Question: The first - quarter tax return needs to be filed for Prevosti Farms and Sugarhouse by April 3 0 , 2 0 2 3 .

The firstquarter tax return needs to be filed for Prevosti Farms and Sugarhouse by April For the taxes, assume the second February payroll amounts were duplicated for the March and March payroll periods, and the new benefit elections went into effect as planned. The form was completed and signed on April Complete Form for Prevosti Farms and Sugarhouse. Prevosti Farms and Sugarhouse was assigned EIN Note: Instructions on format can be found on certain cells within the forms.

Complete this question by entering your answers in the tabs below.

PG

PG

Page of Form

Note: Round your final answers to decimal places.

Form for :

Employer's QUARTERLY Federal Tax Return

Department of the Treasury Internal Revenue Service

Report for this Quarte

:

January, Fel

:

April, May, J

:

July, August,

October, Nove

Instructions and prioryear

wwwirs.govfi Number of employees who received wages, tips, or other compensation for the pay period including: June Quarter September Quarter or December Quarter

Wages, tips, and other compensation

Federal income tax withheld from wages, tips, and other compensation

If no wages, tips, and other compensation are subject to social security or Medicare tax

tablea Taxable social security wages,Column Column ai Qualified sick leave wages,ii Qualified family leave wages,b Taxable social security tips,c Taxable Medicare wages & tips,x d Taxable wages & tips subject to Additional Medicare Tax withholding,e Total social security and Medicare taxes. Add Column from lines a

e Total social security and Medicare taxes. Add Column from lines aaiaiibc and d

Check an

Section q Notice and Demand Tax due on unreported tips

Total taxes before adjustments.

Current quarter's adjustment for fractions of cents

Current quarter's adjustment for sick pay

Current quarter's adjustments for tips and groupterm life insurance

Total taxes after adjustments.

Combine lines through

a Qualified small business payroll tax credit for increasing research activities.

see instructions

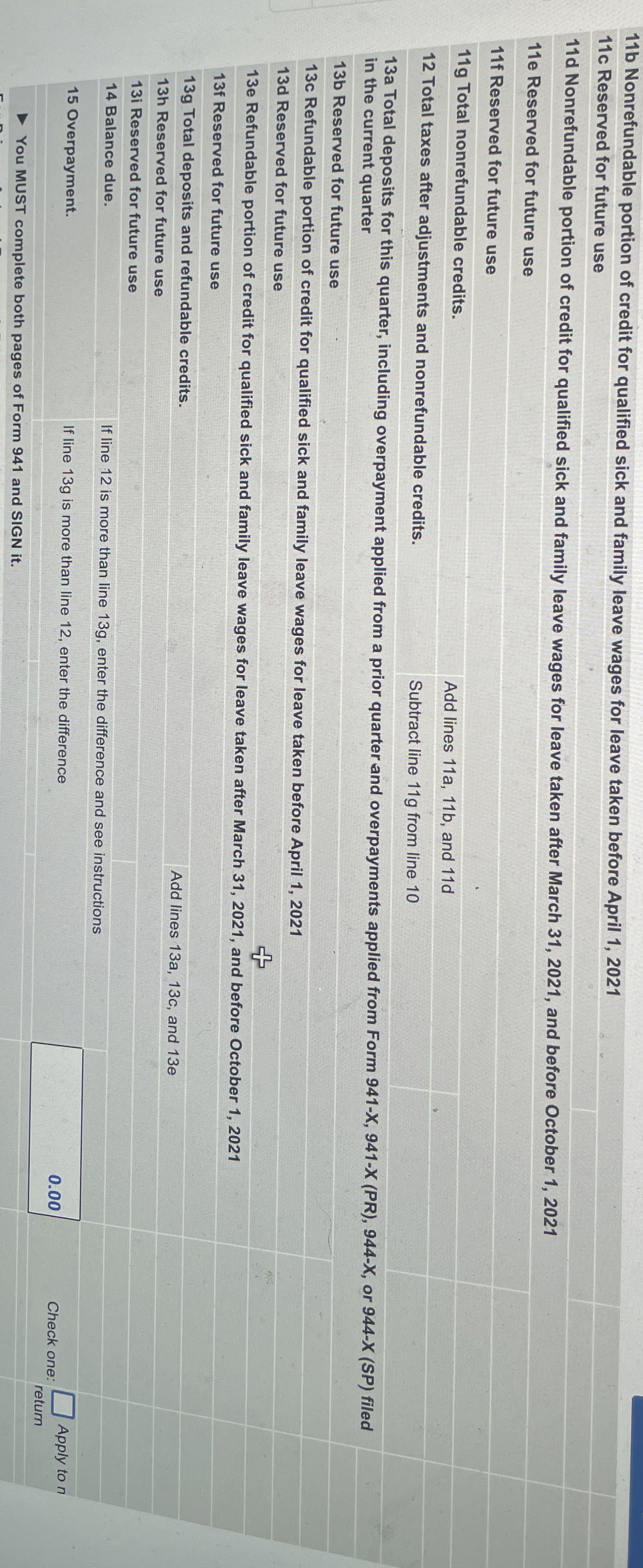

b Nonrefundable portion of credit for qualified sick and family leave wages for leave taken before April

c Reserved for future use

d Nonrefundable portion of credit for qualified sick and family leave wages for leave taken after March and before October b Nonrefundable portion of credit for qualified sick and family leave wages for leave taken before April

c Reserved for future use

d Nonrefundable portion of credit for qualified sick and family leave wages for leave taken after March and before October

e Reserved for future use

f Reserved for future use

g Total nonrefundable credits.

Add lines ab and d

Total taxes after adjustments and nonrefundable credits.

Subtract line g from line

a Total deposits for this quarter, including overpayment applied from a prior quarter and overpayments applied from Form XX PRX or X SP filed in the current quarter

b Reserved for future use

c Refundable portion of credit for qualified sick and family leave wages for leave taken before April

d Reserved for future use

e Refundable portion of credit for qualified sick and family leave wages for leave taken after March and before October

f Reserved for future use

g Total deposits and refundable credits.

h Reserved for future use

Add lines ac and e

i Reserved for future use

Balance due.

If line is more than line g enter the difference and see instructions

Overpayment.

If line g is more than line enter the difference

You MUST complete both pages of Form and SIGN it

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock