Question: [The following information applies to the questions displayed below.) Robert and Sylvia propose to have their corporation, Wolverine Universal (WU), acquire another corporation, EMU Inc.,

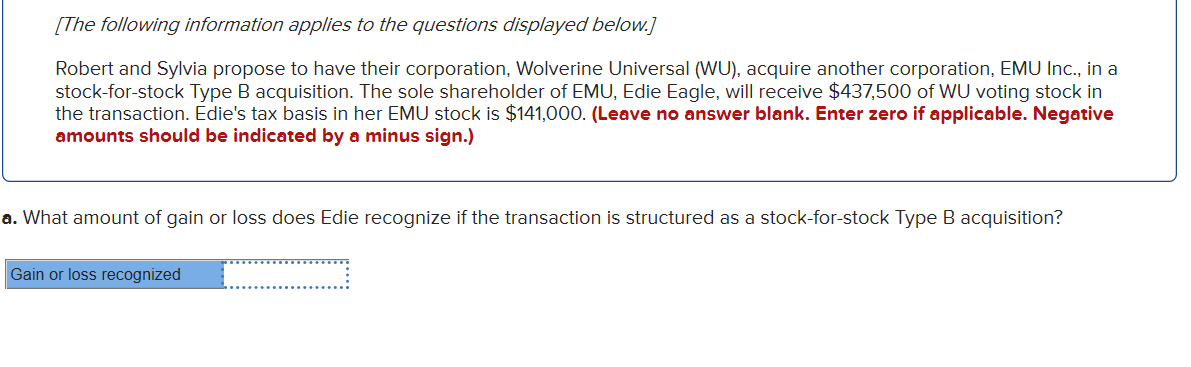

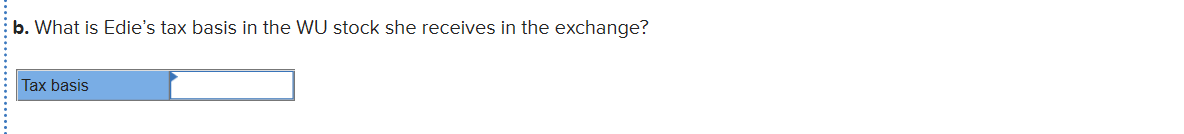

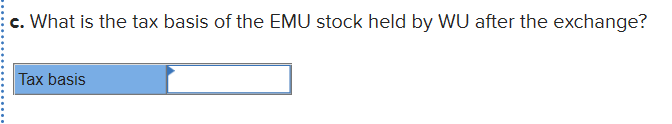

[The following information applies to the questions displayed below.) Robert and Sylvia propose to have their corporation, Wolverine Universal (WU), acquire another corporation, EMU Inc., in a stock-for-stock Type B acquisition. The sole shareholder of EMU, Edie Eagle, will receive $437,500 of WU voting stock in the transaction. Edie's tax basis in her EMU stock is $141,000. (Leave no answer blank. Enter zero if applicable. Negative amounts should be indicated by a minus sign.) a. What amount of gain or loss does Edie recognize if the transaction is structured as a stock-for-stock Type B acquisition? Gain or loss recognized b. What is Edie's tax basis in the WU stock she receives in the exchange? Tax basis c. What is the tax basis of the EMU stock held by WU after the exchange? Tax basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts