Question: The following information is given about two fixed coupon bonds from Company A and Company B, both of which have several years left until

Â

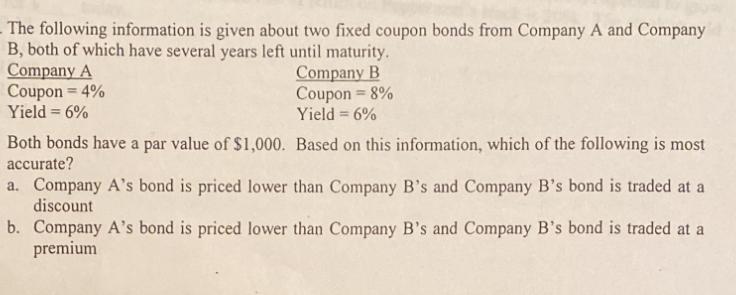

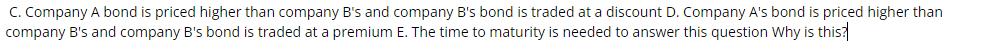

The following information is given about two fixed coupon bonds from Company A and Company B, both of which have several years left until maturity. Company A Coupon = 4% Yield = 6% Company B Coupon = 8% Yield = 6% Both bonds have a par value of $1,000. Based on this information, which of the following is most accurate? a. Company A's bond is priced lower than Company B's and Company B's bond is traded at a discount b. Company A's bond is priced lower than Company B's and Company B's bond is traded at a premium C. Company A bond is priced higher than company B's and company B's bond is traded at a discount D. Company A's bond is priced higher than company B's and company B's bond is traded at a premium E. The time to maturity is needed to answer this question Why is this? The following information is given about two fixed coupon bonds from Company A and Company B, both of which have several years left until maturity. Company A Coupon = 4% Yield = 6% Company B Coupon = 8% Yield = 6% Both bonds have a par value of $1,000. Based on this information, which of the following is most accurate? a. Company A's bond is priced lower than Company B's and Company B's bond is traded at a discount b. Company A's bond is priced lower than Company B's and Company B's bond is traded at a premium C. Company A bond is priced higher than company B's and company B's bond is traded at a discount D. Company A's bond is priced higher than company B's and company B's bond is traded at a premium E. The time to maturity is needed to answer this question Why is this? The following information is given about two fixed coupon bonds from Company A and Company B, both of which have several years left until maturity. Company A Coupon = 4% Yield = 6% Company B Coupon = 8% Yield = 6% Both bonds have a par value of $1,000. Based on this information, which of the following is most accurate? a. Company A's bond is priced lower than Company B's and Company B's bond is traded at a discount b. Company A's bond is priced lower than Company B's and Company B's bond is traded at a premium C. Company A bond is priced higher than company B's and company B's bond is traded at a discount D. Company A's bond is priced higher than company B's and company B's bond is traded at a premium E. The time to maturity is needed to answer this question Why is this?

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

The correct answer is E The time to maturity is needed to answer this question To det... View full answer

Get step-by-step solutions from verified subject matter experts