Question: The following exchange rates and one year interest rate is available in the market today: 1. Find interest rate differential in dollars and euros deposits.

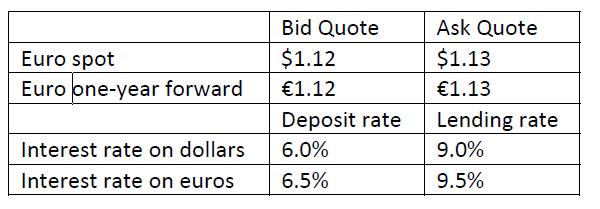

The following exchange rates and one year interest rate is available in the market today:

1. Find interest rate differential in dollars and euros deposits.

2. Is covered interest arbitrage possible? Justify.

3. Show the steps of involved in covered interest arbitrage and calculate arbitrage gain/ losses if these steps are taken.

4. If any arbitrage exists, how it is corrected by market forces, explain with example.

5. Briefly explain Interest rate and purchasing power parity condition. How the parity conditions are linked.

Euro spot Euro one-year forward Interest rate on dollars Interest rate on euros Bid Quote $1.12 1.12 Deposit rate 6.0% 6.5% Ask Quote $1.13 1.13 Lending rate 9.0% 9.5%

Step by Step Solution

There are 3 Steps involved in it

1 The interest rate differential in dollar and euro deposits can be calculated by subtracting the deposit rate of the base currency from the deposit rate of the counter currency In this case Dollar in... View full answer

Get step-by-step solutions from verified subject matter experts