Question: The following data are for Rocky Company. 1 Year Ago $ 139,100 940,600 Current Year $ 154,000 891,105 Accounts receivable, net Net sales (a)

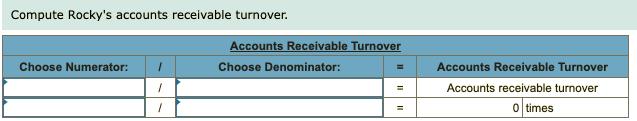

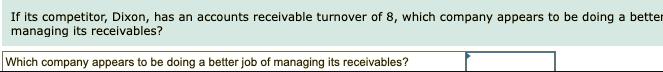

The following data are for Rocky Company. 1 Year Ago $ 139,100 940,600 Current Year $ 154,000 891,105 Accounts receivable, net Net sales (a) Compute Rocky's accounts receivable turnover. (b) If its competitor, Dixon, has an accounts receivable turnover of 8, which company appears to be doing a better job of managing its receivables? Compute Rocky's accounts receivable turnover. Accounts Receivable Turnover Choose Numerator: Choose Denominator: Accounts Receivable Turnover Accounts receivable turnover o times If its competitor, Dixon, has an accounts receivable turnover of 8, which company appears to be doing a better managing its receivables? Which company appears to be doing a better job of managing its receivables?

Step by Step Solution

3.58 Rating (151 Votes )

There are 3 Steps involved in it

a Formula for accounts Receivable Turnover ratio Net Sales Average accounts R... View full answer

Get step-by-step solutions from verified subject matter experts