Question: The first two are completed please help with the blank 3rd part, thanks. Bio Next Corporation is a biotech company that makes a cancer treatment

The first two are completed please help with the blank 3rd part, thanks.

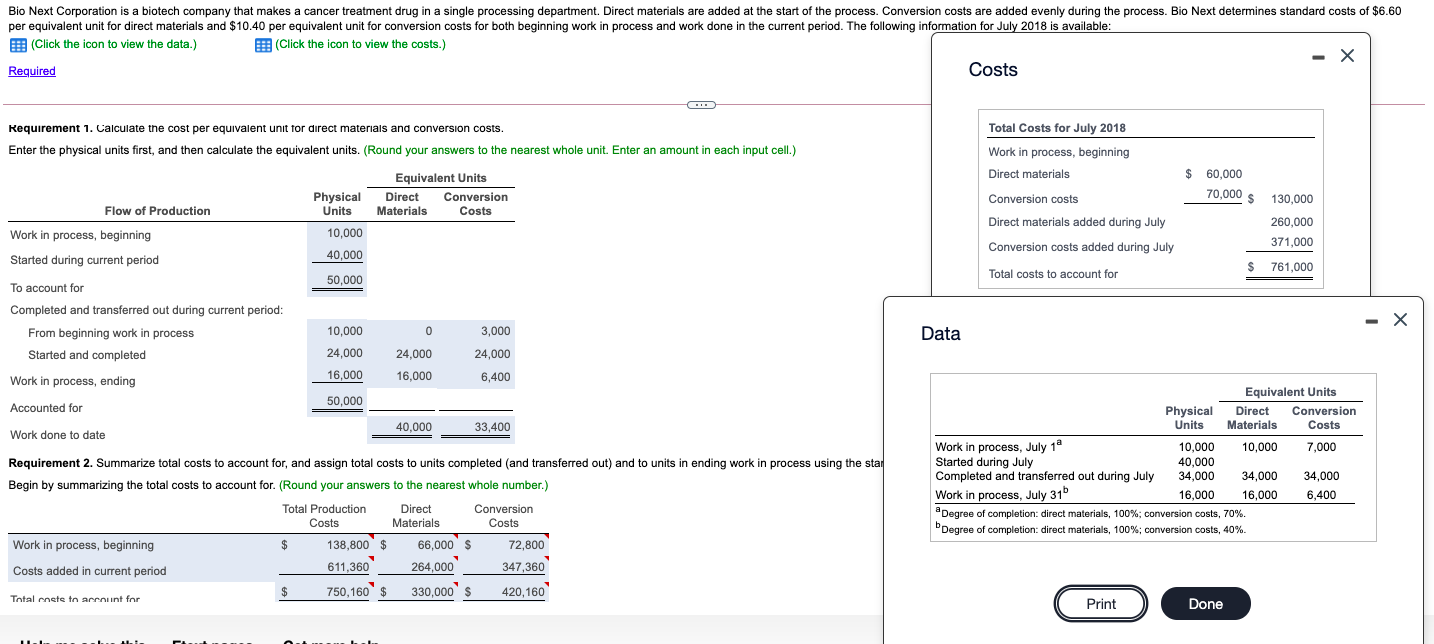

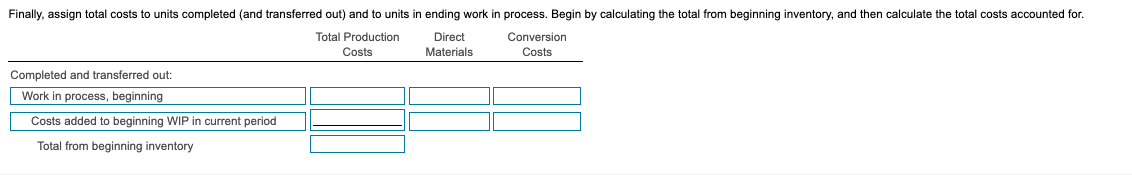

Bio Next Corporation is a biotech company that makes a cancer treatment drug in a single processing department. Direct materials are added at the start of the process. Conversion costs are added evenly during the process. Bio Next determines standard costs of $6.60 per equivalent unit for direct materials and $10.40 per equivalent unit for conversion costs for both beginning work in process and work done in the current period. The following information for July 2018 is available: (Click the icon to view the data.) E (Click the icon to view the costs.) - X Required Costs Total Costs for July 2018 Requirement 1. Calculate the cost per equivalent unit for direct materials and conversion costs. Enter the physical units first, and then calculate the equivalent units. (Round your answers to the nearest whole unit. Enter an amount in each input cell.) Work in process, beginning Direct materials $ 60,000 Equivalent Units Direct Conversion Materials Costs Physical Units 70,000 $ Flow of Production Conversion costs Direct materials added during July 130,000 260,000 371,000 Work in process, beginning Conversion costs added during July Started during current period 10,000 40,000 50,000 Total costs to account for $ 761,000 To account for - Completed and transferred out during current period: From beginning work in process Started and completed 0 3,000 Data 10,000 24,000 16,000 24,000 24,000 16,000 Work in process, ending 6,400 50,000 Accounted for 40,000 33,400 Work done to date Equivalent Units Physical Direct Conversion Units Materials Costs Work in process, July 10 10,000 10,000 7,000 Started during July 40,000 Completed and transferred out during July 34,000 34,000 Work in process, July 31 16,000 16,000 6,400 Degree of completion: direct materials, 100%; conversion costs, 70%. Degree of completion: direct materials, 100%; conversion costs, 40%. 34,000 Requirement 2. Summarize total costs to account for, and assign total costs to units completed (and transferred out) and to units in ending work in process using the star Begin by summarizing the total costs to account for. (Round your answers to the nearest whole number.) Total Production Direct Conversion Costs Materials Costs Work in process, beginning $ 138,800 $ 66,000 $ 72,800 Costs added in current period 611,360 264,000 347,360 $ 750,160 $ 330,000 $ $ 420,160 Total cnete to account for Print Done Finally, assign total costs to units completed (and transferred out) and to units Total Production Costs ending work in process. Begin by calculating the total from beginning inventory, and then calculate the total costs accounted for. Direct Conversion Materials Costs Completed and transferred out: Work in process, beginning Costs added to beginning WIP in current period Total from beginning inventory Required 1. Calculate the cost per equivalent unit for direct materials and conversion costs. 2. Summarize total costs to account for, and assign total costs to units completed (and transferred out) and to units in ending work in process using the standard-costing method. Note that you first need to calculate the equivalent units of work done in the current period (for direct materials and conversion costs) to complete beginning work in process, to start and complete new units, and to produce ending work in process. 3. Compute the total direct materials and conversion costs variances for July 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts