Question: The following data represents information necessary to assist in preparing the June 30, 2020 bank reconciliation for Trimore Company. The June 30 bank balance

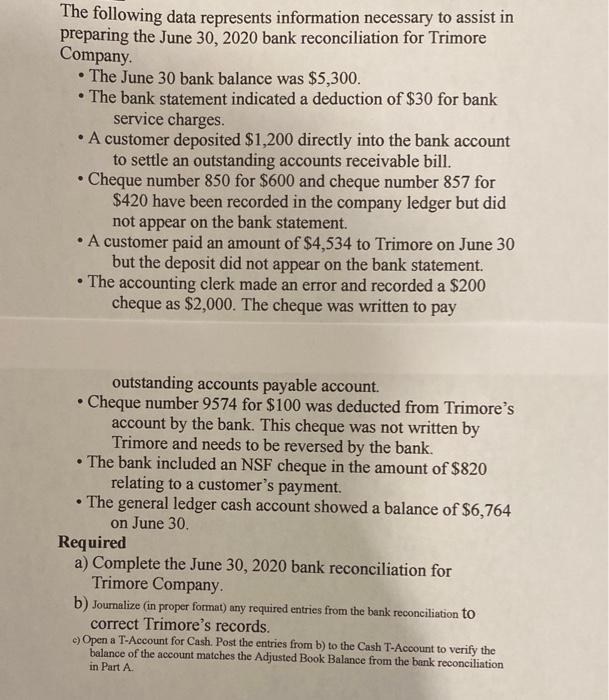

The following data represents information necessary to assist in preparing the June 30, 2020 bank reconciliation for Trimore Company. The June 30 bank balance was $5,300. The bank statement indicated a deduction of $30 for bank service charges. A customer deposited $1,200 directly into the bank account to settle an outstanding accounts receivable bill. Cheque number 850 for $600 and cheque number 857 for $420 have been recorded in the company ledger but did not appear on the bank statement. A customer paid an amount of $4,534 to Trimore on June 30 but the deposit did not appear on the bank statement. The accounting clerk made an error and recorded a $200 cheque as $2,000. The cheque was written to pay outstanding accounts payable account. Cheque number 9574 for $100 was deducted from Trimore's account by the bank. This cheque was not written by Trimore and needs to be reversed by the bank. The bank included an NSF cheque in the amount of $820 relating to a customer's payment. The general ledger cash account showed a balance of $6,764 on June 30. Required a) Complete the June 30, 2020 bank reconciliation for Trimore Company. b) Journalize (in proper format) any required entries from the bank reconciliation to correct Trimore's records. e) Open a T-Account for Cash. Post the entries from b) to the Cash T-Account to verify the balance of the account matches the Adjusted Book Balance from the bank reconciliation in Part A.

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Trimore Company Bank Reconciliation June 30 2019 Cash balance per Bank Statement ... View full answer

Get step-by-step solutions from verified subject matter experts