Question: The following is my solution I have used Direct Method. Now, the problem is that Net increase/decrease in cash is coming: $226,000 whereas it should

The following is my solution

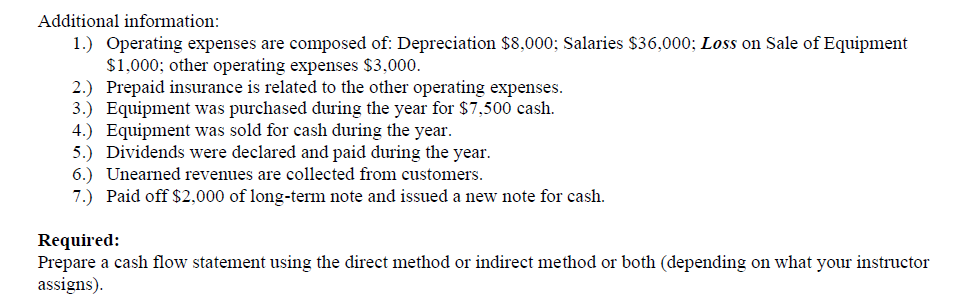

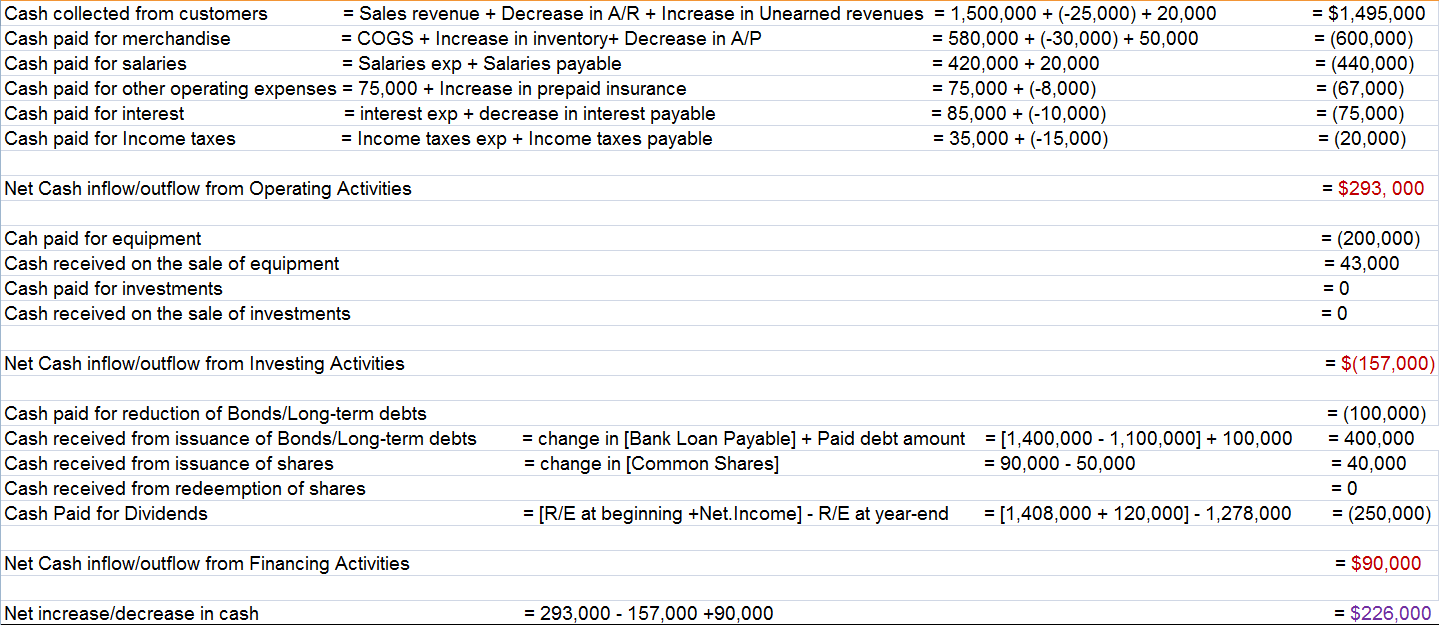

I have used Direct Method. Now, the problem is that Net increase/decrease in cash is coming: $226,000 whereas it should be $241,000 (because, Ending cash balance - Beginning cash balance = 821,000 - 580,000 = $241,000) . Please tell me what is wrong and also show correct calculations for any thing that I have done wrong.

I have used Direct Method. Now, the problem is that Net increase/decrease in cash is coming: $226,000 whereas it should be $241,000 (because, Ending cash balance - Beginning cash balance = 821,000 - 580,000 = $241,000) . Please tell me what is wrong and also show correct calculations for any thing that I have done wrong.

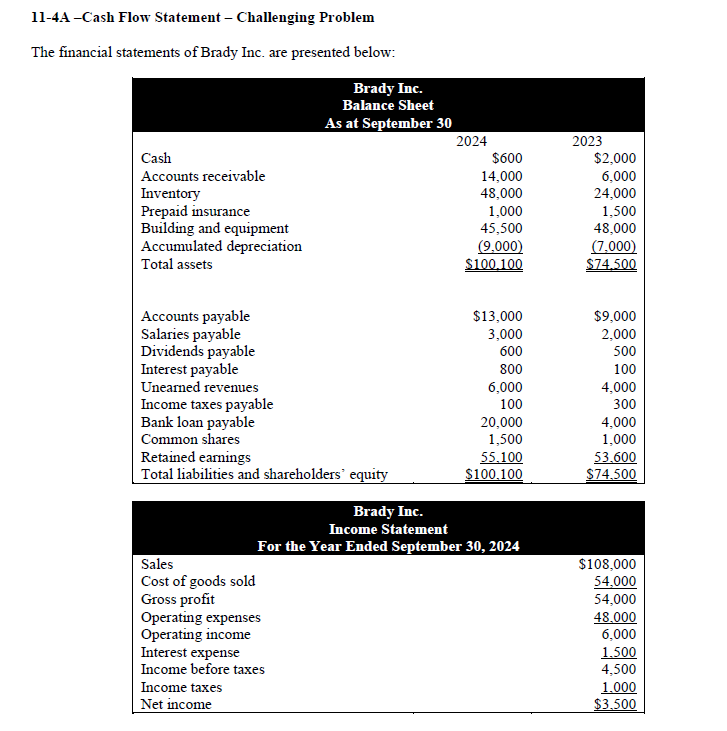

11-4A -Cash Flow Statement - Challenging Problem The financial statements of Brady Inc. are presented below: Cash Accounts receivable Inventory Prepaid insurance Building and equipment Accumulated depreciation Total assets Brady Inc. Balance Sheet As at September 30 2024 $600 14,000 48,000 1,000 45,500 (9,000) $100.100 2023 $2,000 6,000 24,000 1,500 48,000 (7.000) $74.500 Accounts payable Salaries payable Dividends payable Interest payable Unearned revenues Income taxes payable Bank loan payable Common shares Retained earnings Total liabilities and shareholders' equity $13,000 3,000 600 800 6,000 100 20,000 1,500 55.100 $100,100 $9,000 2,000 500 100 4,000 300 4,000 1,000 53.600 $74.500 Brady Inc. Income Statement For the Year Ended September 30, 2024 Sales Cost of goods sold Gross profit Operating expenses Operating income Interest expense Income before taxes Income taxes Net income $108,000 54,000 54,000 48.000 6,000 1.500 4,500 1.000 $3.500 Additional information: 1.) Operating expenses are composed of: Depreciation $8,000; Salaries $36,000; Loss on Sale of Equipment $1,000; other operating expenses $3,000. 2.) Prepaid insurance is related to the other operating expenses. 3.) Equipment was purchased during the year for $7,500 cash. 4.) Equipment was sold for cash during the year. 5.) Dividends were declared and paid during the year. 6.) Unearned revenues are collected from customers. 7.) Paid off $2,000 of long-term note and issued a new note for cash. Required: Prepare a cash flow statement using the direct method or indirect method or both (depending on what your instructor assigns). Cash collected from customers = Sales revenue + Decrease in A/R + Increase in Unearned revenues = 1,500,000 + (-25,000) + 20,000 Cash paid for merchandise = COGS + Increase in inventory+ Decrease in A/P = 580,000 + (-30,000) + 50,000 Cash paid for salaries = Salaries exp + Salaries payable = 420,000 + 20,000 Cash paid for other operating expenses = 75,000 + Increase in prepaid insurance = 75,000 + (-8,000) Cash paid for interest = interest exp + decrease in interest payable = 85,000 + (-10,000) Cash paid for Income taxes = Income taxes exp + Income taxes payable = 35,000 + (-15,000) = $1,495,000 = (600,000) = (440,000) = (67,000) = (75,000) = (20,000) Net Cash inflow/outflow from Operating Activities = $293, 000 Cah paid for equipment Cash received on the sale of equipment Cash paid for investments Cash received on the sale of investments = (200,000) = 43,000 = 0 = 0 Net Cash inflow/outflow from Investing Activities = $(157,000) Cash paid for reduction of Bonds/Long-term debts Cash received from issuance of Bonds/Long-term debts Cash received from issuance of shares Cash received from redeemption of shares Cash Paid for Dividends = change in [Bank Loan Payable] + Paid debt amount = [1,400,000 - 1,100,000] + 100,000 = change in (Common Shares] = 90,000 - 50,000 = (100,000) = 400,000 = 40,000 = 0 = (250,000) = [R/E at beginning +Net.Income] - R/E at year-end = [1,408,000 + 120,000] - 1,278,000 Net Cash inflow/outflow from Financing Activities = $90,000 Net increase/decrease in cash = 293,000 - 157,000 +90,000 = $226,000 Cash Balance, Beginning of the year Cash Balance, End of the year = $580,000 = $821,000 Historical cost of equipment sold = [Beginning Historical Cost of equipment - Ending Historical Cost of Equipment] - [Beginning Accumulated Depreciation + Depreciation expense for the period - Ending Accumulated Depreciation] + Purchase amount of equipment = [3,400,000 - 3,512,000] - [1,800,000 + 200,000 - 1,940,000] + 200,000 = $28,000 Cash Received on the sale of equipment = Historical Cost of equipment sold + Gain on sale of equipment = 28,000 + 15,000 = $43,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts