Question: The following cash flows represent three different mutually exclusive options related to a property you acquired one year ago for ten million dollars. If other

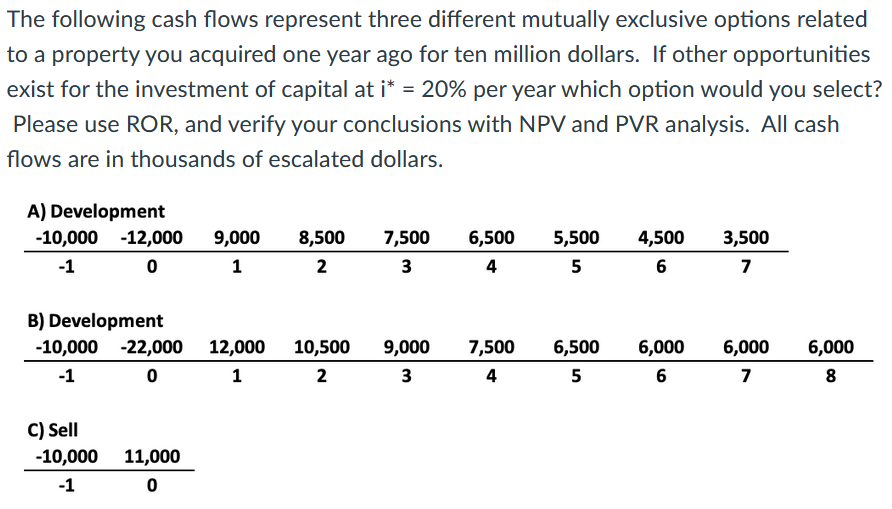

The following cash flows represent three different mutually exclusive options related to a property you acquired one year ago for ten million dollars. If other opportunities exist for the investment of capital at i* = 20% per year which option would you select? Please use ROR, and verify your conclusions with NPV and PVR analysis. All cash flows are in thousands of escalated dollars. A) Development -10,000 -12,000 0 9,000 1 8,500 2 7,500 3 6,500 4 5,500 5 4,500 6 3,500 7 B) Development -10,000 -22,000 12,000 10,500 -1 0 1 2 9,000 3 7,500 4 6,500 5 6,000 6 6,000 7 6,000 8 C) Sell -10,000 -1 11,000 0

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock