Question: The Five situations are located below. There is no more information to provide. For each of the five independent situations below, prepare a single journal

The Five situations are located below. There is no more information to provide.

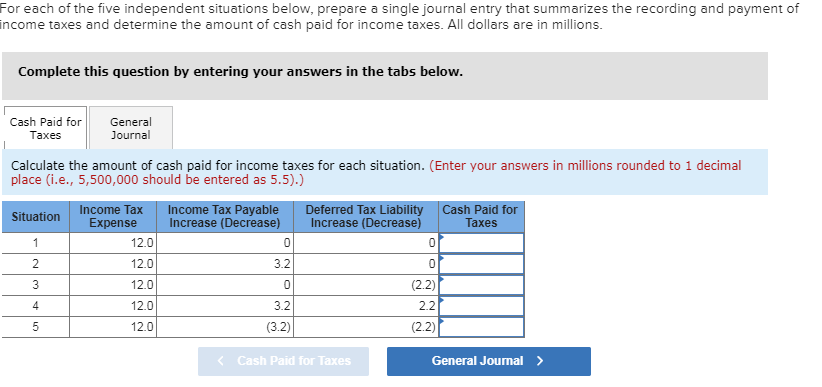

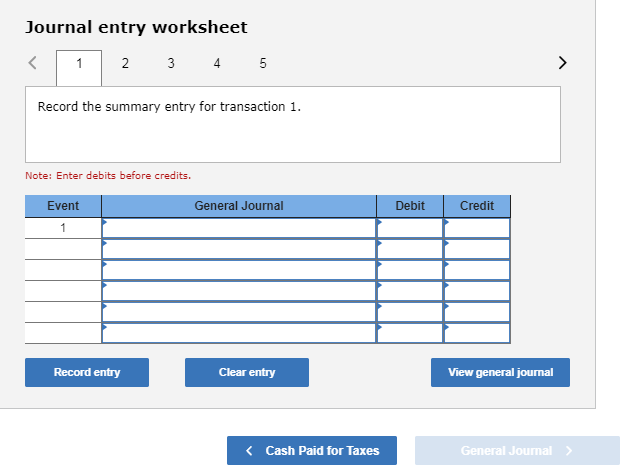

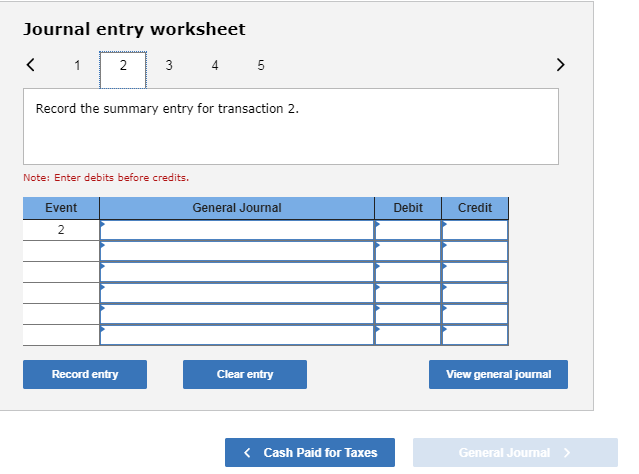

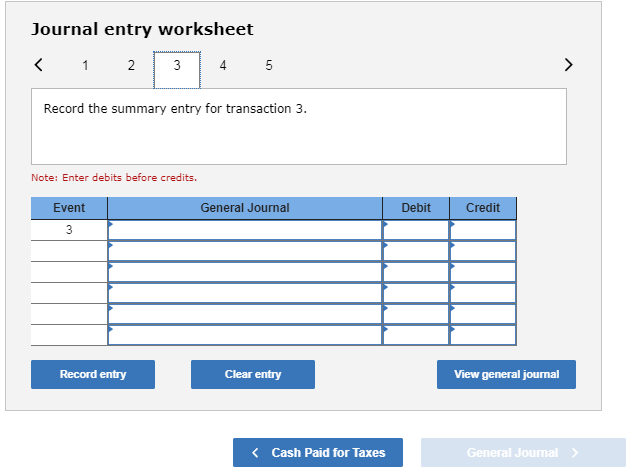

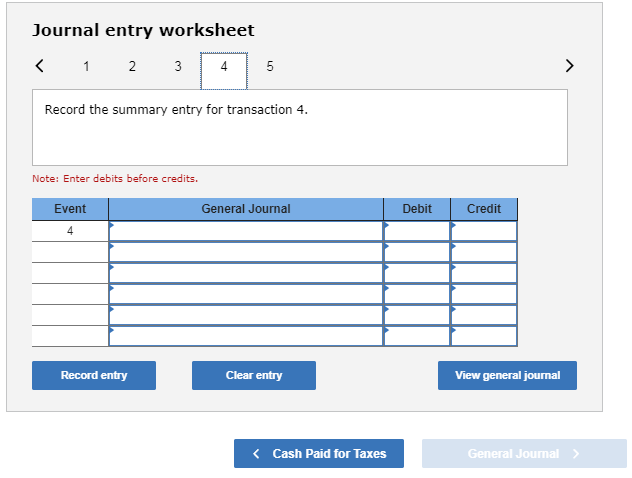

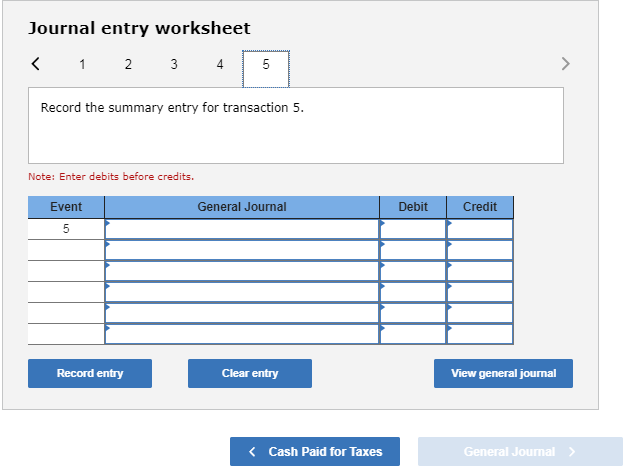

For each of the five independent situations below, prepare a single journal entry that summarizes the recording and payment of income taxes and determine the amount of cash paid for income taxes. All dollars are in millions. Complete this question by entering your answers in the tabs below. General Journal Cash Paid for Taxes Calculate the amount of cash paid for income taxes for each situation. (Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) Income Tax Expense Income Tax Payable Increase (Decrease) Deferred Tax Liability Increase (Decrease) Cash Paid for Taxes Situation 1 12.0 0 0 2 12.0 3.2 3 12.0 0 (2.2) 4 12.0 3.2 2.2 12.0 (2.2) 5 (3.2) General Joumal> Cash Paid for Taxes Journal entry worksheet 1 2 3 4 5 Record the summary entry for transaction 1. Note: Enter debits before credits. Event General Journal Debit Credit 1 View general journal Record entry Clear entry Cash Paid for Taxes General Journal Journal entry worksheet 5 2 Record the summary entry for transaction 3 Note: Enter debits before credits. Event General Journal Debit Credit 3 Record entry Clear entry View general journal Cash Paid for Taxes General Journal Journal entry worksheet 1 2 3 4 Record the summary entry for transaction 4 Note: Enter debits before credits. Event General Journal Debit Credit 4 Clear entry Record entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts