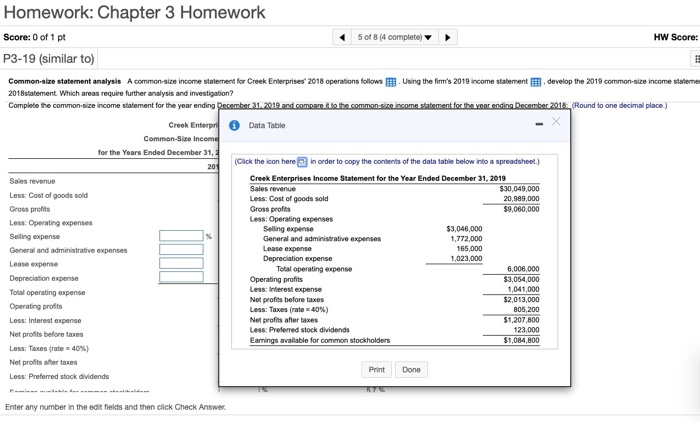

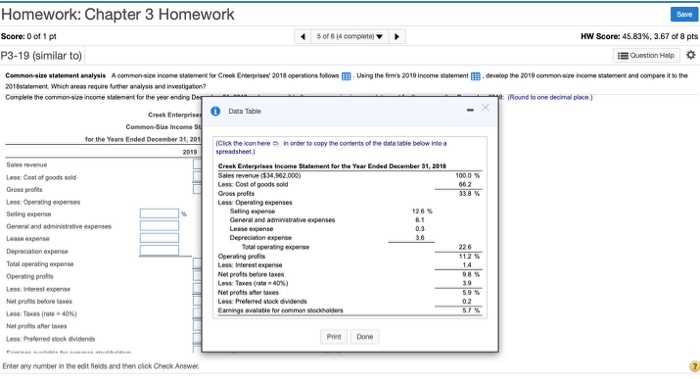

Question: The first two pictures are the data used to answer the questions which is the 3rd question Homework: Chapter 3 Homework Score: 0 of 1

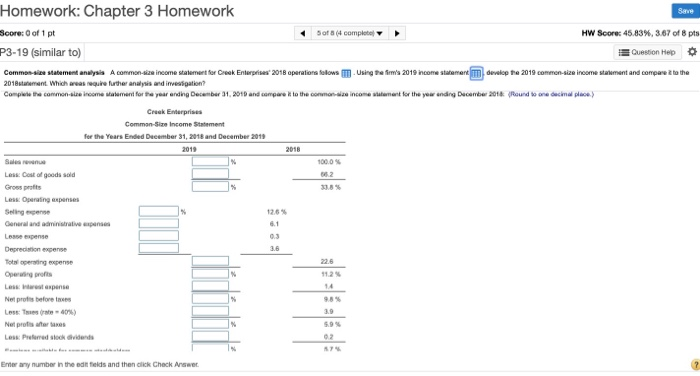

Homework: Chapter 3 Homework Score: 0 of 1 pt 5 of 8 (4 complete) HW Score: P3-19 (similar to) Common-size statement analysis A common-size income statement for Creek Enterprises 2018 operations follows Using the firm's 2019 income statement develop the 2019 common-size income stateme 2018 statement. Which areas require further analysis and investigation? Complete the common-size income statement for the year ending December 31, 2019 and compare to the common size income statement for the year ending December 2013 (Round to one decimal place.) Creek Enterprl 0 Data Table Common-Size Income for the Years Ended December 31, (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) 201 Sales revenue Creek Enterprises Income Statement for the Year Ended December 31, 2019 Sales revenue $30,049,000 Less: Cost of goods sold Less: Cost of goods sold 20,989,000 Gross profits Gross profits $9,060,000 Less Operating expenses Less: Operating expenses Selling expense $3,046,000 Selling expense General and administrative expenses 1,772,000 General and administrative expenses Lease expense 165,000 Depreciation expense 1,023,000 Lease expense Total operating expense 6,006,000 Depreciation expense Operating profits $3,054,000 Total operating expense Less: Interest expense 1,041,000 Net profits before taxes $2,013,000 Operating profits Less: Taxes (rate=40%) 805,200 Less: Interest expense Net profits after taxes $1,207,800 Less: Preferred stock dividends 123,000 Net profits before taxes Earnings available for common stockholders $1,084,800 Less: Taxes (rate=40%) Net profits after taxes Done Less: Preferred stock dividends Print Enter any number in the edit fields and then click Check Answer. Homework: Chapter 3 Homework Save Score: 0 of 11 5 of 8 (4 completo HW Score: 45.83%, 3.67 of 8 pts P3-19 (similar to) Question Help Commen size statement analysis common size income statement for Creek Enterprises 2018 operations follows Using the firm's 2010 income statement velop the 2018 common size income statement and compare it to the 2018tatement. Which areas require further analysis and investigation? Complete the common side income statement for the year ending Dey Round to one decimal place) Creek Enterprised Data Table Commons Income for the Year Ended December 31, 201 Click the icon here in order to copy the contents of the datatable below into a 2019 spreadsheet) Creek Enterprises Income Statement for the Year Ended December 31, 2018 Less: Cost of goods sold Sales revenue ( 512.000) 1000 Less Cost of goods sold 662 Gross pros Gross profits Less: Operating expert Less Operating expenses Selling expense Seling expense 1264 General and administrative expenses 6.1 General and adminive expenses 0.3 Depreciation expense 36 Total operating experte 226 Depreciation expense Operwing profits 112 Total operating expense Less Interest expense Operating profits Net profits before taxes Less Taxes (rate 60%) 39 Net profits Less Preferred stock dividends 02 Earnings available for common stockholders Net profits after Les Preferred stock didende Print Done Enter any number in the edit fields and then click Check Answer Homework: Chapter 3 Homework Save Score: 0 of 1 pt Sofa (4 complete HW Score: 45.83%, 3.67 of 8 pts P3-19 (similar to) Question Help Commonsie statement analysis A common-size income statement for Creek Enterprises 2018 operations follows Using the fim'a 2019 income statement develop the 2019 common-size income statement and compare to the 2018statement which creas require further analysis and investigation? Complete the common se income talement for the year ending December 31, 2013 and compare to the common income tant for the year ending December 2016 Round to one cecinal place Creek Enterprises Comman-Size Income Statement for the Years Ended December 31, 2018 and December 2013 2019 2018 Swewe 100.0% Less Cost of goods sold % Less Operating pres Solingen General and administratives Le pense Depreciation expense Tots operating expense 0.3 9.8% Les pense Netprofis before Less: Tiere 40%) Net profiter les Less Preferred to dividende Enter any number in the edit fields and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts