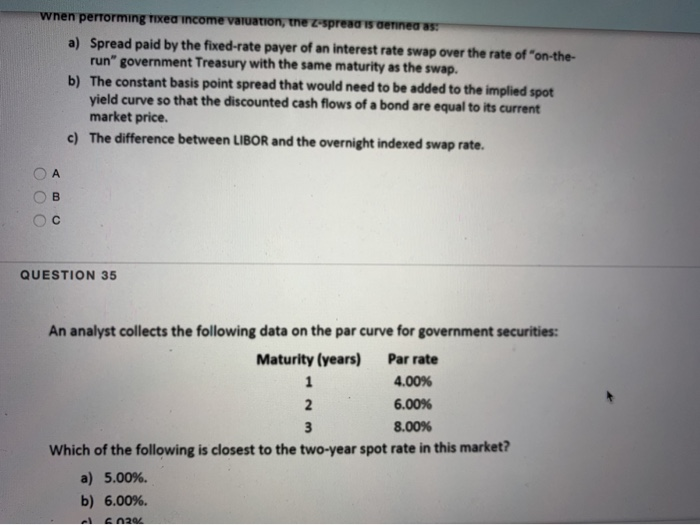

Question: the first sentence is : when performing fixed income valuation the z spread is defined as : when performing Txed income valuation, the zespread benneas

when performing Txed income valuation, the zespread benneas a) Spread paid by the fixed-rate payer of an interest rate swap over the rate of "on-the- run government Treasury with the same maturity as the swap. b) The constant basis point spread that would need to be added to the implied spot yield curve so that the discounted cash flows of a bond are equal to its current market price. c) The difference between LIBOR and the overnight indexed swap rate. OA OC QUESTION 35 An analyst collects the following data on the par curve for government securities: Maturity (years) Par rate 4.00% 6.00% 8.00% Which of the following is closest to the two-year spot rate in this market? a) 5.00%. b) 6.00%. al 202

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts