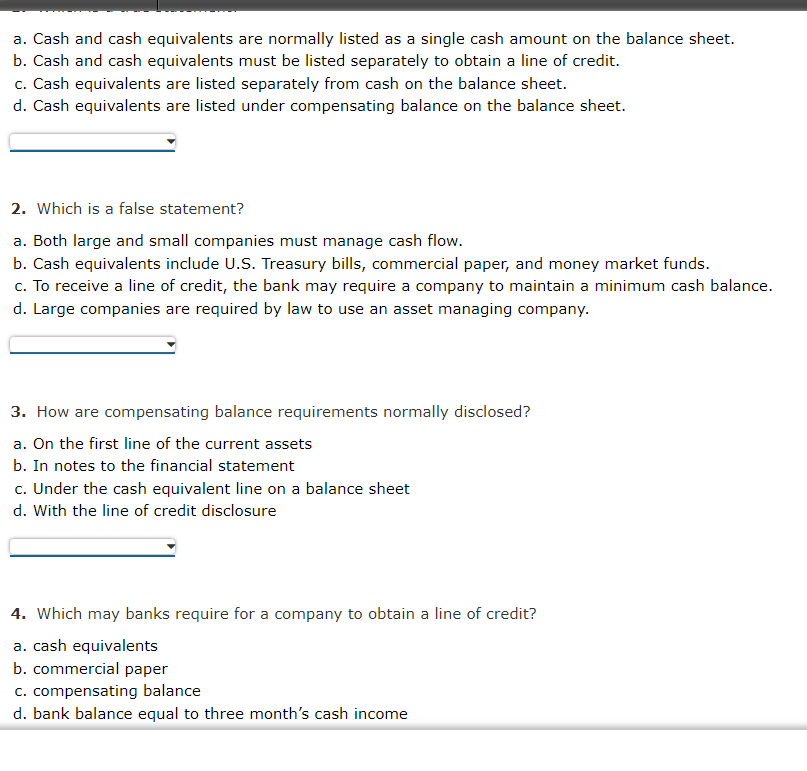

Question: The first question is, which is a true statement? a. Cash and cash equivalents are normally listed as a single cash amount on the balance

The first question is, which is a true statement?

a. Cash and cash equivalents are normally listed as a single cash amount on the balance sheet. b. Cash and cash equivalents must be listed separately to obtain a line of credit. c. Cash equivalents are listed separately from cash on the balance sheet. d. Cash equivalents are listed under compensating balance on the balance sheet. 2. Which is a false statement? a. Both large and small companies must manage cash flow. b. Cash equivalents include U.S. Treasury bills, commercial paper, and money market funds. c. To receive a line of credit, the bank may require a company to maintain a minimum cash balance. d. Large companies are required by law to use an asset managing company. 3. How are compensating balance requirements normally disclosed? a. On the first line of the current assets b. In notes to the financial statement c. Under the cash equivalent line on a balance sheet d. With the line of credit disclosure 4. Which may banks require for a company to obtain a line of credit? a. cash equivalents b. commercial paper C. compensating balance d. bank balance equal to three month's cash income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts