Question: The following four cases make different assumptions for the current year with respect to the amounts of income and deductions of Jakob McLaughlin. View the

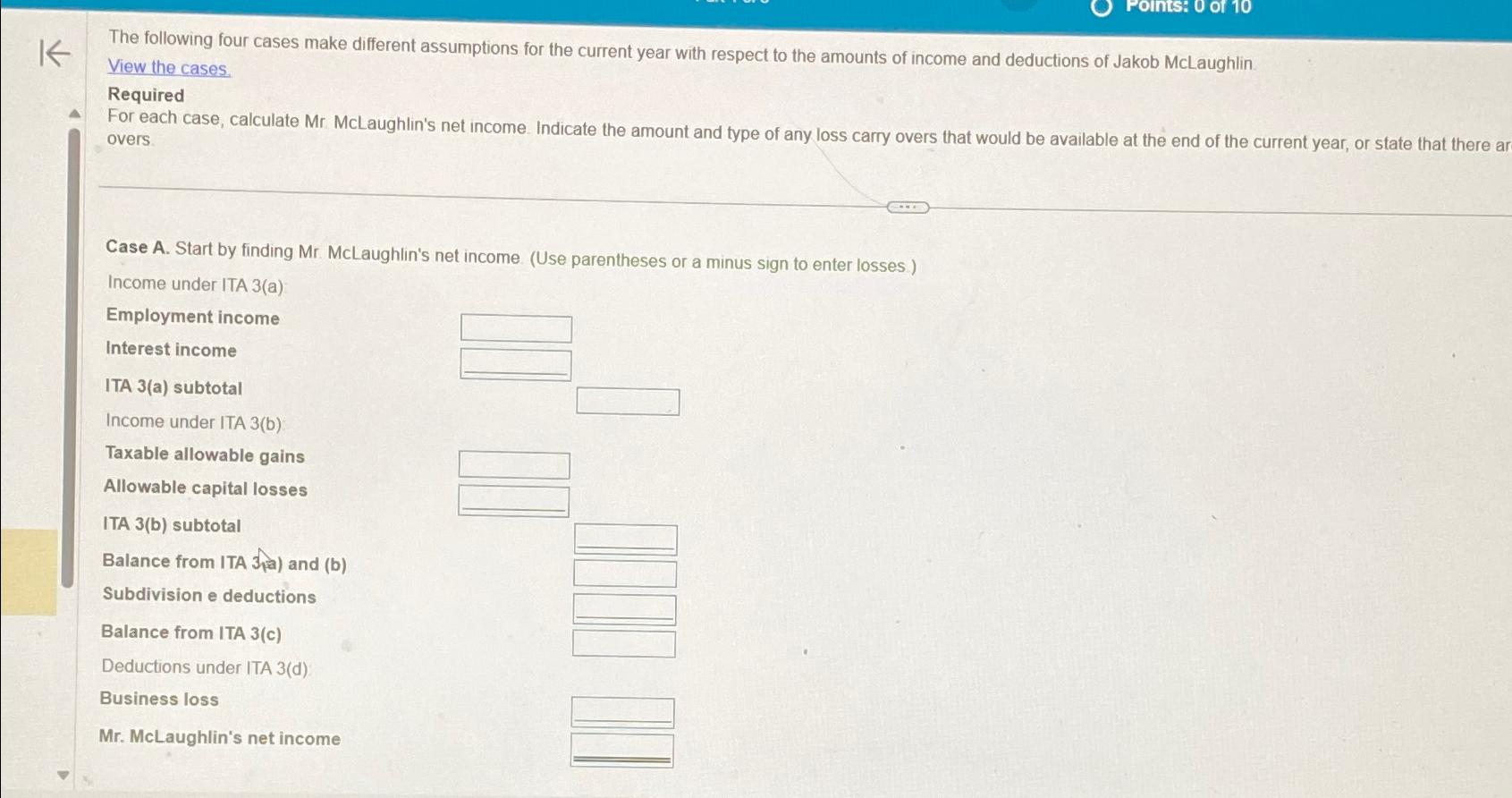

The following four cases make different assumptions for the current year with respect to the amounts of income and deductions of Jakob McLaughlin. View the cases.\ Required\ For each case, calculate Mr. McLaughlin's net income. Indicate the amount and type of any loss carry overs that would be available at the end of the current year, or state that there ar overs.\ Case A. Start by finding Mr. McLaughlin's net income (Use parentheses or a minus sign to enter losses)\ Income under ITA 3(a)\ Employment income\ Interest income\ ITA 3(a) subtotal\ Income under ITA 3(b)\ Taxable allowable gains\ Allowable capital losses\ ITA 3(b) subtotal\ Balance from ITA 3.a) and (b)\ Subdivision eductions\ Balance from ITA 3(c)\ Deductions under ITA 3(d).\ Business loss\ Mr. McLaughlin's net income

The following four cases make different assumptions for the current year with respect to the amounts of income and deductions of Jakob McLaughlin. View the cases. Required For each case, calculate Mr. McLaughlin's net income. Indicate the amount and type of any loss carry overs that would be available at the end of the current year, or state that there ar overs. Case A. Start by finding Mr. McLaughlin's net income (Use parentheses or a minus sign to enter losses )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts