Question: The first-in, first out method of costing inventory is based on the assumption that costs should be charged against revenue in the order in

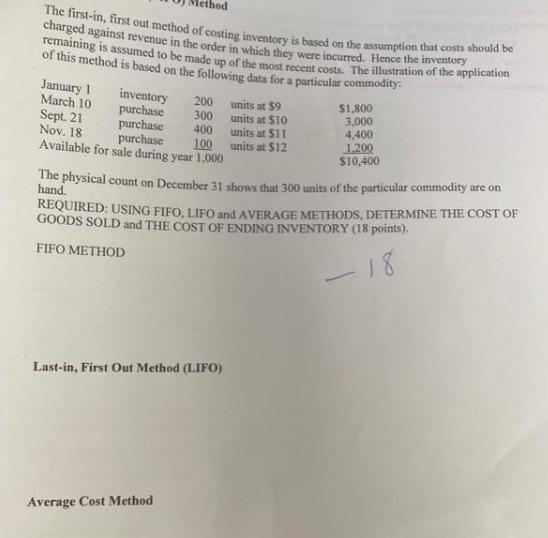

The first-in, first out method of costing inventory is based on the assumption that costs should be charged against revenue in the order in which they were incurred. Hence the inventory remaining is assumed to be made up of the most recent costs. The illustration of the application of this method is based on the following data for a particular commodity January I March 10 Sept. 21 Nov. 18 inventory purchase purchase purchase Available for sale during year 1.000 200 300 400 100 units at $9 units at $10 units at $11 units at $12 $1,800 3,000 4,400 1.200 S10,400 The physical count on December 31 shows that 300 units of the particular commodity are on hand. REQUIRED: USING FIFO, LIFO and AVERAGE METHODS, DETERMINE THE COST OF GOODS SOLD and THE COST OF ENDING INVENTORY (18 points). 18 FIFO METHOD Last-in, First Out Method (LIFO) Average Cost Method

Step by Step Solution

3.51 Rating (175 Votes )

There are 3 Steps involved in it

FIFO Method FirstIn FirstOut Under the FIFO method it is assumed that the items sold are the ones th... View full answer

Get step-by-step solutions from verified subject matter experts