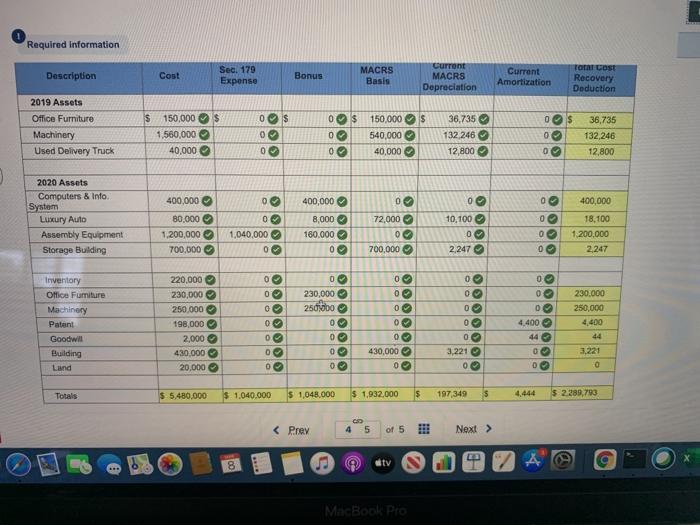

Question: the first two pictures are just information needed for problem (e) Required information Description Cost Sec. 179 Expense Bonus MACRS Basis Current MACRS Depreciation Current

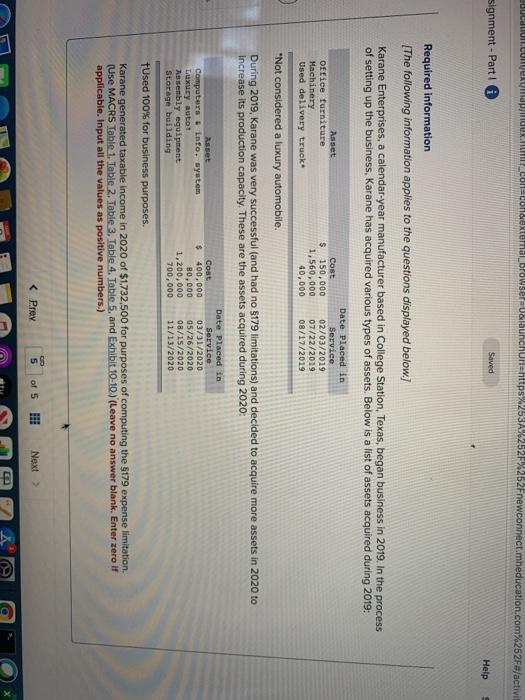

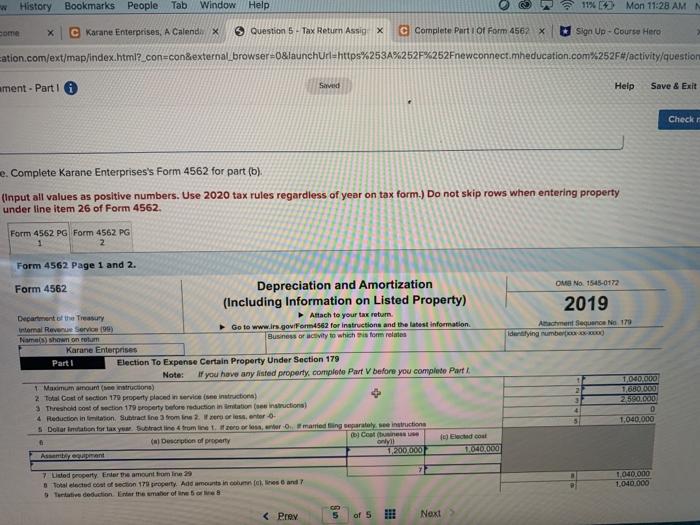

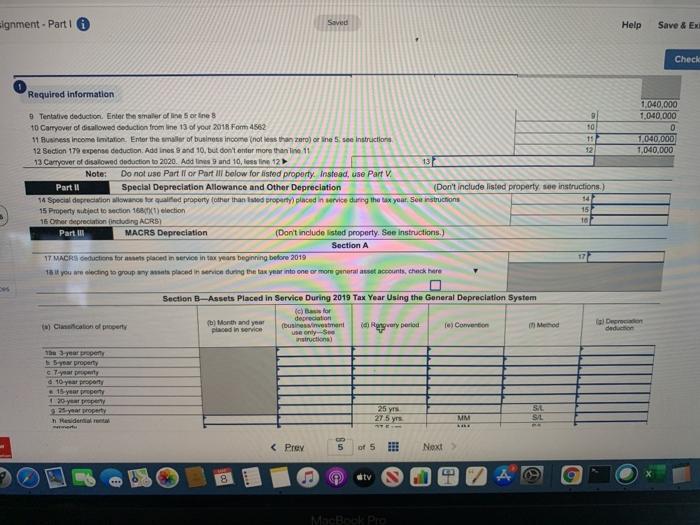

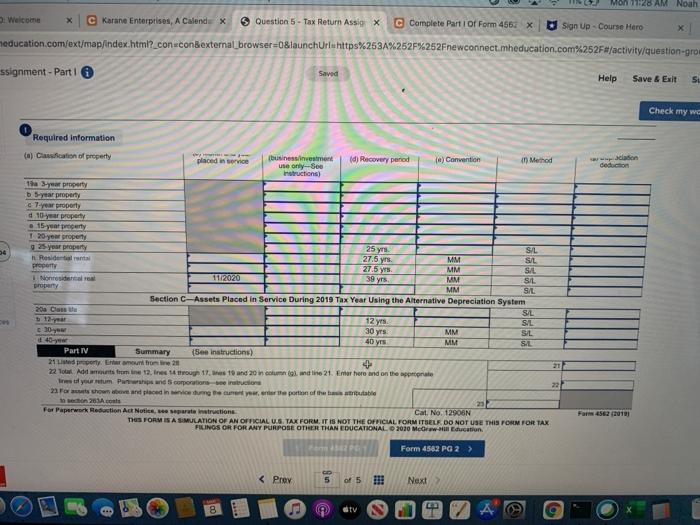

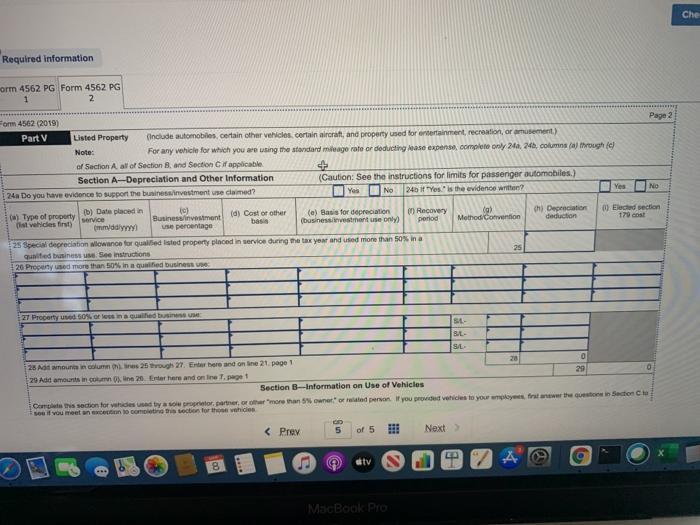

Required information Description Cost Sec. 179 Expense Bonus MACRS Basis Current MACRS Depreciation Current Amortization TORT LOST Recovery Deduction $ OS 2019 Assets Office Furniture Machinery Used Delivery Truck 150,000 $ 1.560,000 40,000 O 0 03 0 0 150,000 $ 540,000 40,000 36,735 132.246 12,800 OS og 0 36,735 132,246 12,800 400,000 400,000 O 0 2020 Assets Computers & Info System Luxury Auto Assembly Equipment Storage Building 72,000 80.000 1.200,000 700,000 0 0 1,040,000 0 8,000 160.000 0 o 8 10,100 0 2,247 0 0 0 0 400,000 18.100 1.200,000 2,247 700,000 0 0 0 Inventory Office Furniture Machinery Patent Goodwill Building Land 220,000 230,000 250.000 198,000 2,000 430,000 20,000 0 230,000 250000 0 0 0 0 0 0 0 0 O 0 02 0 430,000 0 0 0 og 0 O 3,221 0 09 0 0 4,400 44 230.000 250,000 4.400 44 3.221 0 Totals $ 5.480,000 $ 1.040,000 $ 1,048.000 $ 1,932,000 S 197,349 $ $ 2289,793 @ 1 ty 8 Co MacBook Pro dedin.com/mex.com.conxornalbrowser U&launchurl=https%253A%2 62Fnewconnect.mheducation.com%252F#/activit signment - Parti Saved Help Required information [The following information applies to the questions displayed below.) Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2019. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2019: Asset Office furniture Machinery Used delivery truck Cost $ 150,000 1,560,000 40,000 Date placed in Service 02/03/2019 07/22/2019 08/17/2019 "Not considered a luxury automobile. During 2019, Karane was very successful and had no 5179 limitations) and decided to acquire more assets in 2020 to Increase its production capacity. These are the assets acquired during 2020: Asset Computers & Info. system Luxury autot Assembly equipment Storage building Cost $ 400,000 80,000 1,200,000 700,000 Date Placed in Service 03/31/2020 05/26/2020 08/15/2020 11/13/2020 Used 100% for business purposes Karane generated taxable income in 2020 of $1.732,500 for purposes of computing the $179 expense limitation. (Use MACRS Table 1. Table 2. Table 3. Table 4. Table 5, and Exhibit 10-10.) (Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers.) History Bookmarks People Tab Window Help 11% 1 Mon 11:28 AM N some X C Korane Enterprises, A Calendis X 5 Question 5 - Tax Return Assig: X cComplete Part 1 of Form 4562 X Sign Up - Course Hero ation.com/ext/map/index.html?_con=con&external_browser=0&launchurl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question ament - Part 1 Saved Help Save & Exit Check e. Complete Karane Enterprises's Form 4562 for part (b) (Input all values as positive numbers. Use 2020 tax rules regardless of year on tax form.) Do not skip rows when entering property under line item 26 of Form 4562. Form 4562 PG Form 4562 PG 2 OMB NO. 1545-0172 2019 Aachment Sequence No 179 Form 4562 Page 1 and 2. Form 4562 Depreciation and Amortization (Including Information on Listed Property) Departementet the Treasury Attach to your tax return internal Revenue Service (90) Go to www.lrs.govForm 562 for instructions and the latest information Names) shown on folum Business or activity to which is for relates Karane Enterprises Part 1 Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part 1 Manouchons) 2 Total Cost of section 179 properly placed in services instruction) 3 Threshold cost of section 179 property before reduction in station instructions) 4 Reduction information Stitrat in romi 2. er or less ro 5 Dolar nation for laxy Srinetromle terors normanding separately we intructions Costiness (Desorption of property only Assement 1200000 104.000 TOHO,000 TOBOT00 2.590.000 0 1.040.000 7 Lided property Eriere amount omine 29 Total elected cont of section 17 property. Add amounts com les and Te deduction Enter the mater of 1,040.000 1.000.000 . Question 5 - Tax Return Assix Complete Part 1 of Form 4561 X Sign Up - Course Hero X meducation.com/ext/map/index.html?_con=con external_browser=0&launchurluhttps%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-gro ssignment - Part 1 Saved Help Save & Exit SL Check my wc Required information (a) Canication of property -- placed in service (d) Recovery period (e) Convention business investment use only. See Instructions) in Method deduction the your property b5-year property 7-year property 54 15-year certy 120 year proper g 25-year property 25 yrs. SIL Residential 27.5 yrs MM SIL property 275 yrs MM SIL Nonsidera 11.2020 39 yrs MM SIL property MM SIL Section C-Assets Placed in Service During 2019 Tax Year Using the Alternative Depreciation System 200 Cane SIL 12 yrs S/L c30 30 yrs MM SL 40 40 yrs MM SAL Part IV Summary (See Instructions) 21 Lipperty Eamente 2 + 22 To Add stromine 12 in 14 through 11.10 and 20 incolumn landline 21 Ene here and on the appropriate your um Purwap and corporations were 221 2 For a shown and placed in inguruare portion of the stabile on 21 coats 232 For Paperwork Reduction Act Notite se separate instructions Cat No. 12906N THE FORM IS A SIMULATION OF AN OFFICIALUS TAK FORM, IT IS NOT THE OFFICIAL FORM ITSELE DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2010 Merww- Education Farm456270101 Form 4502 PG 2 > @ 1 ty 8 Co MacBook Pro dedin.com/mex.com.conxornalbrowser U&launchurl=https%253A%2 62Fnewconnect.mheducation.com%252F#/activit signment - Parti Saved Help Required information [The following information applies to the questions displayed below.) Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2019. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2019: Asset Office furniture Machinery Used delivery truck Cost $ 150,000 1,560,000 40,000 Date placed in Service 02/03/2019 07/22/2019 08/17/2019 "Not considered a luxury automobile. During 2019, Karane was very successful and had no 5179 limitations) and decided to acquire more assets in 2020 to Increase its production capacity. These are the assets acquired during 2020: Asset Computers & Info. system Luxury autot Assembly equipment Storage building Cost $ 400,000 80,000 1,200,000 700,000 Date Placed in Service 03/31/2020 05/26/2020 08/15/2020 11/13/2020 Used 100% for business purposes Karane generated taxable income in 2020 of $1.732,500 for purposes of computing the $179 expense limitation. (Use MACRS Table 1. Table 2. Table 3. Table 4. Table 5, and Exhibit 10-10.) (Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers.) History Bookmarks People Tab Window Help 11% 1 Mon 11:28 AM N some X C Korane Enterprises, A Calendis X 5 Question 5 - Tax Return Assig: X cComplete Part 1 of Form 4562 X Sign Up - Course Hero ation.com/ext/map/index.html?_con=con&external_browser=0&launchurl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question ament - Part 1 Saved Help Save & Exit Check e. Complete Karane Enterprises's Form 4562 for part (b) (Input all values as positive numbers. Use 2020 tax rules regardless of year on tax form.) Do not skip rows when entering property under line item 26 of Form 4562. Form 4562 PG Form 4562 PG 2 OMB NO. 1545-0172 2019 Aachment Sequence No 179 Form 4562 Page 1 and 2. Form 4562 Depreciation and Amortization (Including Information on Listed Property) Departementet the Treasury Attach to your tax return internal Revenue Service (90) Go to www.lrs.govForm 562 for instructions and the latest information Names) shown on folum Business or activity to which is for relates Karane Enterprises Part 1 Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part 1 Manouchons) 2 Total Cost of section 179 properly placed in services instruction) 3 Threshold cost of section 179 property before reduction in station instructions) 4 Reduction information Stitrat in romi 2. er or less ro 5 Dolar nation for laxy Srinetromle terors normanding separately we intructions Costiness (Desorption of property only Assement 1200000 104.000 TOHO,000 TOBOT00 2.590.000 0 1.040.000 7 Lided property Eriere amount omine 29 Total elected cont of section 17 property. Add amounts com les and Te deduction Enter the mater of 1,040.000 1.000.000 . Question 5 - Tax Return Assix Complete Part 1 of Form 4561 X Sign Up - Course Hero X meducation.com/ext/map/index.html?_con=con external_browser=0&launchurluhttps%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-gro ssignment - Part 1 Saved Help Save & Exit SL Check my wc Required information (a) Canication of property -- placed in service (d) Recovery period (e) Convention business investment use only. See Instructions) in Method deduction the your property b5-year property 7-year property 54 15-year certy 120 year proper g 25-year property 25 yrs. SIL Residential 27.5 yrs MM SIL property 275 yrs MM SIL Nonsidera 11.2020 39 yrs MM SIL property MM SIL Section C-Assets Placed in Service During 2019 Tax Year Using the Alternative Depreciation System 200 Cane SIL 12 yrs S/L c30 30 yrs MM SL 40 40 yrs MM SAL Part IV Summary (See Instructions) 21 Lipperty Eamente 2 + 22 To Add stromine 12 in 14 through 11.10 and 20 incolumn landline 21 Ene here and on the appropriate your um Purwap and corporations were 221 2 For a shown and placed in inguruare portion of the stabile on 21 coats 232 For Paperwork Reduction Act Notite se separate instructions Cat No. 12906N THE FORM IS A SIMULATION OF AN OFFICIALUS TAK FORM, IT IS NOT THE OFFICIAL FORM ITSELE DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2010 Merww- Education Farm456270101 Form 4502 PG 2 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts