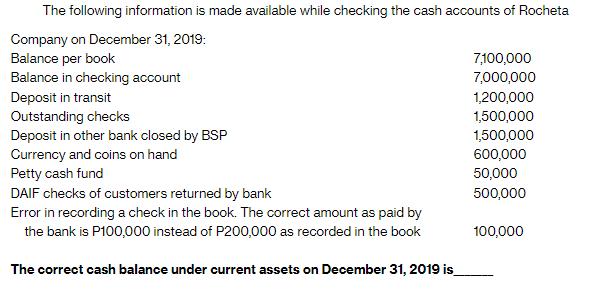

Question: The following information is made available while checking the cash accounts of Rocheta Company on December 31, 2019: Balance per book Balance in checking

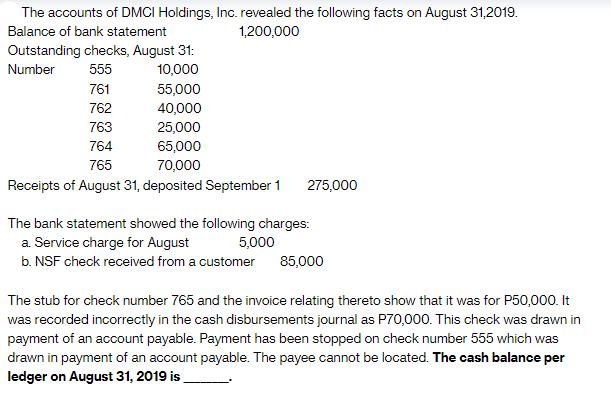

The following information is made available while checking the cash accounts of Rocheta Company on December 31, 2019: Balance per book Balance in checking account Deposit in transit Outstanding checks Deposit in other bank closed by BSP Currency and coins on hand Petty cash fund DAIF checks of customers returned by bank Error in recording a check in the book. The correct amount as paid by the bank is P100,000 instead of P200,000 as recorded in the book The correct cash balance under current assets on December 31, 2019 is 7,100,000 7,000,000 1,200,000 1,500,000 1,500,000 600,000 50,000 500,000 100,000 The accounts of DMCI Holdings, Inc. revealed the following facts on August 31,2019. Balance of bank statement 1,200,000 Outstanding checks, August 31: Number 555 10,000 55,000 40,000 25,000 65,000 70,000 761 762 763 764 765 Receipts of August 31, deposited September 1 275,000 The bank statement showed the following charges: a. Service charge for August 5,000 b. NSF check received from a customer 85,000 The stub for check number 765 and the invoice relating thereto show that it was for P50,000. It was recorded incorrectly in the cash disbursements journal as P70,000. This check was drawn in payment of an account payable. Payment has been stopped on check number 555 which was drawn in payment of an account payable. The payee cannot be located. The cash balance per ledger on August 31, 2019 is

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts