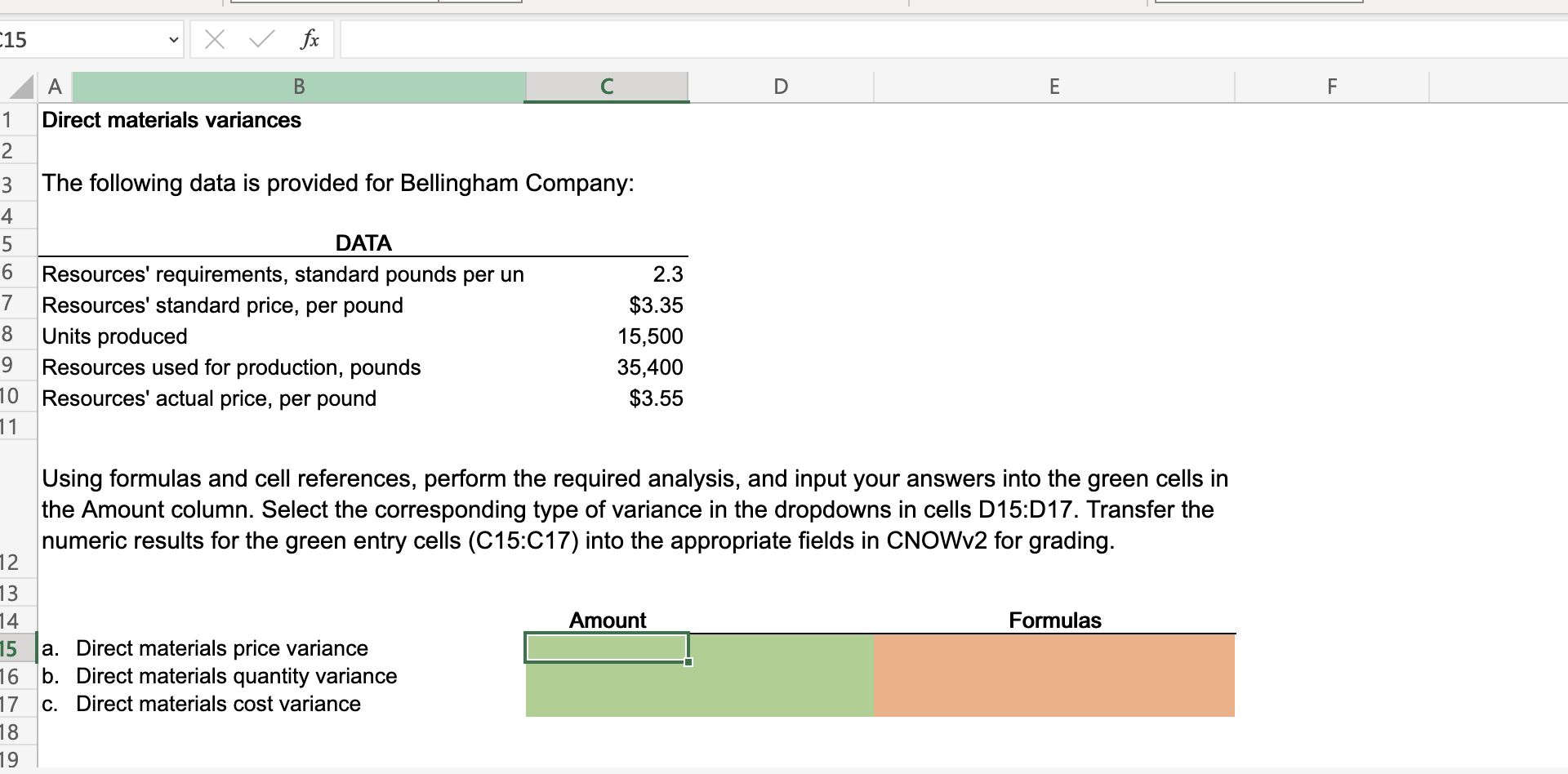

Question: The following data is provided for Bellingham Company: Using formulas and cell references, perform the required analysis, and input your answers into the green cells

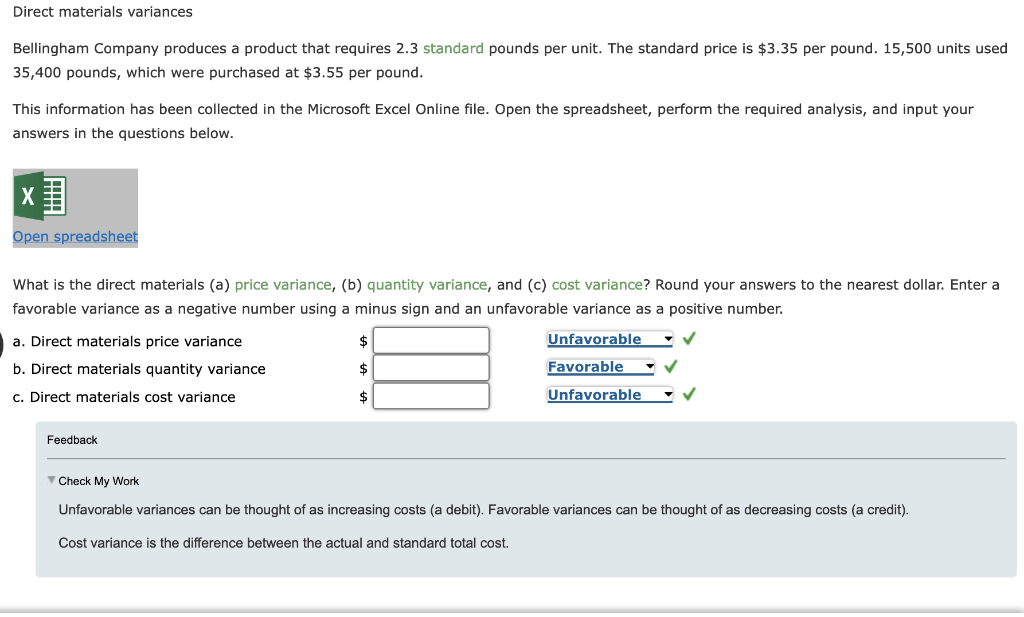

The following data is provided for Bellingham Company: Using formulas and cell references, perform the required analysis, and input your answers into the green cells in the Amount column. Select the corresponding type of variance in the dropdowns in cells D15:D17. Transfer the numeric results for the green entry cells (C15:C17) into the appropriate fields in CNOWv2 for grading. Bellingham Company produces a product that requires 2.3 standard pounds per unit. The standard price is $3.35 per pound. 15,500 units used 35,400 pounds, which were purchased at $3.55 per pound. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. What is the direct materials (a) price variance, (b) quantity variance, and (c) cost variance? Round your answers to the nearest dollar. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. a. Direct materials price variance b. Direct materials quantity variance c. Direct materials cost variance Feedback Check My Work Unfavorable variances can be thought of as increasing costs (a debit). Favorable variances can be thought of as decreasing costs (a credit). Cost variance is the difference between the actual and standard total cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts