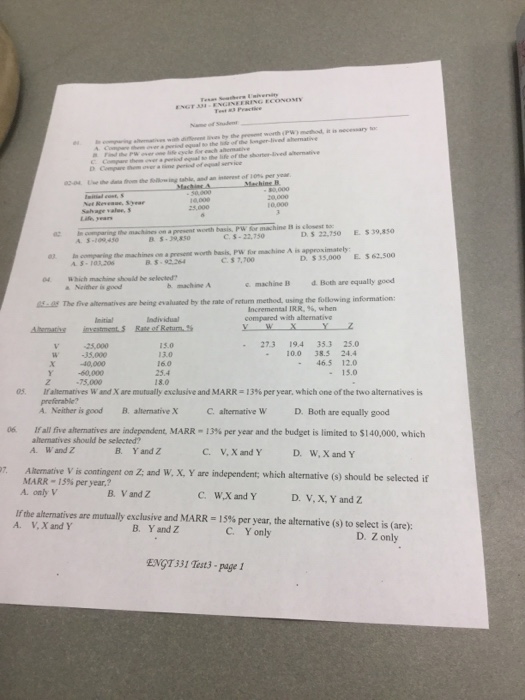

Question: The five alternatives are being evaluated by the rate return method, using the following information: If alternatives W and X are mutually exclusive and MARR

The five alternatives are being evaluated by the rate return method, using the following information: If alternatives W and X are mutually exclusive and MARR = 13% per year, which one of the two alternatives is preferable Neither is good Alternative X alternative W Both are equally good If all five alternative are independent MARR = 13% per year and the budget is limited to $140,000, which alternatives should be selected W and Z Y and Z V,X and Y W, X and Y Alternative V is contingent on Z; and W, X, Y are independent; which alternative (s) should be selected if MARR = 15% per year only V V and Z W,X and Y V,x, y and Z If the alternatives are mutually exclusive and MARR = 15% per year, the alternatives (s) to select is (are): V, X and Y Y and Z Y only Z only. The five alternatives are being evaluated by the rate return method, using the following information: If alternatives W and X are mutually exclusive and MARR = 13% per year, which one of the two alternatives is preferable Neither is good Alternative X alternative W Both are equally good If all five alternative are independent MARR = 13% per year and the budget is limited to $140,000, which alternatives should be selected W and Z Y and Z V,X and Y W, X and Y Alternative V is contingent on Z; and W, X, Y are independent; which alternative (s) should be selected if MARR = 15% per year only V V and Z W,X and Y V,x, y and Z If the alternatives are mutually exclusive and MARR = 15% per year, the alternatives (s) to select is (are): V, X and Y Y and Z Y only Z only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts