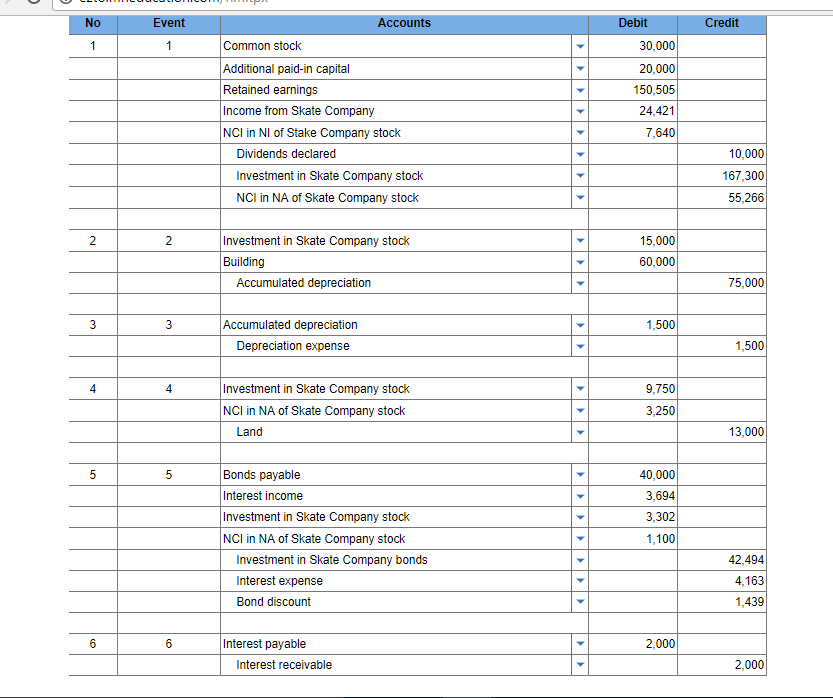

Question: The first two screen shots are given information. Above are the onfirmed answers for all consolidation entries needed at December 31, 20X8, to complete a

The first two screen shots are given information.

Above are the onfirmed answers for all consolidation entries needed at December 31, 20X8, to complete a three-part consolidation worksheet.

please give caluclations for each entry. including calucations for reversal/deffered GP calculations

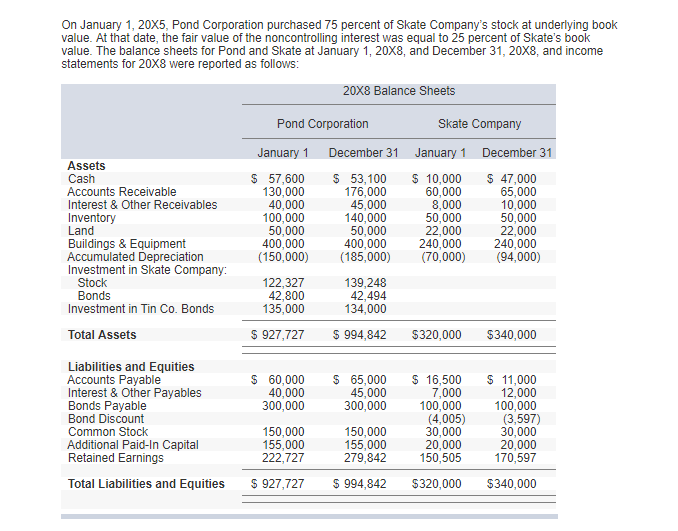

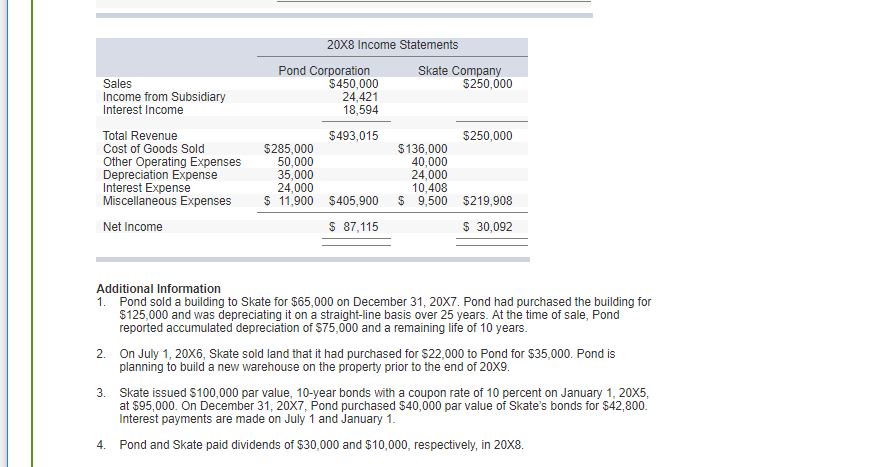

On January 1, 20X5, Pond Corporation purchased 75 percent of Skate Company's stock at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 25 percent of Skate's book value. The balance sheets for Pond and Skate at January 1, 20X8, and December 31, 20x8, and income statements for 20X8 were reported as follows 20X8 Balance Sheets Pond Corporation Skate Company January 1 December 31 January 1 December 31 Assets Cash Accounts Receivable Interest & Other Receivables Inventory Land Buildings & Equipment Accumulated Depreciation Investment in Skate Company: S 57,600 S53,100 10,000 S 47,000 65,000 10,000 50,000 22,000 240,000 130,000 40,000 100,000 50,000 400,000 176,000 45,000 140,000 50,000 400,000 60,000 8,000 50,000 22,000 240,000 (150,000) (185,000) (70,000) 94,000) 22,327 42,800 135,000 Stock 139,248 Bonds Investment in Tin Co. Bonds 42,494 134,000 Total Assets S 927,727 994,842 $320,000 S340,000 Liabilities and Equities Accounts Payable Interest & Other Payables Bonds Payable Bond Discount Common Stock Additional Paid-In Capital Retained Earnings S 60,000 S65,000 S16,500 S 11,000 12,000 100,000 (3,597) 30,000 20,000 170,597 7,000 100,000 (4,005) 30,000 20,000 150,505 40,000 300,000 45,000 300,000 150,000 155,000 222,727 150,000 155,000 279,842 Total Liabilities and Equities S927,727 $ 994,842 $320,000 $340,000 On January 1, 20X5, Pond Corporation purchased 75 percent of Skate Company's stock at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 25 percent of Skate's book value. The balance sheets for Pond and Skate at January 1, 20X8, and December 31, 20x8, and income statements for 20X8 were reported as follows 20X8 Balance Sheets Pond Corporation Skate Company January 1 December 31 January 1 December 31 Assets Cash Accounts Receivable Interest & Other Receivables Inventory Land Buildings & Equipment Accumulated Depreciation Investment in Skate Company: S 57,600 S53,100 10,000 S 47,000 65,000 10,000 50,000 22,000 240,000 130,000 40,000 100,000 50,000 400,000 176,000 45,000 140,000 50,000 400,000 60,000 8,000 50,000 22,000 240,000 (150,000) (185,000) (70,000) 94,000) 22,327 42,800 135,000 Stock 139,248 Bonds Investment in Tin Co. Bonds 42,494 134,000 Total Assets S 927,727 994,842 $320,000 S340,000 Liabilities and Equities Accounts Payable Interest & Other Payables Bonds Payable Bond Discount Common Stock Additional Paid-In Capital Retained Earnings S 60,000 S65,000 S16,500 S 11,000 12,000 100,000 (3,597) 30,000 20,000 170,597 7,000 100,000 (4,005) 30,000 20,000 150,505 40,000 300,000 45,000 300,000 150,000 155,000 222,727 150,000 155,000 279,842 Total Liabilities and Equities S927,727 $ 994,842 $320,000 $340,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts