The following information is available on 31 March 2020 for preparation of adjusting entries: (a) Electricity incurred

Question:

The following information is available on 31 March 2020 for preparation of adjusting entries: | |

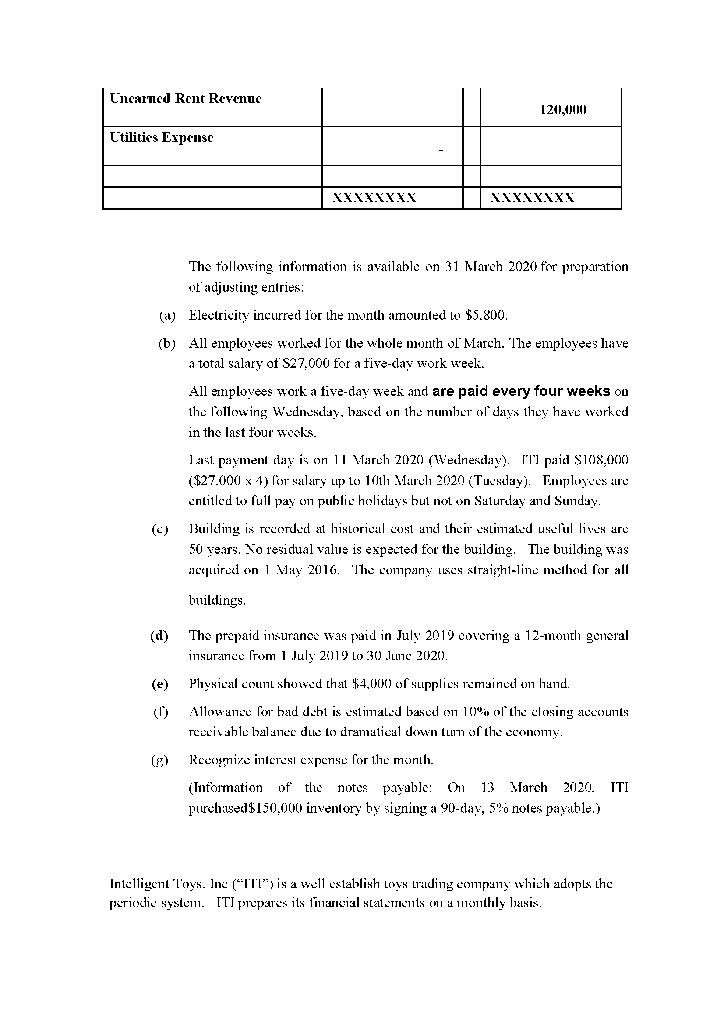

(a) | Electricity incurred for the month amounted to $5,800. |

(b) | All employees worked for the whole month of March. The employees have a total salary of $27,000 for a five-day work week. All employees work a five-day week and are paid every four weeks on the following Wednesday, based on the number of days they have worked in the last four weeks. Last payment day is on 11 March 2020 (Wednesday). ITI paid $108,000 ($27,000 x 4) for salary up to 10th March 2020 (Tuesday). Employees are entitled to full pay on public holidays but not on Saturday and Sunday. |

(c) | Building is recorded at historical cost and their estimated useful lives are 50 years. No residual value is expected for the building. The building was acquired on 1 May 2016. The company uses straight-line method for all buildings. |

(d) | The prepaid insurance was paid in July 2019 covering a 12-month general insurance from 1 July 2019 to 30 June 2020. |

(e) | Physical count showed that $4,000 of supplies remained on hand. |

(f) | Allowance for bad debt is estimated based on 10% of the closing accounts receivable balance due to dramatical down turn of the economy. |

(g) | Recognize interest expense for the month. (Information of the notes payable: On 13 March 2020, ITI purchased$150,000 inventory by signing a 90-day, 5% notes payable.) |

The following information is available on 31 March 2020 for preparation of adjusting entries: | |

(a) | Electricity incurred for the month amounted to $5,800. |

(b) | All employees worked for the whole month of March. The employees have a total salary of $27,000 for a five-day work week. All employees work a five-day week and are paid every four weeks on the following Wednesday, based on the number of days they have worked in the last four weeks. Last payment day is on 11 March 2020 (Wednesday). ITI paid $108,000 ($27,000 x 4) for salary up to 10th March 2020 (Tuesday). Employees are entitled to full pay on public holidays but not on Saturday and Sunday. |

(c) | Building is recorded at historical cost and their estimated useful lives are 50 years. No residual value is expected for the building. The building was acquired on 1 May 2016. The company uses straight-line method for all buildings. |

(d) | The prepaid insurance was paid in July 2019 covering a 12-month general insurance from 1 July 2019 to 30 June 2020. |

(e) | Physical count showed that $4,000 of supplies remained on hand. |

(f) | Allowance for bad debt is estimated based on 10% of the closing accounts receivable balance due to dramatical down turn of the economy. |

(g) | Recognize interest expense for the month. (Information of the notes payable: On 13 March 2020, ITI purchased$150,000 inventory by signing a 90-day, 5% notes payable.) |

Fundamentals of Financial Management

ISBN: 9780273713630

13th Revised edition

Authors: James van Horne, John Wachowicz