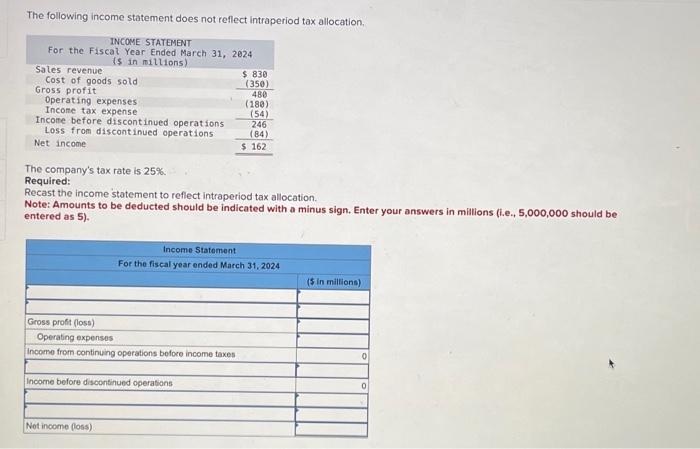

Question: The following income statement does not reflect intraperiod tax allocation. INCOME STATEMENT For the Fiscal Year Ended March 31, 2024 Sales revenue is in millions)

The following income statement does not reflect intraperiod tax allocation. INCOME STATEMENT For the Fiscal Year Ended March 31, 2024 Sales revenue is in millions) Cost of goods sold Gross profit Income tax expense Operating expenses Income before discontinued operations Loss from discontinued operations Net income The company's tax rate is 25%. Required: $ 830 (350) 480 (180) (54) 246 (84) $ 162 Recast the income statement to reflect intraperiod tax allocation. Note: Amounts to be deducted should be indicated with a minus sign. Enter your answers in millions (i.e., 5,000,000 should be entered as 5). Income Statement For the fiscal year ended March 31, 2024 Gross profit (loss) Operating expenses Income from continuing operations before income taxes Income before discontinued operations Net income (loss) ($ in millions) 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts