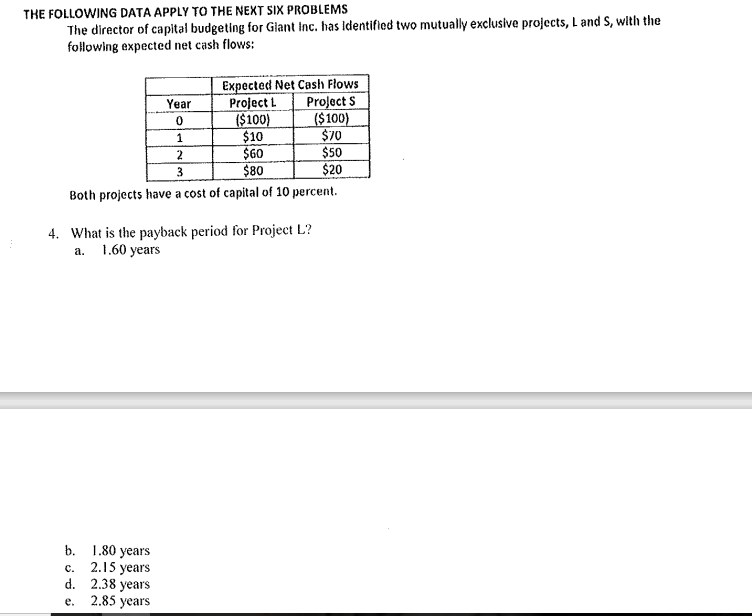

Question: THE FOLLOWING DATA APPLY TO THE NEXT SIX PROBLEMS The director of capital budgeting for Giant inc. has identified two mutually exclusive projects, L and

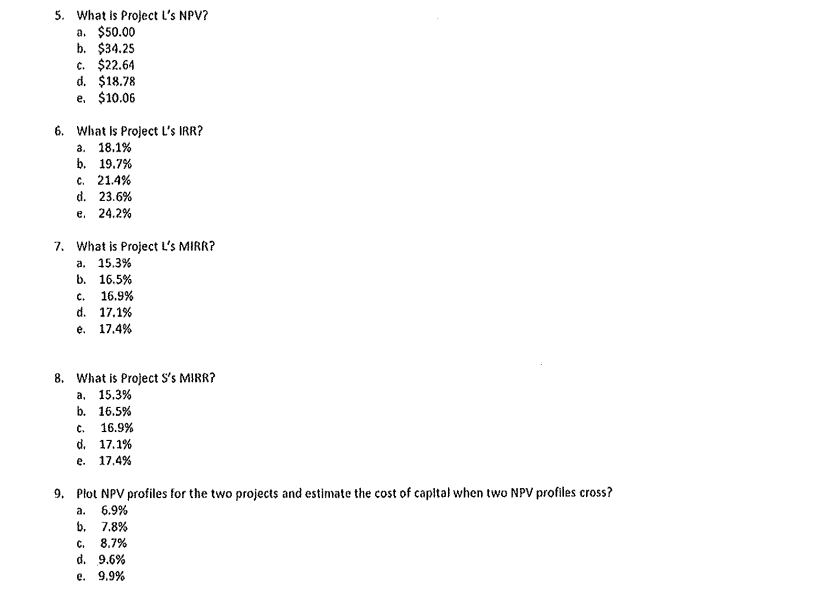

THE FOLLOWING DATA APPLY TO THE NEXT SIX PROBLEMS The director of capital budgeting for Giant inc. has identified two mutually exclusive projects, L and S, with the following expected net cash flows: Both projects have a cost of capital of 10 percent. 4. What is the payback period for Project L ? a. 1.60 years b. 1.80 years c. 2.15 years d. 2.38 years e. 2.85 years 5. What is Project L's NPV? a. $50.00 b. $34.25 c. $22.64 d. $18.78 e. $10.06 6. What is Project L's IRR? a. 18.1% b. 19.7% c. 21.4% d. 23.6% e. 24.2% 7. What is Project L's MIRR? a. 15.3% b. 16.5% c. 16.9% d. 17,1% e. 17.4% 8. What is Project S'S MIRR? a. 15.3% b. 16.5% c. 16.9% d. 17.1% e. 17,4% 9. Plot NPV profiles for the two projects and estimate the cost of capital when two NPV profiles cross? a. 6.9% b. 7.8% c. 8.7% d. 9.6% e. 9.9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts