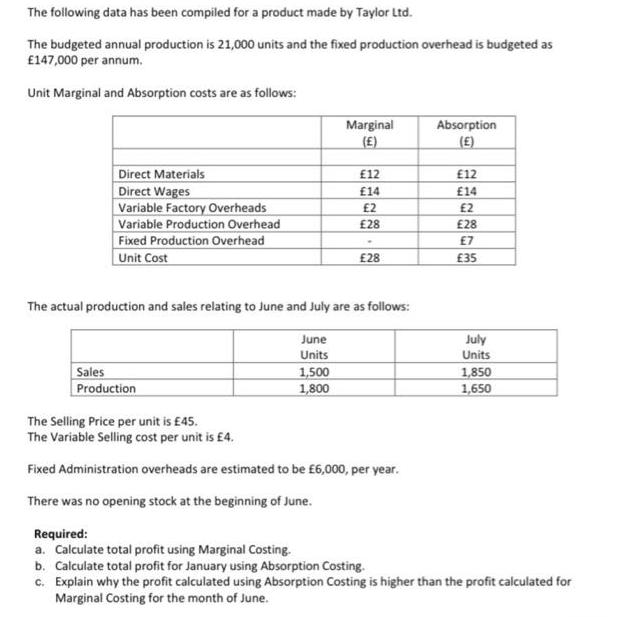

Question: The following data has been compiled for a product made by Taylor Ltd. The budgeted annual production is 21,000 units and the fixed production

The following data has been compiled for a product made by Taylor Ltd. The budgeted annual production is 21,000 units and the fixed production overhead is budgeted as 147,000 per annum. Unit Marginal and Absorption costs are as follows: Direct Materials Direct Wages Variable Factory Overheads Variable Production Overhead Fixed Production Overhead Unit Cost Marginal Sales Production 12 14 2 28 28 The actual production and sales relating to June and July are as follows: June Units 1,500 1,800 The Selling Price per unit is 45. The Variable Selling cost per unit is 4. Fixed Administration overheads are estimated to be 6,000, per year. There was no opening stock at the beginning of June. Absorption 12 14 2 28 7 35 July Units 1,850 1,650 Required: a. Calculate total profit using Marginal Costing. b. Calculate total profit for January using Absorption Costing. c. Explain why the profit calculated using Absorption Costing is higher than the profit calculated for Marginal Costing for the month of June.

Step by Step Solution

3.51 Rating (161 Votes )

There are 3 Steps involved in it

The answer provided below has been developed in a clear step by step manner Step 1 The solution is a... View full answer

Get step-by-step solutions from verified subject matter experts