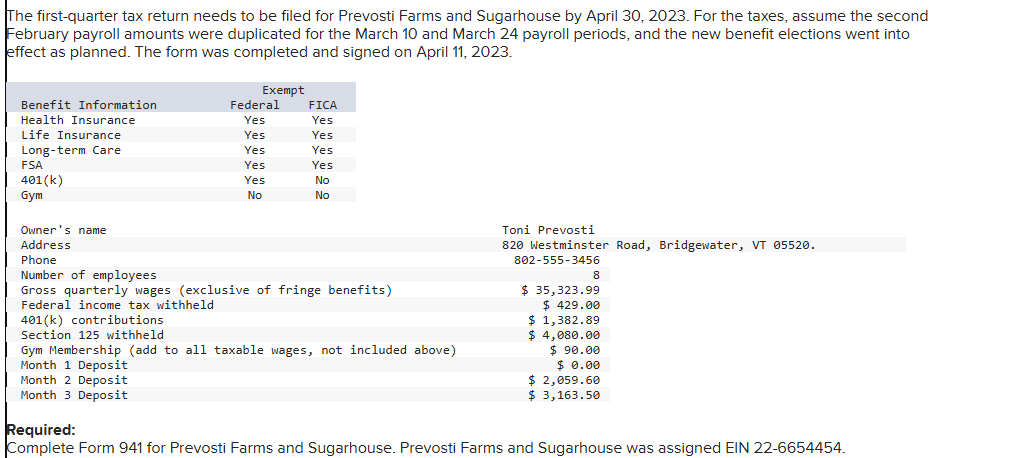

Question: The first - quarter tax return needs to be filed for Prevosti Farms and Sugarhouse by April 3 0 , 2 0 2 3 .

The firstquarter tax return needs to be filed for Prevosti Farms and Sugarhouse by April For the taxes, assume the second February payroll amounts were duplicated for the March and March payroll periods, and the new benefit elections went into effect as planned. The form was completed and signed on April

Required:

Complete Form for Prevosti Farms and Sugarhouse. Prevosti Farms and Sugarhouse was assigned EIN Read the separate instructions before you complete Form Type or print within the boxes.

Part : quad Answer these questions for this quarter.

Number of employees who received wages, tips, or other compensation for the pay period including: June Quarter September Quarter or December Quarter b Nonrefundable portion of credit for qualified sick and family leave wages for leave taken before April

c Reserved for future use

d Nonrefundable portion of credit for qualified sick and family leave wages for leave taken after March and before October

e Reserved for future use

f Reserved for future use

g Total nonrefundable credits.

Add lines ab and d

Total taxes after adjustments and nonrefundable credits.

Subtract line g from line

a Total deposits for this quarter, including overpayment applied from a prior quarter and overpayments applied from Form XX PRX or X SP filed in the current quarter

b Reserved for future use

c Refundable portion of credit for qualified sick and family leave wages for leave taken before April

d Reserved for future use

e Refundable portion of credit for qualified sick and family leave wages for leave taken after March and before October

f Reserved for future use

g Total deposits and refundable credits.

h Reserved for future use

i Reserved for future use

Balance due.

If line is more than line g enter the difference and see instructions

Overpayment.

If line g is more than line enter the difference

Check one:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock