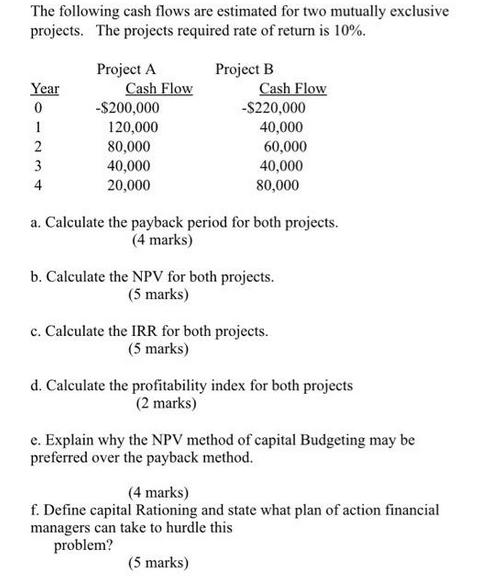

Question: The following cash flows are estimated for two mutually exclusive projects. The projects required rate of return is 10%. Project A Project B Year

The following cash flows are estimated for two mutually exclusive projects. The projects required rate of return is 10%. Project A Project B Year Cash Flow Cash Flow 0 -$200,000 -$220,000 1234 120,000 40,000 80,000 40,000 60,000 40,000 20,000 80,000 a. Calculate the payback period for both projects. (4 marks) b. Calculate the NPV for both projects. (5 marks) c. Calculate the IRR for both projects. (5 marks) d. Calculate the profitability index for both projects (2 marks) e. Explain why the NPV method of capital Budgeting may be preferred over the payback method. (4 marks) f. Define capital Rationing and state what plan of action financial managers can take to hurdle this problem? (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts