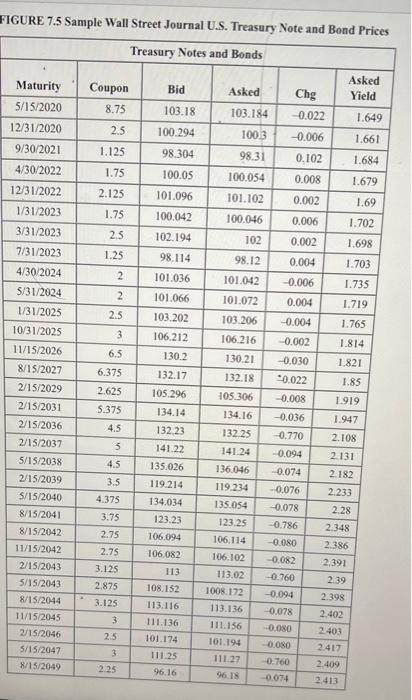

Question: the first two are correct, but i keep getting the last one wrong FIGURE 7.5 Sample Wall Street Journal U.S. Treasury Note and Bond Prices

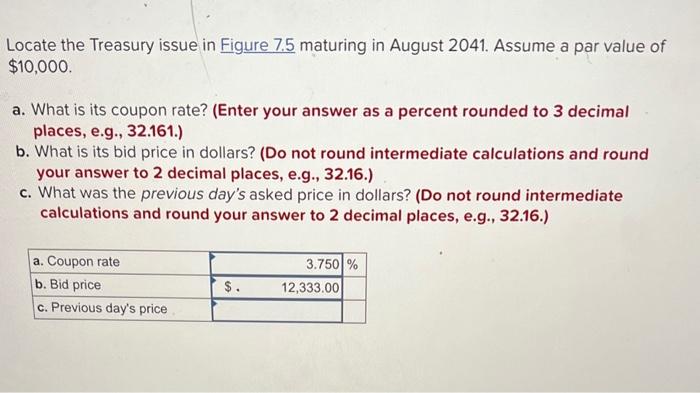

FIGURE 7.5 Sample Wall Street Journal U.S. Treasury Note and Bond Prices Locate the Treasury issue in Figure 7.5 maturing in August 2041. Assume a par value of $10,000 a. What is its coupon rate? (Enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.) b. What is its bid price in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What was the previous day's asked price in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts