Question: The following formula expresses the expected amount lost when a borrower defaults on a loan, where PD is the probability of default on the loan,

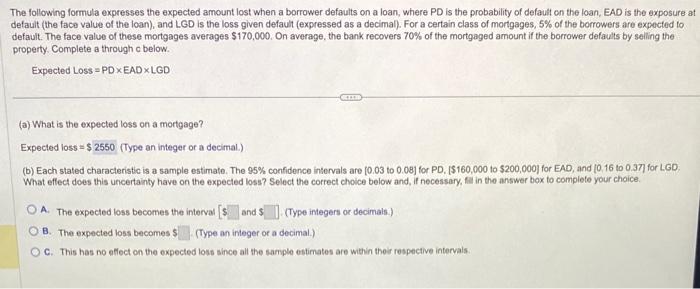

The following formula expresses the expected amount lost when a borrower defaults on a loan, where PD is the probability of default on the loan, EAD is the exposure at default (the face value of the loan), and LGD is the loss given default (expressed as a decimal). For a certain class of mortgages, 5% of the borrowers are expected to default. The face value of these mortgages averages $170,000. On average, the bank recovers 70% of the mortgaged amount if the borrower defaults by selling the property. Complete a through c below. Expected Loss = PD EAD LGD (a) What is the expected loss on a mortgage? Expected loss =$ (Type an integer or a decimal.) (b) Each stated characteristic is a sample estimate. The 95% confidence intervals are [0.03 to 0.08] for PD. [\$160,000 to $200,000] for EAD, and [0,16 to 0.37] for L.GD: What effect does this uncertainty have on the expected loss? Select the correct choice below and, if necessary, fili in the answer box to complete your choice. A. The expected loss becomes the interval | and: (Type integers or decimals.) B. The expected loss becomes 5 (Type an integer or a decimal.) C. This has no effect on the expected loss since all the sample estimates are within their respective intervals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts